ASX Stocks Estimated To Be Up To 48.3% Below Intrinsic Value

In the current Australian market landscape, recent events such as the Reserve Bank of Australia's decision to hold interest rates steady have led to mixed reactions, with major indices experiencing fluctuations and sectors like real estate showing some resilience. Amidst these conditions, identifying undervalued stocks can be a strategic approach for investors seeking opportunities that may offer potential upside when market sentiments shift.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webjet Group (ASX:WJL) | A$0.885 | A$1.43 | 38.3% |

| Smart Parking (ASX:SPZ) | A$1.38 | A$2.26 | 39.1% |

| NRW Holdings (ASX:NWH) | A$5.02 | A$8.93 | 43.8% |

| Lynas Rare Earths (ASX:LYC) | A$12.93 | A$22.15 | 41.6% |

| Light & Wonder (ASX:LNW) | A$150.94 | A$243.27 | 38% |

| LGI (ASX:LGI) | A$4.02 | A$7.77 | 48.3% |

| Guzman y Gomez (ASX:GYG) | A$21.45 | A$39.12 | 45.2% |

| Cromwell Property Group (ASX:CMW) | A$0.465 | A$0.87 | 46.5% |

| CleanSpace Holdings (ASX:CSX) | A$0.63 | A$1.11 | 43.1% |

| Airtasker (ASX:ART) | A$0.33 | A$0.63 | 47.9% |

Let's uncover some gems from our specialized screener.

LGI (ASX:LGI)

Overview: LGI Limited operates in Australia, offering carbon abatement and renewable energy solutions through biogas from landfill, with a market cap of A$415.83 million.

Operations: The company's revenue is derived from three main segments: Carbon Abatement (A$17.29 million), Renewable Energy (A$17.08 million), and Infrastructure Construction and Management (A$2.37 million).

