Powell Industries (POWL): Is the Recent Growth Surge Reflected Fairly in Today’s Valuation?

Powell Industries (POWL) is back on investors radar after delivering 26% annual revenue growth over the past two years, paired with faster earnings expansion and a sharp improvement in free cash flow margins.

See our latest analysis for Powell Industries.

The share price has responded accordingly, with a year to date share price return of nearly 50% and a three year total shareholder return above 800%, signalling strong momentum as investors price in sustained growth rather than a one off upswing.

If Powell’s run has you rethinking where growth might come from next, it could be worth exploring fast growing stocks with high insider ownership as a way to spot other under the radar compounders.

Yet with the stock now trading well above analyst targets and at a steep premium to most valuation models, investors must ask: Is Powell still mispriced to the upside, or could there be a genuine buying opportunity here?

Most Popular Narrative: 27% Overvalued

With Powell Industries last closing at $342.86 against a most-followed fair value of $269.26, the narrative frames today’s price as running ahead of fundamentals.

The analysts have a consensus price target of $245.927 for Powell Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $280.0, and the most bearish reporting a price target of just $224.78.

Want to see what kind of modest revenue trajectory, easing margins, and future earnings multiple still justify that lower fair value than today’s price? The narrative lays out a surprisingly restrained long term profit path that clashes sharply with the recent share price surge. Curious which specific earnings and valuation assumptions underpin that call and how they differ from the market story you see in the chart?

Result: Fair Value of $269.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust electrification demand and successful expansion into higher margin automation and SCADA solutions could sustain elevated growth and challenge the cautious analyst narrative.

Find out about the key risks to this Powell Industries narrative.

Another Angle on Valuation

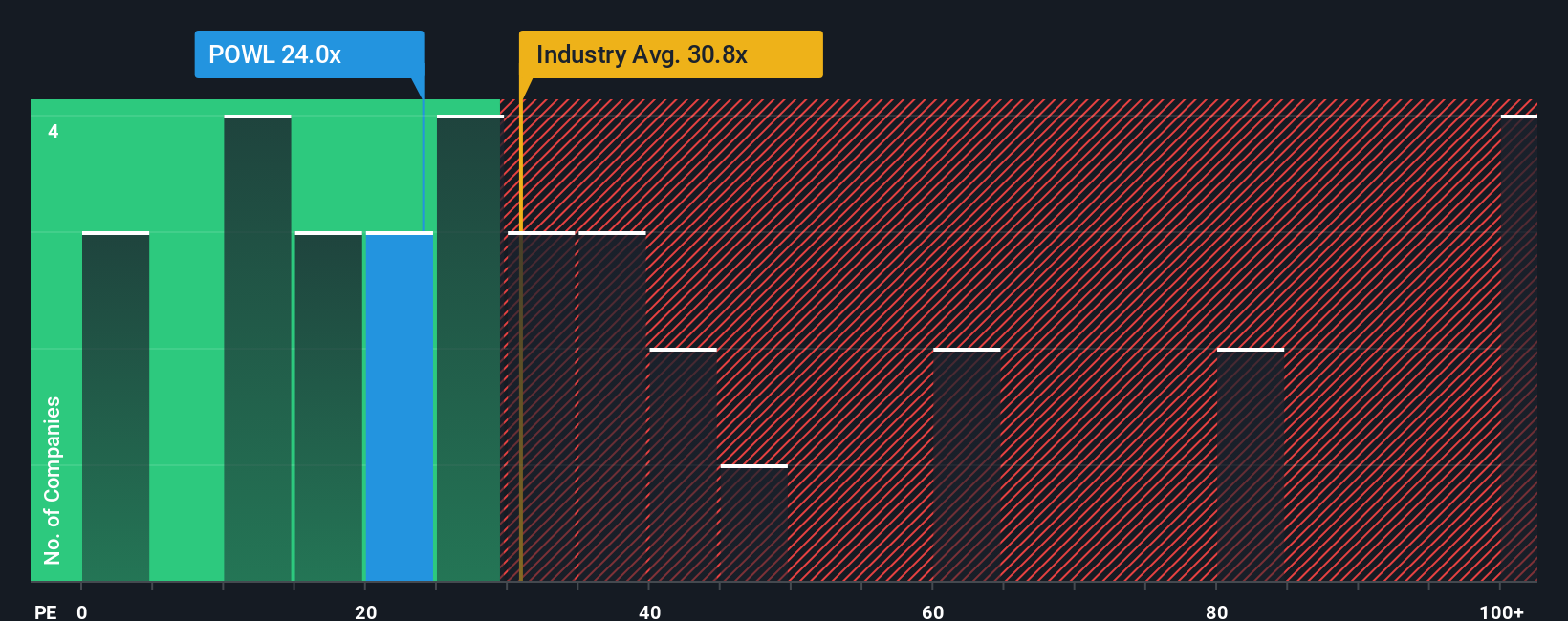

Price based models say Powell is expensive, yet its price to earnings ratio of 22.9x still sits well below the US Electrical industry at 31.3x and peer average at 47.4x, only slightly above its 21.2x fair ratio. Is that modest premium a warning sign or the cost of quality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Powell Industries Narrative

If your view differs or you prefer to dig into the numbers yourself, you can quickly build a personalized Powell thesis in just minutes, Do it your way.

A great starting point for your Powell Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with Powell when the market is full of opportunities. Use the Simply Wall Street Screener to pinpoint your next high conviction idea today.

- Capture early stage growth momentum by targeting quality small caps through these 3593 penny stocks with strong financials before broader markets fully catch on.

- Position yourself for the next wave of automation and productivity gains by focusing on companies powering innovation in these 27 AI penny stocks.

- Identify potential mispricings by zeroing in on these 908 undervalued stocks based on cash flows that may still trade below what their future cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com