Shinpoong Paper Mfg. Co., Ltd's (KRX:002870) Business Is Trailing The Industry But Its Shares Aren't

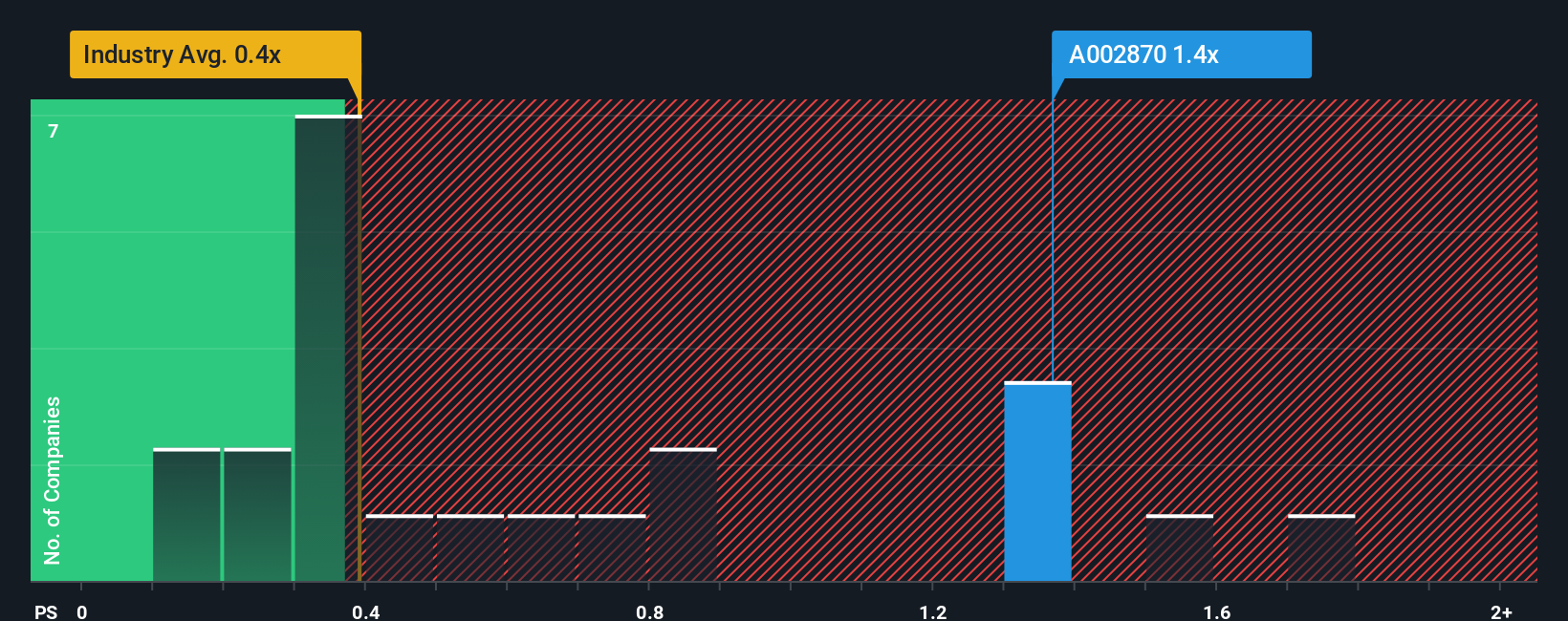

When close to half the companies in the Packaging industry in Korea have price-to-sales ratios (or "P/S") below 0.4x, you may consider Shinpoong Paper Mfg. Co., Ltd (KRX:002870) as a stock to potentially avoid with its 1.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Shinpoong Paper Mfg

How Has Shinpoong Paper Mfg Performed Recently?

The recent revenue growth at Shinpoong Paper Mfg would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shinpoong Paper Mfg's earnings, revenue and cash flow.How Is Shinpoong Paper Mfg's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Shinpoong Paper Mfg's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 3.9%. The latest three year period has also seen a 21% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 14% shows it's noticeably less attractive.

With this information, we find it concerning that Shinpoong Paper Mfg is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shinpoong Paper Mfg revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Shinpoong Paper Mfg (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.