Corning (GLW) Valuation Check After AI-Driven Optical Communications Growth and Strong Earnings

Corning (GLW) is back on investors radar after its optical communications business again took center stage in the latest earnings update, with AI driven data center demand powering a meaningful jump in sales and profit contribution.

See our latest analysis for Corning.

That backdrop helps explain why Corning’s share price has climbed to about $88, with a powerful year to date share price return of roughly 89 percent and a three year total shareholder return above 180 percent, signaling momentum that is still building.

If Corning’s AI fueled run has you thinking about where else growth and demand might surprise, it could be worth scanning high growth tech and AI stocks for other potential standouts.

With Corning now trading just below analyst targets after an AI fueled surge, investors face a pivotal question: is GLW still undervalued on its long term fiber and materials opportunity, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 5.4% Undervalued

With Corning last closing at $88.27 against a narrative fair value near $93.31, the story leans toward modest upside driven by long term structural demand.

Corning's Springboard plan aims to add more than $4 billion in annualized sales by 2026, driven by strong demand in Optical Communications and Solar sectors due to powerful secular trends, positively impacting revenue growth. The company sees substantial growth in Optical Communications, particularly in innovations for Gen AI data centers, which are expected to drive incremental revenue and accelerate operating margin improvements toward 20% by the end of 2026.

To see what kind of revenue ramp and margin reset could justify that higher fair value, and how far profitability might stretch, dig into the full narrative behind these projections.

Result: Fair Value of $93.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering macro and trade risks, including potential AI demand hiccups and renewed tariff pressures, could quickly challenge Corning’s optimistic growth narrative.

Find out about the key risks to this Corning narrative.

Another View: Rich Multiples Signal a Different Story

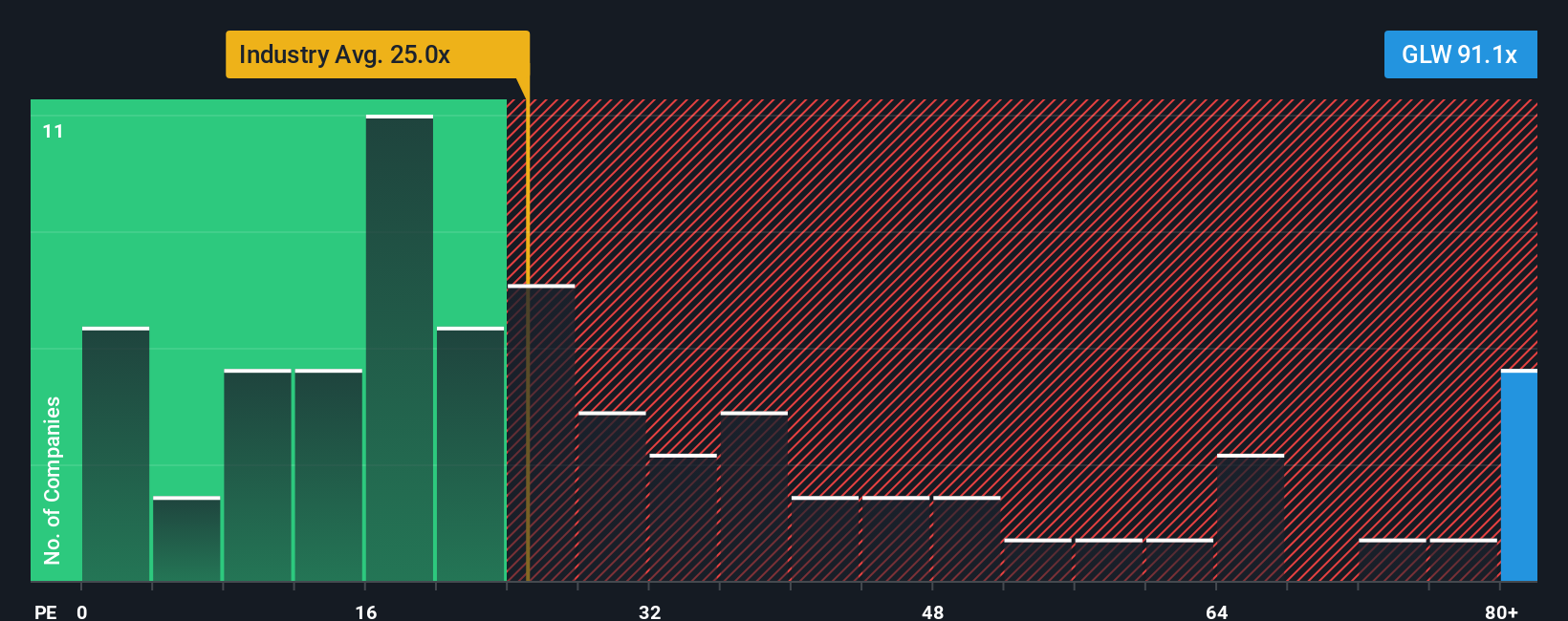

While the narrative fair value suggests upside, a simple earnings based lens is far less forgiving. Corning trades on a 55.4 times price to earnings ratio versus 37.4 times for peers and a fair ratio of 35 times. This implies the stock may already be pricing in a lot of good news.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corning Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Corning research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop hunting for the next opportunity, and the Simply Wall St Screener can help you uncover under the radar winners before the crowd catches on.

- Capitalize on mispriced quality by targeting companies that look cheap relative to their cash flows using these 909 undervalued stocks based on cash flows tailored to value focused investors.

- Ride the next wave of innovation by scanning these 27 AI penny stocks for companies positioned at the heart of the AI transformation across multiple industries.

- Explore potential income streams by filtering the market for these 15 dividend stocks with yields > 3% that may help boost your portfolio’s yield while still focusing on fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com