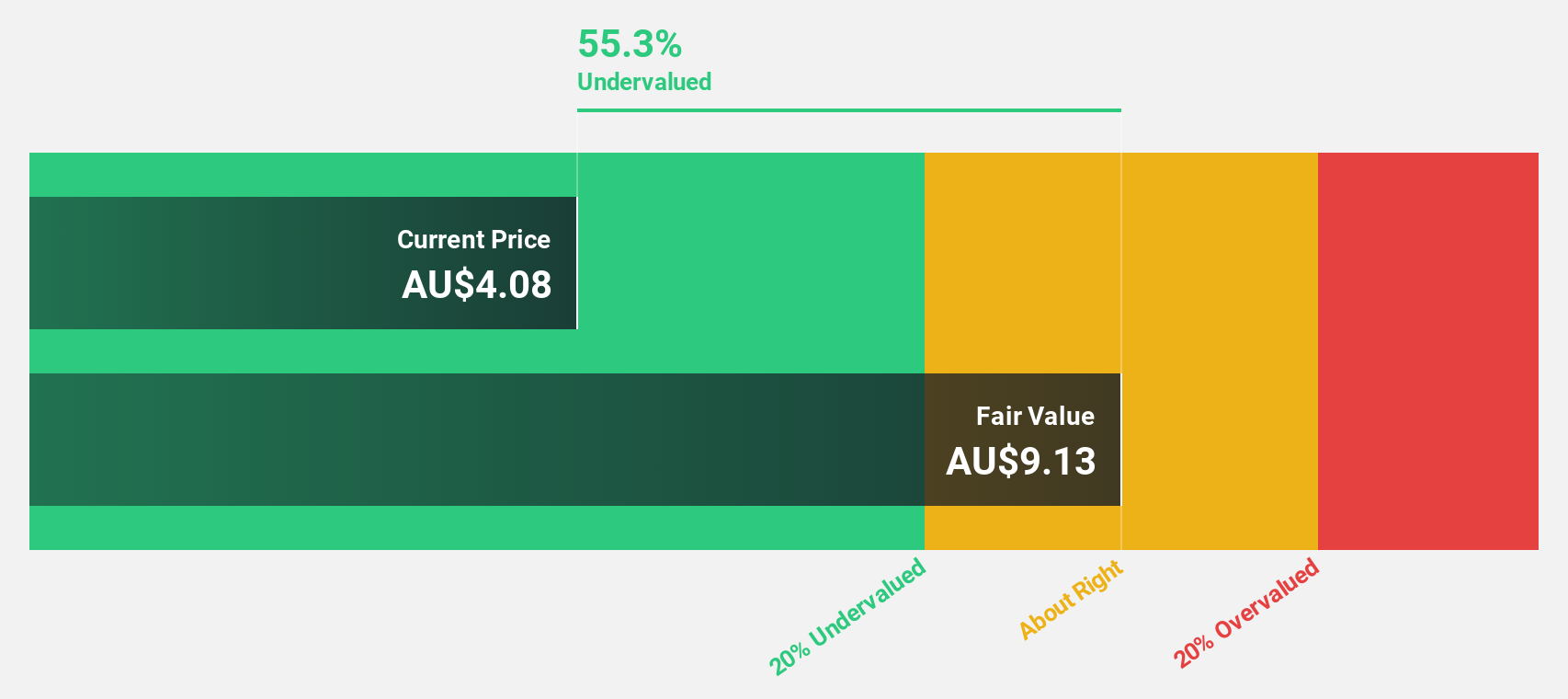

Estimated Discount To Fair Value: 48.3%

LGI is trading at A$4.02, considerably below its estimated fair value of A$7.77, indicating potential undervaluation based on discounted cash flow analysis. Despite recent shareholder dilution from equity offerings totaling over A$56 million, LGI's earnings are projected to grow significantly at 28.6% annually, outpacing the Australian market's average growth rate. However, its return on equity is forecasted to remain low at 13.5% in three years.

- In light of our recent growth report, it seems possible that LGI's financial performance will exceed current levels.

- Take a closer look at LGI's balance sheet health here in our report.

Myer Holdings (ASX:MYR)

Overview: Myer Holdings Limited operates department stores in Australia and New Zealand, with a market cap of A$735.57 million.

Operations: The company's revenue is primarily derived from its retail operations, generating A$2.64 billion, and apparel brands, contributing A$370.60 million.

