A Look at First Busey’s (BUSE) Valuation After Its Expanded Share Repurchase Authorization

First Busey (BUSE) just dialed up its share repurchase plans, adding 4 million shares to its buyback authorization, a move that often reflects management confidence and a shareholder friendly capital strategy.

See our latest analysis for First Busey.

The stepped up buyback comes after a steady run in the stock, with a roughly 5 percent year to date share price return to about $24.29, even as the 1 year total shareholder return is still slightly negative. This suggests improving but not blazing momentum as investors reassess the bank following leadership changes and ongoing preferred dividend payments.

If this kind of capital return story has your attention, it could be worth seeing what other financial names are doing, starting with fast growing stocks with high insider ownership.

With earnings growing faster than revenue, the stock trading below analyst targets, and a sizable intrinsic value discount implied by some models, is First Busey quietly undervalued or already pricing in its next leg of growth?

Price-to-Earnings of 22.1x: Is it justified?

On a headline basis, First Busey trades on a 22.1x price to earnings multiple at $24.29 per share, a richer valuation than most US bank peers.

The price to earnings ratio compares the company’s share price to its per share earnings, so a higher multiple usually reflects stronger expected profit growth or perceived quality.

In First Busey’s case, investors are paying a premium multiple versus both its direct peer group average of 17.8x and the broader US banks industry at 11.6x, even though the stock scores poorly on some profitability metrics and its current return on equity sits below typical bank benchmarks. The market is effectively assigning a valuation consistent with a higher quality or faster growing franchise than its recent earnings record alone might justify, especially when the estimated fair price to earnings ratio from our work is closer to 19.2x. This is a level the multiple could gravitate toward if sentiment normalizes.

Explore the SWS fair ratio for First Busey

Result: Price-to-Earnings of 22.1x (OVERVALUED)

However, slowing revenue growth or a reversal in credit quality could quickly challenge the premium valuation and dampen enthusiasm around the buyback story.

Find out about the key risks to this First Busey narrative.

Another Angle: Our DCF Work

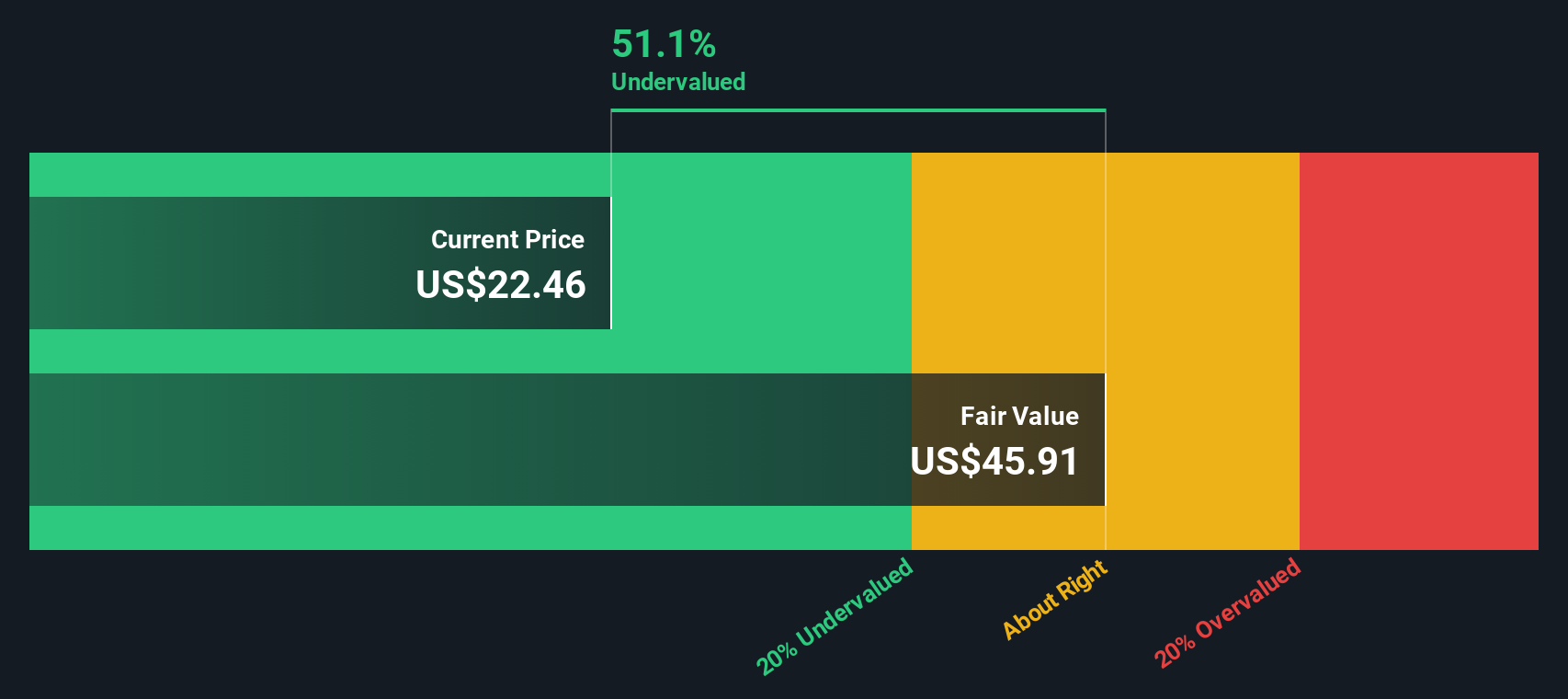

Switching from earnings multiples to our DCF model flips the story. On that lens, First Busey appears deeply undervalued, with the shares trading about 46.6 percent below an estimated fair value of roughly $45.48. Is the market missing something, or is the model too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Busey for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Busey Narrative

If you see the numbers differently or want to explore the details yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your First Busey research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single bank thesis. Use Simply Wall Street’s screener to target fresh opportunities before the crowd catches on and capitalizes ahead of the next move.

- Capture early stage upside by scanning these 3595 penny stocks with strong financials that pair small size with improving fundamentals and the potential to rerate quickly as results surprise the market.

- Explore structural growth trends by focusing on these 27 AI penny stocks positioned in areas such as automation, data intelligence, and productivity solutions.

- Look for potential mispricings with these 903 undervalued stocks based on cash flows that trade below their estimated cash flow value, which may provide a margin of safety if sentiment turns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com