The Bull Case For Somnigroup International (SGI) Could Change Following Insider Buy After Leggett & Platt Deal

- In early December 2025, Somnigroup International board member Simon Dyer disclosed a Form 4 insider purchase of 32,000 shares, worth about US$3.00 million, signaling his personal commitment to the company.

- This sizeable insider buying, coming soon after Somnigroup’s proposed all-stock acquisition of Leggett & Platt, highlights internal confidence in the combined group’s long-term direction.

- Next, we’ll explore how Simon Dyer’s sizeable insider buying shapes Somnigroup International’s investment narrative and perceived alignment with shareholders.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Somnigroup International Investment Narrative Recap

To own Somnigroup International, you need to believe in its ability to convert strong bedding brands and global reach into sustained earnings growth, while managing cyclical swings in big-ticket consumer spending. The key near term catalyst remains execution on acquisitions and integration, particularly around Leggett & Platt, and this recent US$3.0 million insider purchase reinforces perceived leadership confidence rather than materially changing those fundamentals. The biggest risk still centers on changing consumer preferences away from durable goods toward experiences.

The most relevant recent announcement here is Somnigroup’s proposed all stock acquisition of Leggett & Platt, pitched as a way to enhance growth potential and shareholder value. Simon Dyer’s sizeable insider buying lands directly against this backdrop, and will likely be interpreted by many investors in the context of whether the combined business can realize the expected operational benefits without over concentrating on a maturing North American bedding market.

Yet while confidence at the board level is encouraging, investors should also be aware of how exposed Somnigroup remains if younger consumers continue shifting away from big-ticket home purchases...

Read the full narrative on Somnigroup International (it's free!)

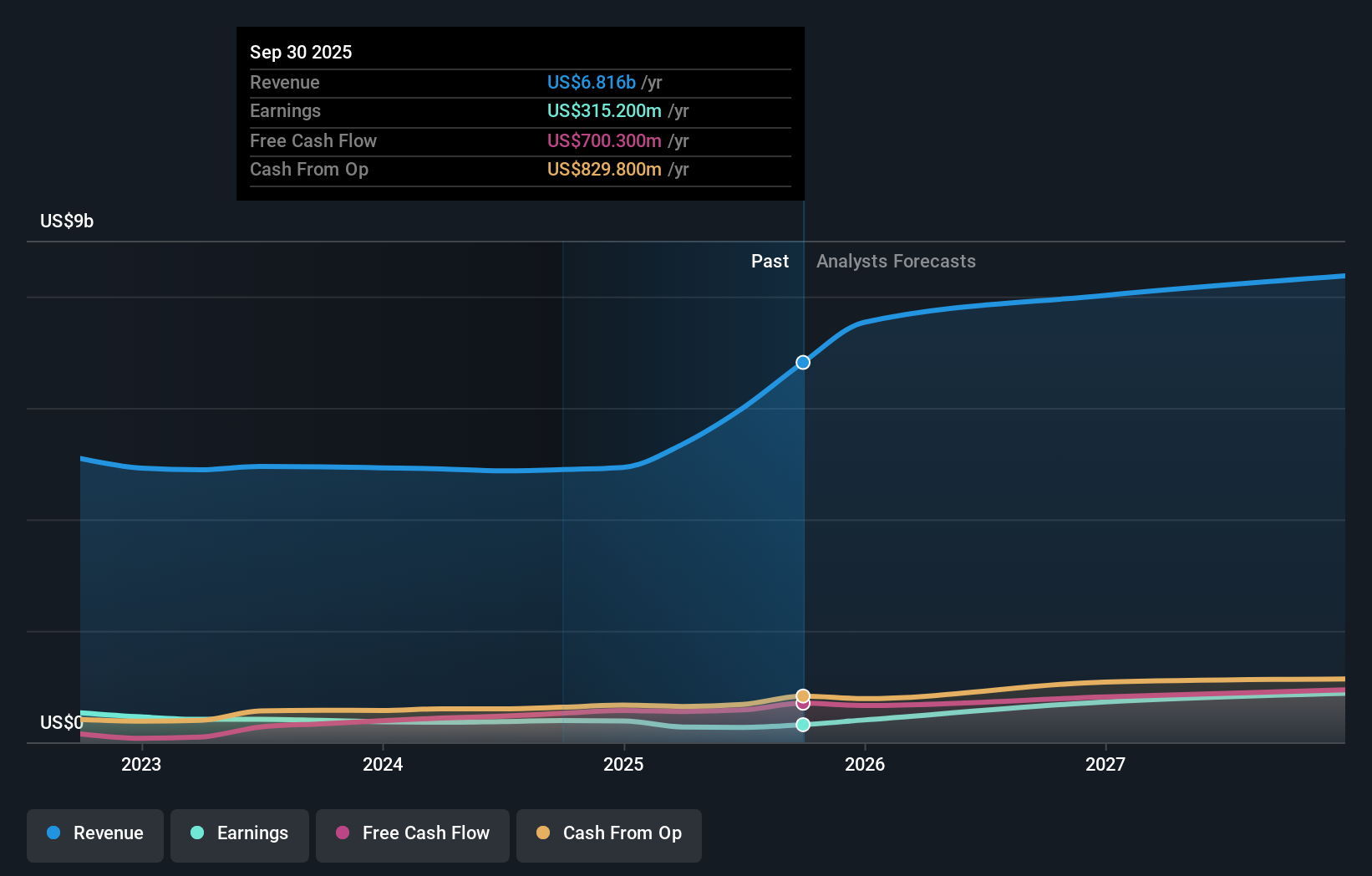

Somnigroup International's narrative projects $8.5 billion revenue and $931.4 million earnings by 2028. This requires 12.5% yearly revenue growth and a $663.6 million earnings increase from $267.8 million.

Uncover how Somnigroup International's forecasts yield a $101.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community cluster between US$88.68 and US$101, underscoring how differently individual investors can view Somnigroup’s worth. Set against that, the company’s dependence on acquisitions for growth and its existing North American concentration could meaningfully influence how those expectations play out, so it is worth weighing several viewpoints before forming your own.

Explore 2 other fair value estimates on Somnigroup International - why the stock might be worth as much as 11% more than the current price!

Build Your Own Somnigroup International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Somnigroup International research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Somnigroup International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Somnigroup International's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com