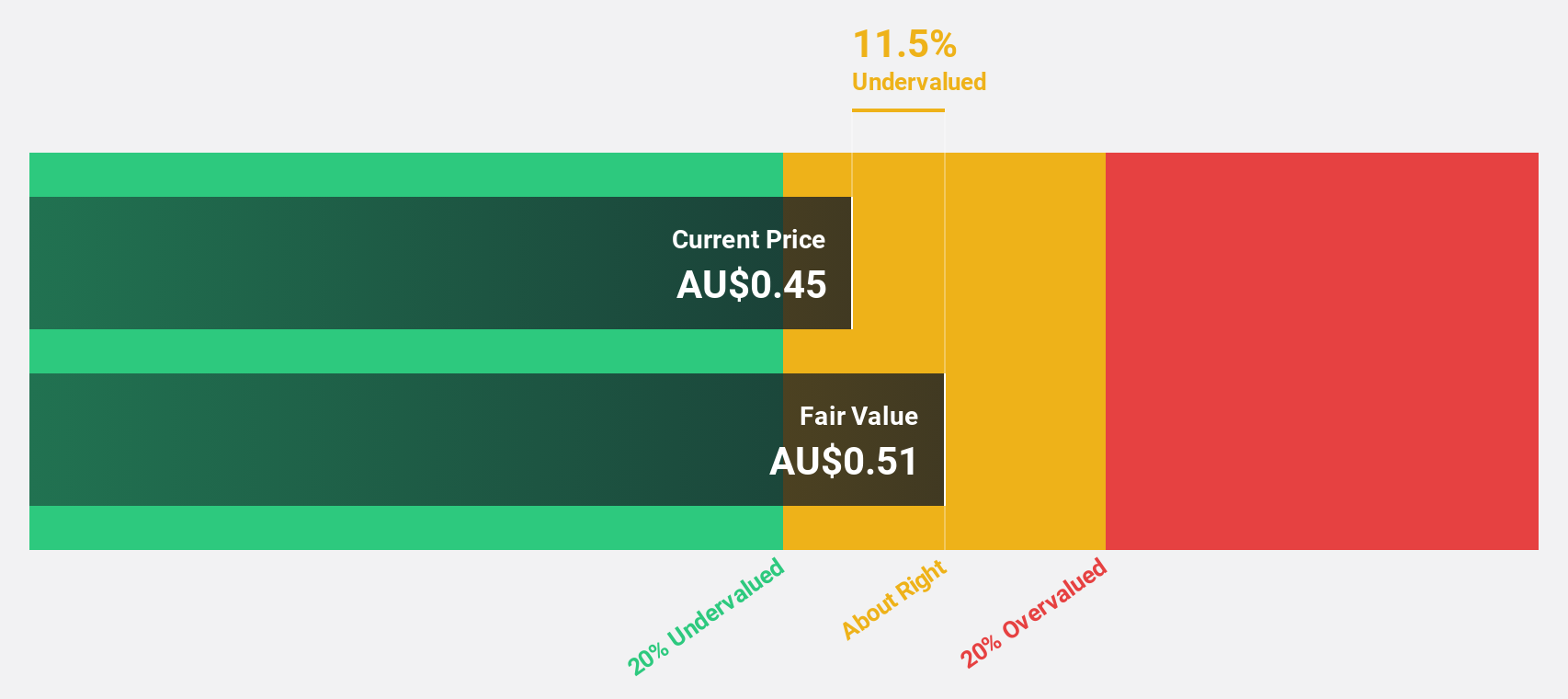

Estimated Discount To Fair Value: 15.8%

Myer Holdings, trading at A$0.43, is priced below its estimated fair value of A$0.5, suggesting it could be undervalued based on cash flow analysis. Despite a reported net loss of A$211.2 million for the year ending July 2025 and low forecasted return on equity of 10.6%, Myer's earnings are expected to grow significantly by 64.11% annually over the next three years, outpacing market growth and potentially achieving profitability within this period.

- Upon reviewing our latest growth report, Myer Holdings' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Myer Holdings.

Nick Scali (ASX:NCK)

Overview: Nick Scali Limited, with a market cap of A$1.94 billion, is involved in the sourcing and retailing of household furniture and accessories across Australia, New Zealand, and the United Kingdom.

Operations: The company's revenue is primarily derived from the retailing of furniture, amounting to A$495.28 million.

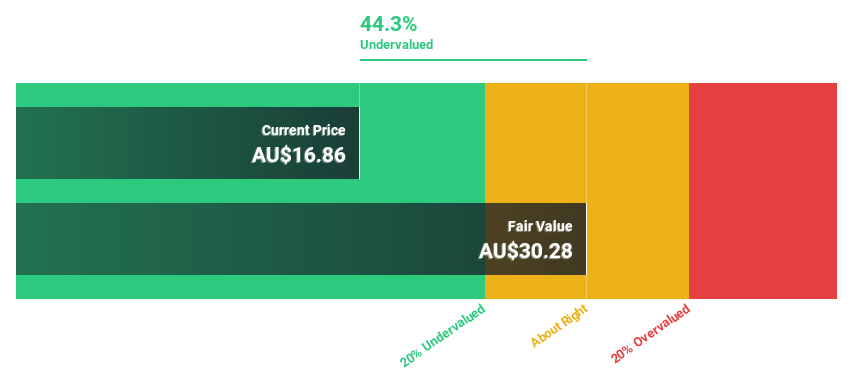

Estimated Discount To Fair Value: 26.8%

Nick Scali, trading at A$22.73, is valued below its fair value estimate of A$31.06, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins to 11.6% from 17.2%, earnings are projected to grow by 15.6% annually, surpassing market growth rates and enhancing return on equity forecasts to a high level over three years. Recent executive changes may influence the company's strategic direction and future performance outcomes.

- The analysis detailed in our Nick Scali growth report hints at robust future financial performance.

- Get an in-depth perspective on Nick Scali's balance sheet by reading our health report here.

Seize The Opportunity

- Click here to access our complete index of 30 Undervalued ASX Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com