Assessing Ascendis Pharma (NasdaqGS:ASND) Valuation After FDA Major Amendment Extends TransCon CNP Review Timeline

Ascendis Pharma (NasdaqGS:ASND) just told investors the FDA has tagged its latest TransCon CNP filing as a major amendment, pushing the decision deadline to February 28, 2026, and subtly reshaping expectations for potential approval.

See our latest analysis for Ascendis Pharma.

The update lands after a strong run, with Ascendis Pharma’s year to date share price return of around 50% and 1 year total shareholder return of about 56%. This suggests momentum is still building as investors reassess the TransCon pipeline’s upside and regulatory risk.

If this FDA delay has you thinking about other healthcare names with different risk profiles, it could be a good moment to explore healthcare stocks.

With shares already up sharply and trading about 25% below consensus targets, the key question now is whether Ascendis is still undervalued on its long-term pipeline potential or whether the market is already pricing in future growth.

Most Popular Narrative: 19.6% Undervalued

Compared with Ascendis Pharma’s last close of $207.12, the most widely followed narrative points to a higher fair value and leans on aggressive growth assumptions.

Regulatory progress and pipeline advancement, such as the priority review for TransCon CNP in achondroplasia and positive combination trial results, are paving the way for new blockbuster therapies and potential multi-billion EUR peak sales opportunities, enhancing future revenue growth and reducing revenue concentration risk.

Curious how rapid revenue expansion, a sharp swing into profitability, and a richer future earnings multiple all fit together? Want to see the full playbook behind that valuation call?

Result: Fair Value of $257.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing safety monitoring and potential pricing or reimbursement pressure could slow Yorvipath uptake and challenge the bullish revenue and margin assumptions underpinning this view.

Find out about the key risks to this Ascendis Pharma narrative.

Another Lens on Value

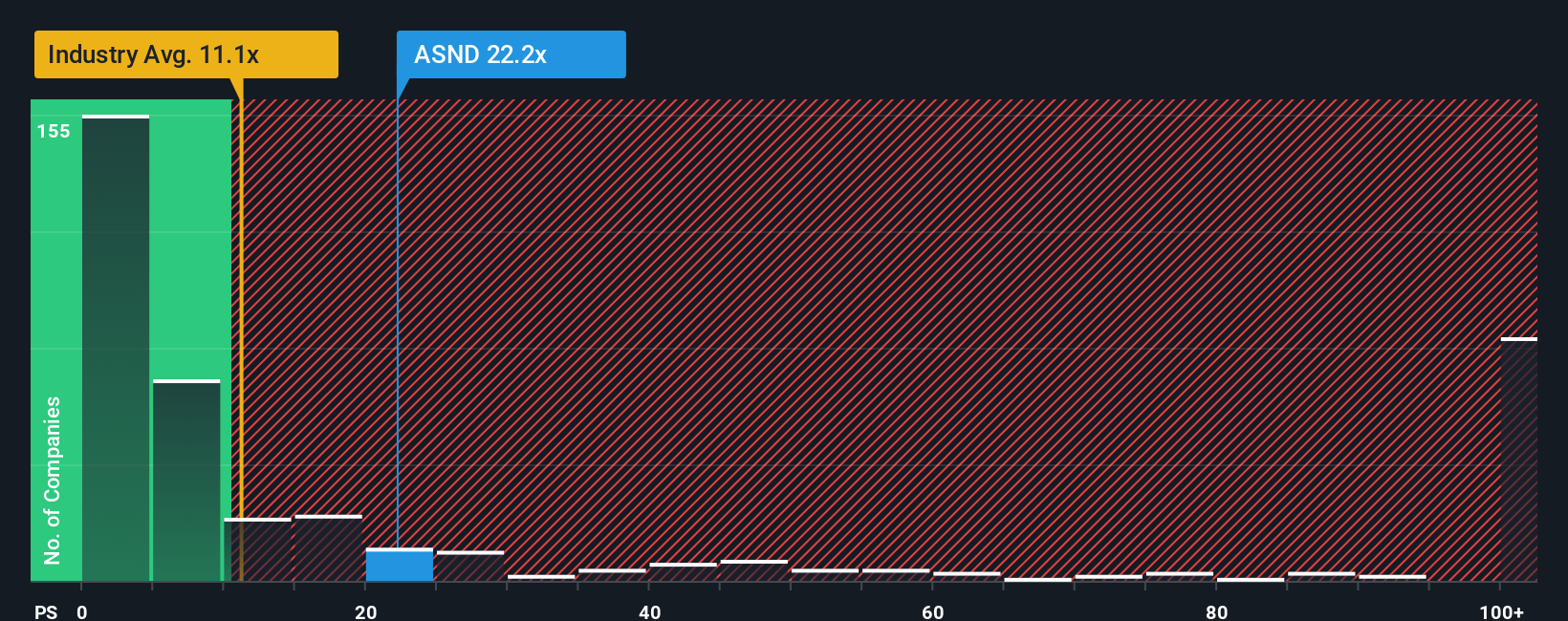

On simple sales based metrics, Ascendis looks more stretched. Its current price to sales ratio of 16.8 times sits above both the US biotech average of 12 times and its own fair ratio of 16.5 times, hinting that sentiment may already be optimistic despite DCF upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ascendis Pharma Narrative

If you see the story differently, or want to stress test every assumption yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Ascendis Pharma research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the next catalyst hits Ascendis, you may wish to consider putting your capital to work by lining up fresh opportunities through Simply Wall Street’s powerful stock screeners tailored to different strategies.

- Explore potential growth opportunities by targeting companies flagged as undervalued on future cash flows using these 905 undervalued stocks based on cash flows.

- Focus on innovation by looking at emerging platforms and tools shaping the future of intelligence through these 27 AI penny stocks.

- Build your income stream by concentrating on businesses with strong cash generation and consistent payouts via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com