Universal Technical Institute (UTI): Valuation Check After Strong Earnings and Fresh Insider Buying

Universal Technical Institute (UTI) just combined a stronger than expected quarter with fresh insider buying from Coliseum Capital, a pairing that tends to make long term investors sit up and pay attention.

See our latest analysis for Universal Technical Institute.

Even after a softer 1 day share price move and a roughly 13% 1 month share price pullback to about $24.55, the combination of strong quarterly results and sizable insider buying comes against the backdrop of a powerful 3 year total shareholder return above 300%. This suggests long term momentum is still very much intact even as near term sentiment cools.

If this mix of performance and insider conviction has your attention, it could be a good moment to see what else is out there with fast growing stocks with high insider ownership.

With shares still well below analyst targets despite a stellar three-year run and fresh insider buying, is UTI quietly undervalued today, or has the market already priced in the next leg of its growth story?

Most Popular Narrative: 34.7% Undervalued

Compared to Universal Technical Institute's last close at $24.55, the most widely followed narrative implies a materially higher fair value anchored in long term growth assumptions.

Strategic investments in campus expansion, new program rollouts (notably in HVAC, aviation, and allied health), and digitization efforts are expected to support top line expansion, while the consolidation of core systems should facilitate operating efficiencies, driving long term margin improvement beyond the near term investment cycle.

Want to see what kind of revenue climb and profit squeeze still justify a richer future valuation multiple than the wider sector, even after discounting cash flows at a mid single digit rate? The narrative lays out a precise roadmap of enrollment growth, margin compression, and a much higher earnings multiple that all have to work together for this fair value to hold. Curious how those moving parts connect.

Result: Fair Value of $37.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in federal student aid or misfired campus expansion could quickly pressure enrollment, margins, and the rich valuation assumptions embedded in this thesis.

Find out about the key risks to this Universal Technical Institute narrative.

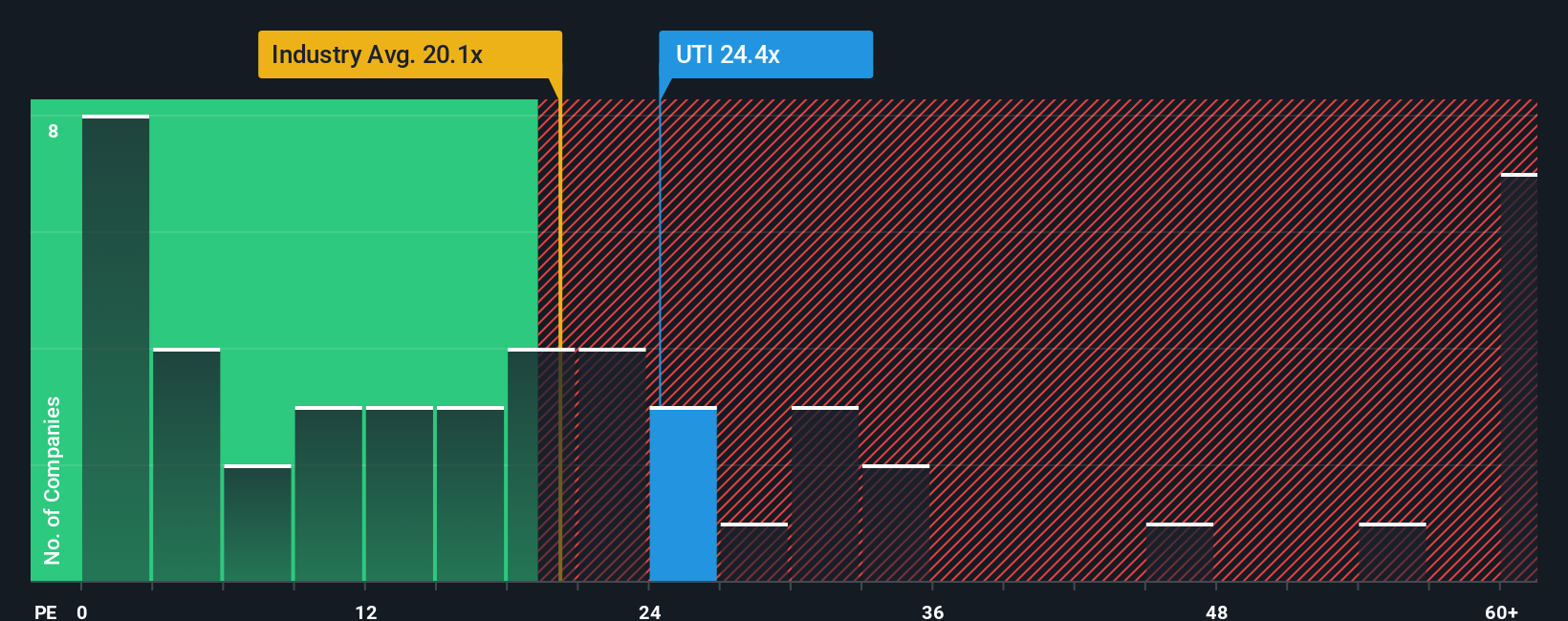

Another View: Market Ratios Flash a Caution Signal

While the narrative suggests UTI is 34.7% undervalued, a simple earnings multiple tells a different story. The stock trades on 21.2 times earnings versus a US Consumer Services average of 16.2, peers at 22.4, and a fair ratio closer to 9.3, which hints at valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Universal Technical Institute Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more actionable investment ideas?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover targeted ideas that match your strategy and help you stay ahead of other investors.

- Capture potential value by reviewing these 902 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow support.

- Position yourself for disruptive innovation by scanning these 27 AI penny stocks shaping the next wave of intelligent automation and data driven services.

- Strengthen your income strategy with these 15 dividend stocks with yields > 3% that can boost portfolio yield while still keeping an eye on fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com