Hermès (ENXTPA:RMS): Assessing Valuation After a Recent Share Price Recovery

Hermès International Société en commandite par actions (ENXTPA:RMS) has been quietly grinding higher over the past month, with the stock up about 3 %, even as its year to date performance remains negative.

See our latest analysis for Hermès International Société en commandite par actions.

That gentle 2.96 % 30 day share price return sits against a weaker year to date share price performance and a resilient five year total shareholder return of 158.22 %, which suggests long term confidence remains intact even as short term momentum cools.

If Hermès has you thinking about quality and staying power, it might be worth scanning fast growing stocks with high insider ownership for other names where management is notably invested in the outcome.

With earnings still growing and the share price lagging its five year record, investors face a familiar luxury dilemma: is Hermès quietly undervalued after a softer run, or is the market already baking in years of future growth?

Most Popular Narrative: 11.2% Undervalued

With Hermès shares last closing at €2,119 against a narrative fair value of about €2,385, the valuation view leans positive and leans heavily on long term growth drivers.

Scarcity driven supply model, underpinned by disciplined capacity investments (opening four new leather workshops in the next four years) and exclusive distribution expansion into key markets (e.g., U.S., China, India), enables Hermès to maximize pricing power and protect industry leading gross/net margins.

Want to see what kind of revenue runway and profit uplift this strategy is built on? The narrative bakes in ambitious growth, rising margins, and a rich future earnings multiple that would not look out of place in fast growing tech. Curious which exact assumptions have to hold for that upside to materialize? Read on to unpack the full story behind this fair value.

Result: Fair Value of €2,385.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat outlook could unravel if Chinese demand stays sluggish and rising input costs squeeze the margins that underpin the premium valuation of Hermès.

Another View: Rich Multiples Temper The Story

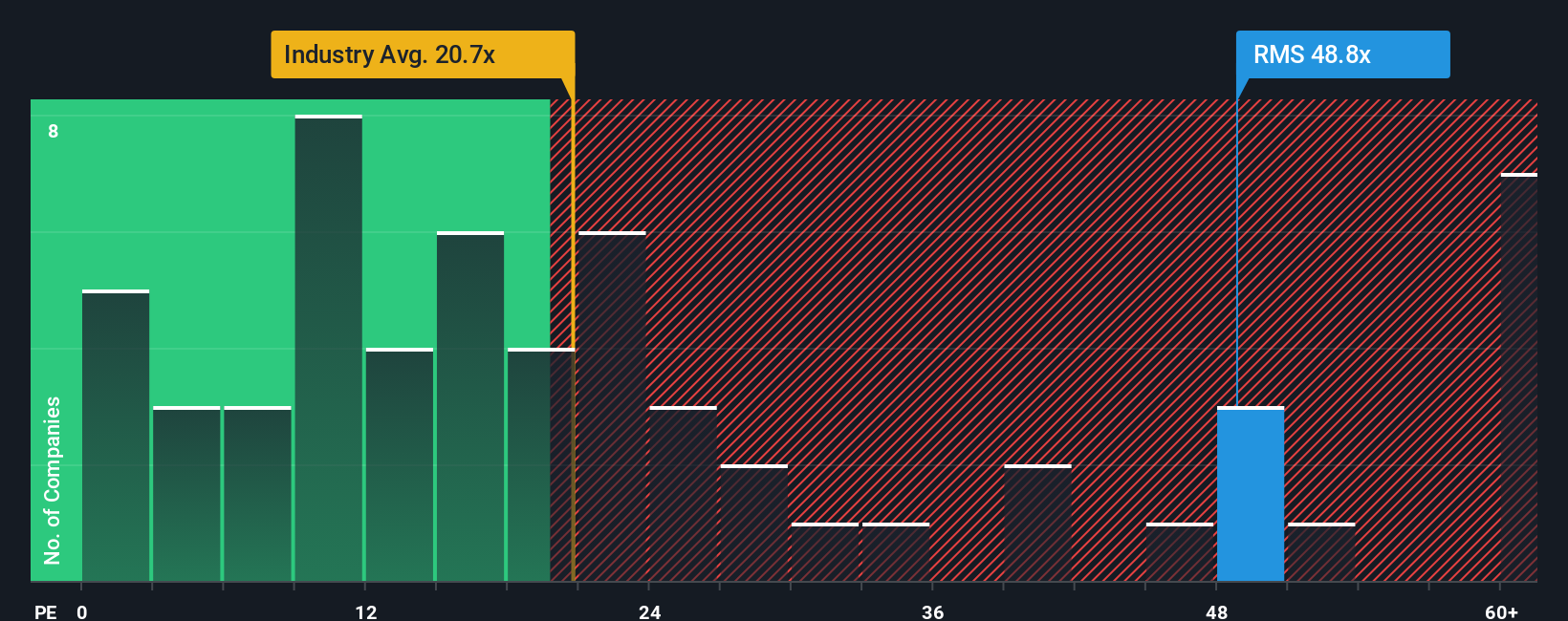

Step away from narratives and Hermès looks far from cheap on simple earnings math. The shares trade at about 49.6 times earnings, versus roughly 31.7 times for peers and a fair ratio near 29.5 times. This suggests valuation risk if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hermès International Société en commandite par actions Narrative

If you want to challenge these assumptions or would rather dig into the numbers yourself, you can craft a personal Hermès thesis in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Hermès International Société en commandite par actions.

Looking for more investment ideas?

Before you move on, you could look for your next opportunity by using the Simply Wall Street Screener to uncover stocks that might reshape your portfolio’s long term potential.

- Explore potential mispricings by targeting companies that appear inexpensive based on their future cash flows with these 904 undervalued stocks based on cash flows.

- Consider positioning yourself early in transformative technology by scanning these 28 quantum computing stocks that may benefit from next generation computing developments.

- Review these 15 dividend stocks with yields > 3% that might offer yields above 3 % together with solid fundamentals as part of an income strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com