Vita Coco (COCO): Revisiting Valuation After a 52% Year-to-Date Share Price Surge

Vita Coco Company (COCO) has quietly turned into one of the stronger consumer names this year, with the stock up around 52% year to date and roughly 48% over the past year.

See our latest analysis for Vita Coco Company.

That climb has not been a straight line, but the recent 30 day share price return of 27.21 percent and a powerful three year total shareholder return of 303.69 percent suggest momentum is still building as investors reassess Vita Coco Company’s growth profile and risk.

If Vita Coco Company’s run has you thinking about what else might be gaining traction, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover other potential compounders.

With earnings still growing faster than sales and shares trading only slightly below analyst targets, the key question now is whether Vita Coco remains undervalued on its fundamentals or if the market is already pricing in its next leg of growth.

Most Popular Narrative: 3.4% Undervalued

With Vita Coco Company last closing at $53.57 versus a narrative fair value of $55.44, the current price leaves only a slim upside gap, but the narrative hinges on a few powerful earnings drivers.

Lower freight costs and tariff rates are expected to lead to improved margins and stronger earnings momentum, particularly in FY26 and FY27. This supports upward earnings per share revisions.

Want to see what justifies a richer future earnings multiple for a coconut water brand? The narrative leans on accelerating sales, expanding margins, and a long runway for category growth. Curious how those moving parts combine into today’s fair value call? Explore the full playbook behind this valuation.

Result: Fair Value of $55.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated tariffs on coconut imports and persistent freight cost volatility could still squeeze margins and undermine the current fair value narrative.

Find out about the key risks to this Vita Coco Company narrative.

Another Lens on Valuation

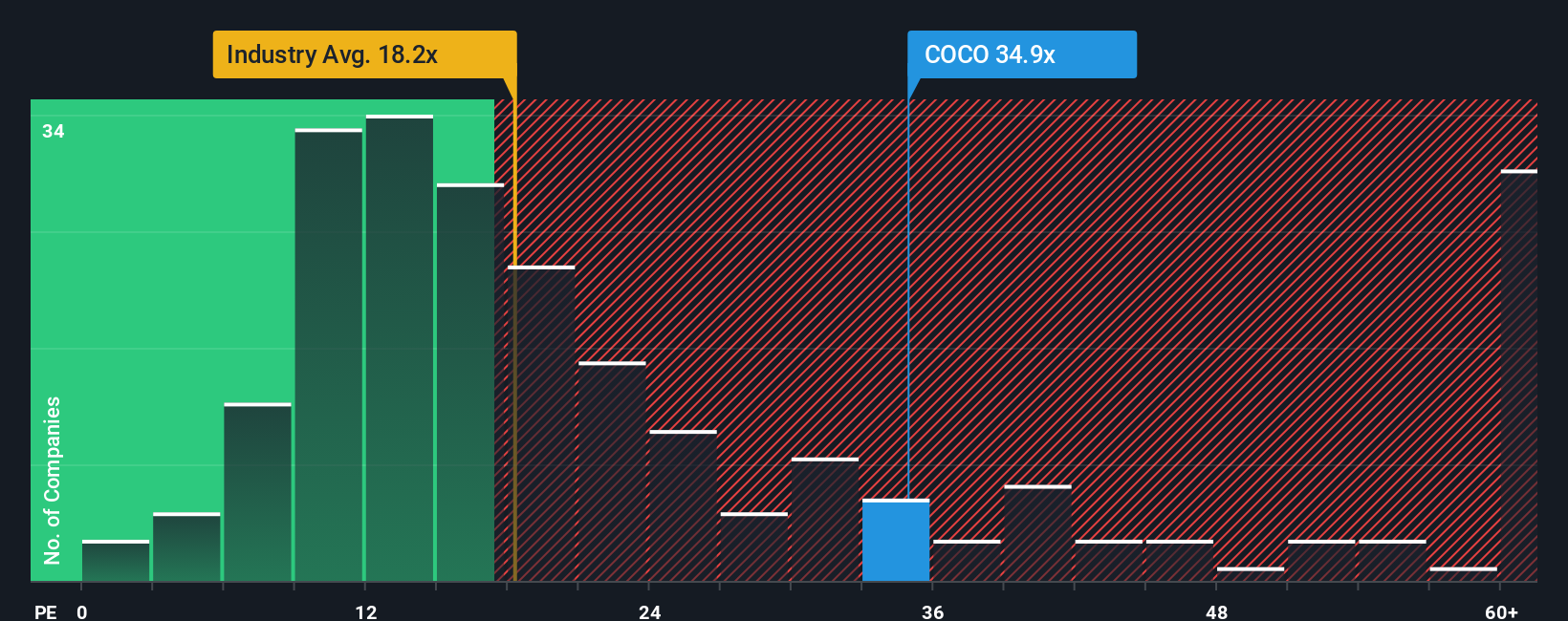

Our fair value work suggests Vita Coco is 21.1 percent below intrinsic value. However, its current price to earnings ratio of 44.1 times looks stretched against a 21.5 times fair ratio, 17.5 times for the global beverage industry, and 20 times for peers. This raises the risk of a sentiment snap back if growth expectations soften.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vita Coco Company Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a custom view in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vita Coco Company.

Looking for more investment ideas?

Use the Simply Wall St Screener today to uncover fresh opportunities tailored to your strategy, so you do not miss the next wave of standout performers.

- Capture early upside in high potential names by scanning these 3595 penny stocks with strong financials that show strong balance sheets and improving fundamentals before they become widely followed.

- Position your portfolio for structural trends by targeting these 27 AI penny stocks that combine innovative technology with scalable business models.

- Focus on these 902 undervalued stocks based on cash flows where cash flow strength may be higher than what the market currently reflects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com