Disney (DIS) Valuation Check After Recent Share Price Dip and Earnings Momentum

How Walt Disney's Recent Performance Frames the Stock Debate

Walt Disney (DIS) has quietly slipped about 5% over the past year and roughly 8% in the past 3 months, even as annual revenue and net income continue to grow.

See our latest analysis for Walt Disney.

Despite a mild 1 year total shareholder return of around negative 5%, the recent 1 day share price gain of 2.21% to $107.63 hints that sentiment may be stabilising as investors reassess Disney's earnings momentum and streaming strategy.

If you are rethinking your media exposure, this is also a good moment to look across entertainment rivals and explore aerospace and defense stocks as a different corner of the market with distinct growth drivers.

With revenue and earnings still edging higher while the share price lags, investors face a familiar crossroads: is Disney quietly undervalued after a tough run, or is the market already pricing in its next wave of growth?

Most Popular Narrative Narrative: 18.2% Undervalued

With Walt Disney last closing at $107.63 versus a narrative fair value of about $131.50, the storyline points to meaningful upside if its assumptions hold.

The next five years are described as potentially transformative: ESPN’s NFL-driven streaming strength, streaming scaling into multibillion-dollar profits, parks and cruises expanding globally, and blockbuster releases supporting the IP machine. Disney could experience sustained double-digit EPS growth and a re-rating of the stock as sports shifts from a cable anchor into a digital growth driver.

According to Cashflow_Queen, this fair value hinges on streaming turning strongly profitable, Experiences remaining a significant cash generator, and sports evolving into a higher-margin digital business. Want to see how revenue, margins, and earnings are modeled to support that potential upside, and what kind of future profit multiple this implies for Disney?

Result: Fair Value of $131.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, escalating sports rights costs and softer park demand in a weaker economy could quickly undermine the margin and earnings trajectory that this bullish view assumes.

Find out about the key risks to this Walt Disney narrative.

Another Way to Look at Value

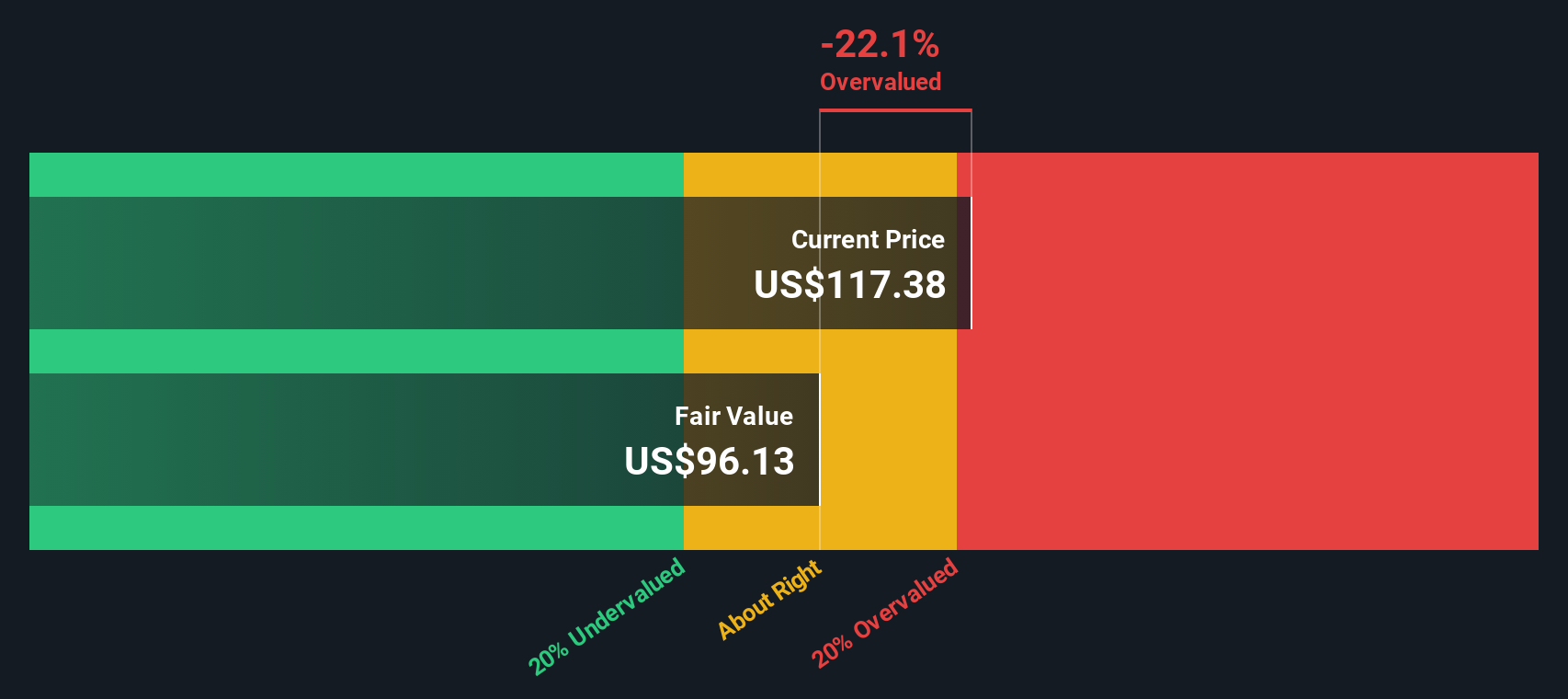

Our DCF model paints a cooler picture, suggesting Disney is slightly overvalued at $107.63 versus an estimated fair value of about $105.26. With the price sitting just above this line, investors have to ask whether the potential upside is worth the execution risk.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Walt Disney for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Walt Disney Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised thesis in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Walt Disney.

Ready to hunt for your next opportunity?

Do not stop your research at Disney alone. Use the Simply Wall Street Screener to spot fresh, data driven ideas before everyone else is talking about them.

- Capture potential mispricings by scanning these 904 undervalued stocks based on cash flows that may offer stronger upside than mature household names.

- Ride powerful technological tailwinds by targeting these 27 AI penny stocks positioned at the heart of automation and intelligent software.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that aim to reward shareholders with consistent cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com