Daiichi Sankyo (TSE:4568) Valuation After Patent Win and New ENHERTU, DATROWAY Oncology Milestones

Daiichi Sankyo Company (TSE:4568) has just cleared a major legal hurdle while pushing deeper into oncology, with a U.S. appeals court invalidating a Seagen patent and fresh clinical momentum around ENHERTU and DATROWAY.

See our latest analysis for Daiichi Sankyo Company.

The mix of a cleared patent overhang and steady ENHERTU and DATROWAY news flow has not yet turned the tide. The share price has delivered a year-to-date return of negative 19.3 percent and a one-year total shareholder return of negative 21.38 percent, suggesting sentiment is still resetting rather than building sustained momentum.

If oncology innovation is on your radar after Daiichi Sankyo, this could be a good moment to explore other healthcare stocks that might fit your strategy.

With the legal overhang easing, oncology assets scaling and the stock still trading at a steep discount to analyst targets, the key question is whether Daiichi Sankyo is now mispriced value or whether markets already anticipate its next leg of growth.

Most Popular Narrative: 37.4% Undervalued

With Daiichi Sankyo last closing at ¥3,470 against a narrative fair value near ¥5,546, the valuation debate centers on how durable its oncology-led growth really is.

Pipeline depth in antibody-drug conjugates, supported by ongoing R&D investment and multiple upcoming pivotal data readouts and regulatory submissions for several major tumor types, positions the company to capture higher margin opportunities as precision medicine gains traction. This could further boost future net margins and earnings as secular demand for innovative targeted therapies increases.

Want to see the math behind this gap? The narrative leans on accelerating oncology revenues, rising margins and a richer future earnings multiple. Curious which assumptions really move the fair value line.

Result: Fair Value of ¥5,546.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could be derailed if ENHERTU or DATROWAY stumble on safety, competition, or pricing pressure, undermining revenue concentration and margins.

Find out about the key risks to this Daiichi Sankyo Company narrative.

Another Way to Look at Value

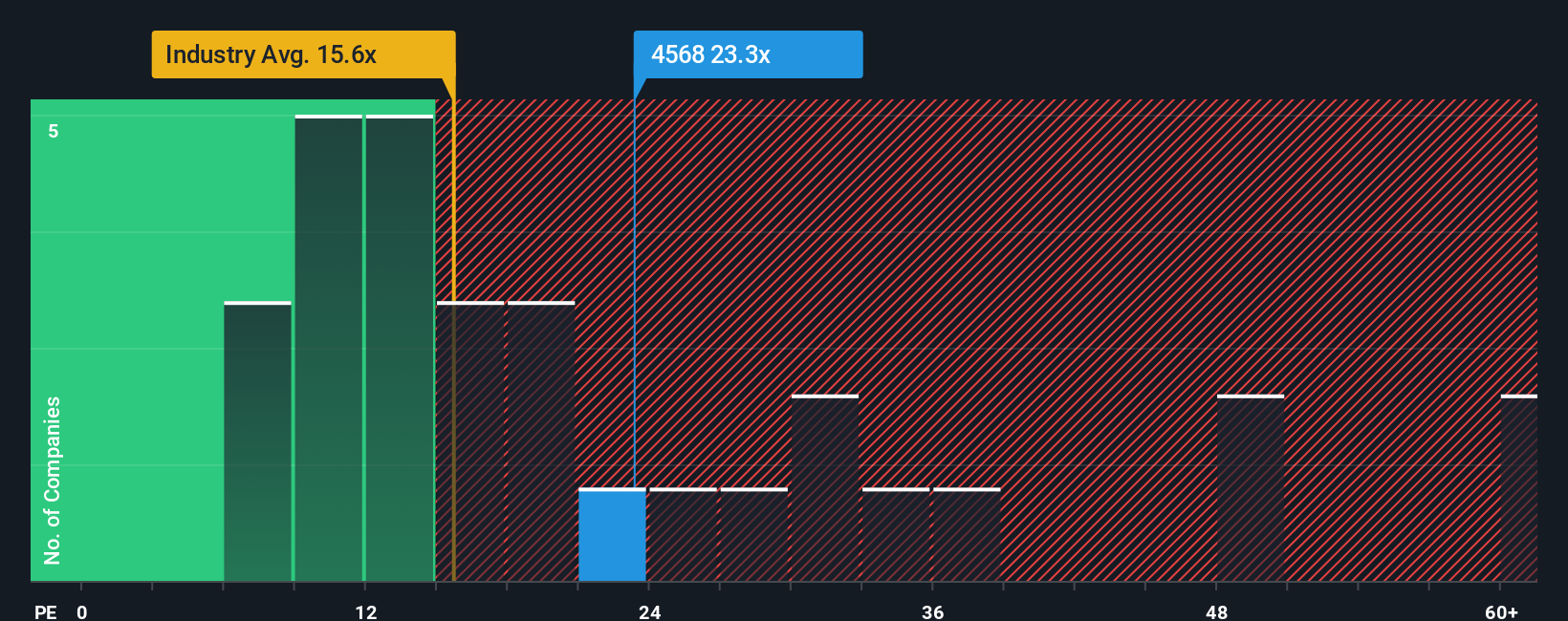

On earnings, Daiichi Sankyo does not look as cheap. The shares trade on roughly 23 times earnings versus about 15.3 times for the wider Japanese pharma sector, even though our fair ratio points closer to 29.5 times. That premium keeps the downside debate alive, especially if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Daiichi Sankyo Company Narrative

If the story here does not fully resonate or you prefer to interrogate the numbers yourself, you can craft a tailored view in minutes: Do it your way.

A great starting point for your Daiichi Sankyo Company research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before markets move again, put your research to work and line up your next opportunity using focused stock screens built from hard fundamentals, not hype.

- Capture potential multi-baggers early by scanning these 3593 penny stocks with strong financials that already show financial strength instead of just speculative buzz.

- Ride structural growth in automation and machine learning by targeting these 27 AI penny stocks positioned at the heart of the AI build out.

- Identify opportunities that the market may be mispricing by reviewing these 908 undervalued stocks based on cash flows based on their projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com