Dollar General (DG) Valuation Check After Strong Recent Share Price Rebound

Dollar General (DG) has quietly staged a comeback, with the stock up about 25% over the past month and more than 60% year to date, prompting investors to revisit its turnaround story.

See our latest analysis for Dollar General.

The recent momentum has been fueled by expectations that management’s reset on pricing and store execution can restore growth. A 30 day share price return of 25.25 percent has helped to offset a still weak five year total shareholder return of minus 34.91 percent, suggesting sentiment is improving but the longer term picture remains a work in progress.

If Dollar General’s rebound has you rethinking defensives, this could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

With shares rebounding and analysts seeing limited upside to their targets, yet valuation screens still flagging a meaningful intrinsic discount, is Dollar General a value play in plain sight or has the market already priced in its recovery?

Most Popular Narrative Narrative: 1.3% Overvalued

With Dollar General last closing at $124.27 against a most popular narrative fair value of about $122.68, expectations are finely balanced rather than extreme.

Remodeling efforts (Project Renovate and Project Elevate), along with expansion of higher margin nonconsumables and continued development of private label brands, are improving store productivity and encouraging higher basket sizes, helping to drive gross margin expansion and profitable earnings growth.

Curious how modest revenue growth, rising margins and a richer future earnings multiple can still justify today’s price? The full narrative explains the math behind that delicate premium.

Result: Fair Value of $122.68 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent wage inflation and intensifying discount competition could erode margins faster than expected, challenging the optimistic earnings trajectory reflected in current forecasts.

Find out about the key risks to this Dollar General narrative.

Another View: Multiples Paint a Different Picture

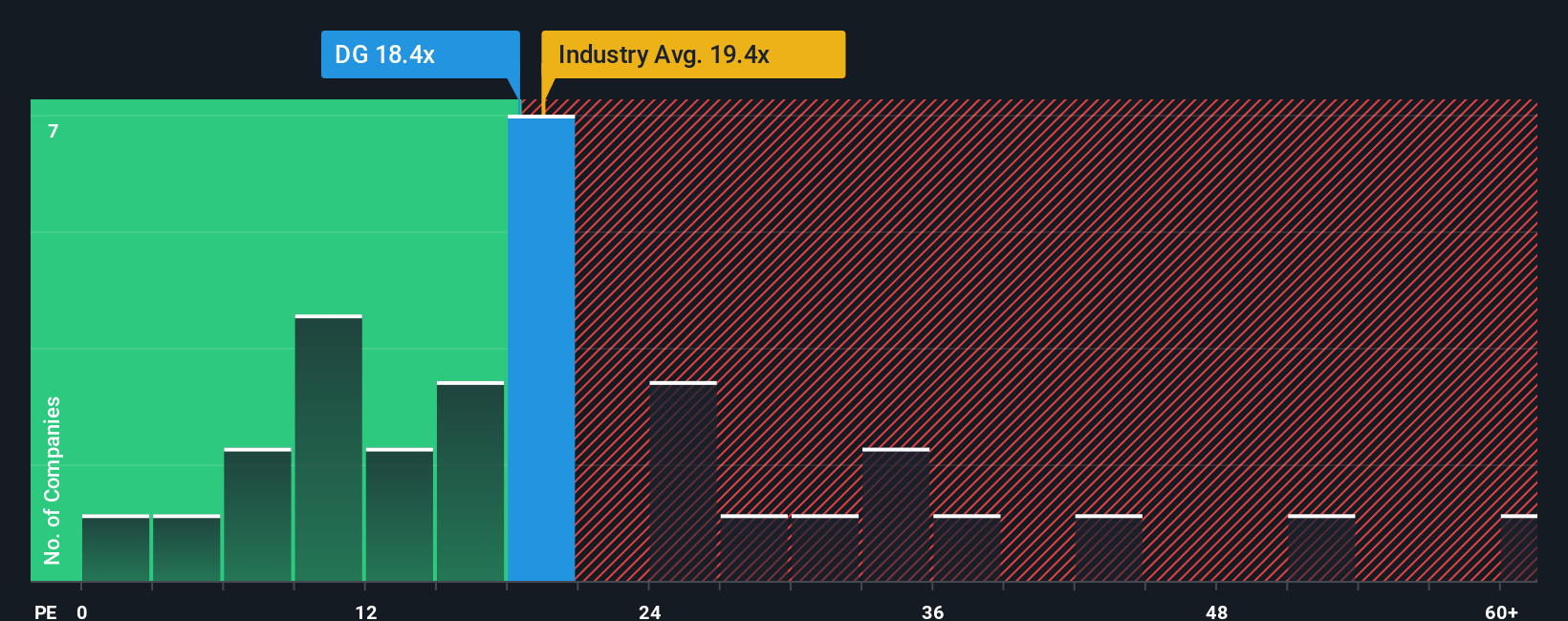

While the most popular narrative sees Dollar General as about 1.3 percent overvalued, its current P E of 21.4 times looks almost spot on versus a fair ratio of 21.6 times and the US Consumer Retailing average of 21.5 times, but richer than peers at 19.8 times.

That slight premium to peers, alongside alignment with both the industry and the fair ratio, suggests valuation risk is finely balanced rather than extreme. This raises the question of whether incremental execution gains or any stumble will decide which way the multiple moves next.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dollar General Narrative

If you are not fully convinced by this view or would rather dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Dollar General research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing move?

Before the market’s next swing leaves you watching from the sidelines, put Simply Wall St’s powerful screener to work and uncover opportunities that match your strategy.

- Capitalize on mispriced opportunities by targeting companies trading below intrinsic value with these 903 undervalued stocks based on cash flows.

- Catch the next wave of innovation by focusing on businesses building real products and services around digital assets through these 80 cryptocurrency and blockchain stocks.

- Strengthen your portfolio’s income engine by zeroing in on reliable payers using these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com