Disc Medicine (IRON): Reassessing Valuation After Encouraging RALLY-MF Phase 2 Anemia Data

Early Trial Data Puts Disc Medicine In Focus

Disc Medicine (IRON) just put its RALLY-MF Phase 2 data for DISC-0974 on the table, showing meaningful anemia improvements in myelofibrosis patients that could reshape expectations around this small hematology focused pipeline.

See our latest analysis for Disc Medicine.

The news lands with Disc already in a strong groove, with a roughly 53% 3 month share price return and a 42.65% 1 year total shareholder return hinting that momentum is building rather than cooling.

If this kind of hematology progress has your attention, it could be a good moment to scout other specialised opportunities through healthcare stocks.

With Disc now trading near 52 week highs yet still sitting roughly 30% below consensus targets, investors face a sharper question: is the iron therapy story still mispriced, or is the market already baking in the next leg of growth?

Price-to-Book of 6.1x: Is It Justified?

Disc Medicine currently trades on a price to book ratio of 6.1x, which makes the stock look expensive compared to much of the biotech space despite its recent run.

Price to book compares the company’s market value to its net assets, a common yardstick for early stage biotechs that are still loss making and light on revenue. In Disc’s case, investors are clearly paying a premium over the balance sheet for the potential of its hematology pipeline rather than today’s financials.

That premium stands out even more against peers. Disc’s 6.1x price to book multiple sits well above the US biotechs industry average of 2.7x, which suggests the market is assigning a higher value to Disc’s prospects or perceived risk profile than to the typical name in the group.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 6.1x (OVERVALUED)

However, setbacks in pivotal trials or slower than expected commercialization of its hematology portfolio could quickly challenge today’s premium valuation and growth assumptions.

Find out about the key risks to this Disc Medicine narrative.

Another Lens on Value

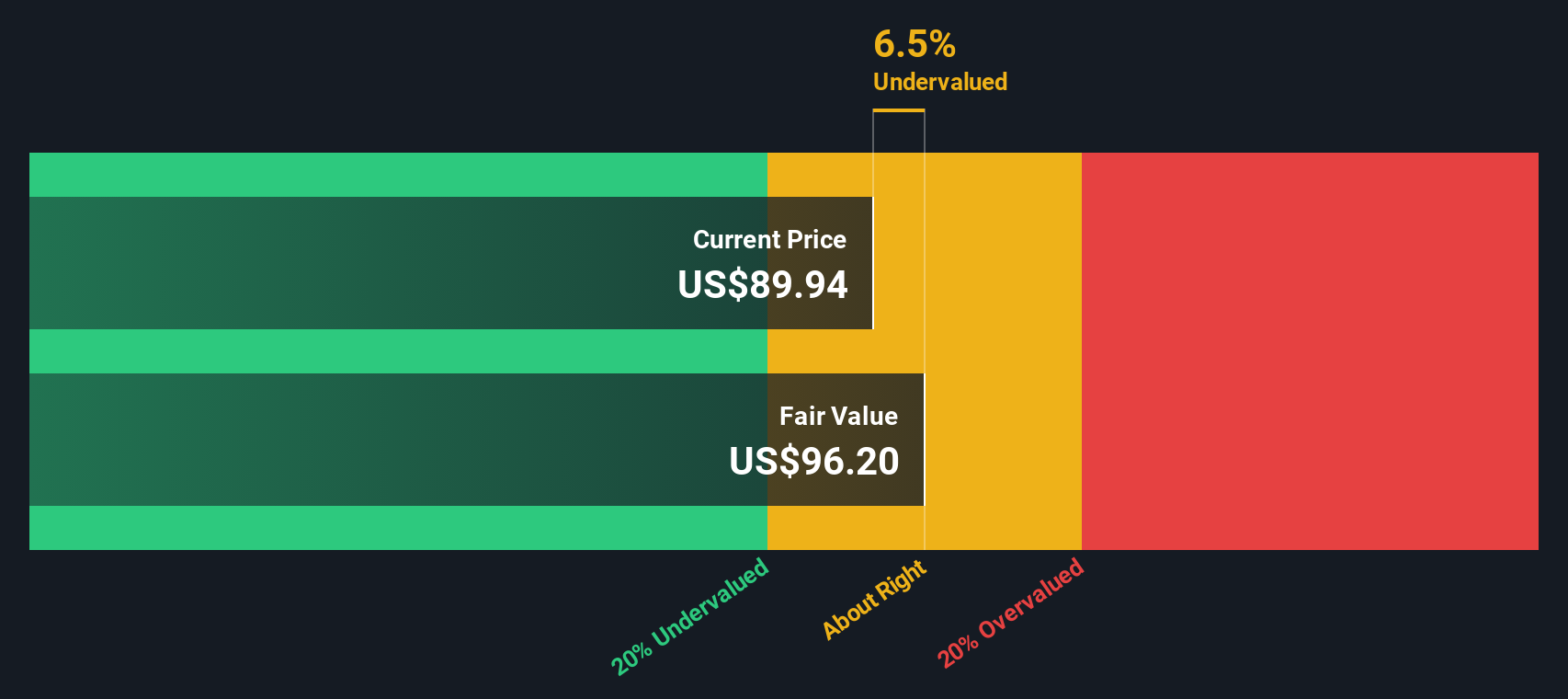

Our DCF model paints a cooler picture, suggesting IRON is trading around 9% above its estimated fair value of approximately $84.88. That clashes with the rich price to book story and raises a clear tension: are investors leaning too hard into the upside case?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Disc Medicine for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Disc Medicine Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Disc Medicine research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready For Your Next Investing Move?

Now put your research momentum to work and line up your next potential winners with focused stock ideas tailored to different strategies and risk appetites.

- Capture potential mispricings before the crowd by scanning these 902 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Tap into powerful trends in automation and machine learning by targeting these 27 AI penny stocks positioned to benefit from accelerating demand for intelligent software and infrastructure.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that could add consistent cash returns alongside capital growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com