Crescent Energy (CRGY): Revisiting Valuation After Mixed Q3 Results and Higher Capital Spending Guidance

Crescent Energy (CRGY) is back in focus after Q3 results showed revenue up about 16% year over year, yet still shy of forecasts, and management lifted full year capital spending guidance on the back of efficiencies and divestiture cash.

See our latest analysis for Crescent Energy.

The mixed Q3 update seems to be nudging sentiment off the lows, with a roughly 21% 3 month share price return contrasting against a still weak 1 year total shareholder return of around negative 28%. This suggests early momentum but not a full turnaround yet.

If Crescent’s rebound has you thinking about where else capital could work harder, this is a good moment to explore fast growing stocks with high insider ownership.

With the stock still well below its 1 year highs and trading at a steep discount to analyst targets despite improving earnings, investors now face a key question: is Crescent Energy undervalued or is future growth already priced in?

Most Popular Narrative: 30.1% Undervalued

With Crescent Energy closing at $9.91 against a narrative fair value in the mid teens, the current gap hinges on aggressive profitability upgrades.

The company's strong balance sheet, disciplined capital allocation, and active debt reduction enhance financial stability and may lower interest expenses, increasing net income and creating capacity for shareholder returns (dividends/buybacks).

Curious how modest revenue growth can still translate into a much richer valuation multiple and sharply higher earnings power? The underlying assumptions reshape margins, leverage, and per share economics in ways the market may not be fully pricing yet.

Result: Fair Value of $14.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained acquisition risks and region specific regulatory shifts could pressure margins and stall the profit expansion that this bullish narrative leans on.

Find out about the key risks to this Crescent Energy narrative.

Another Angle on Valuation

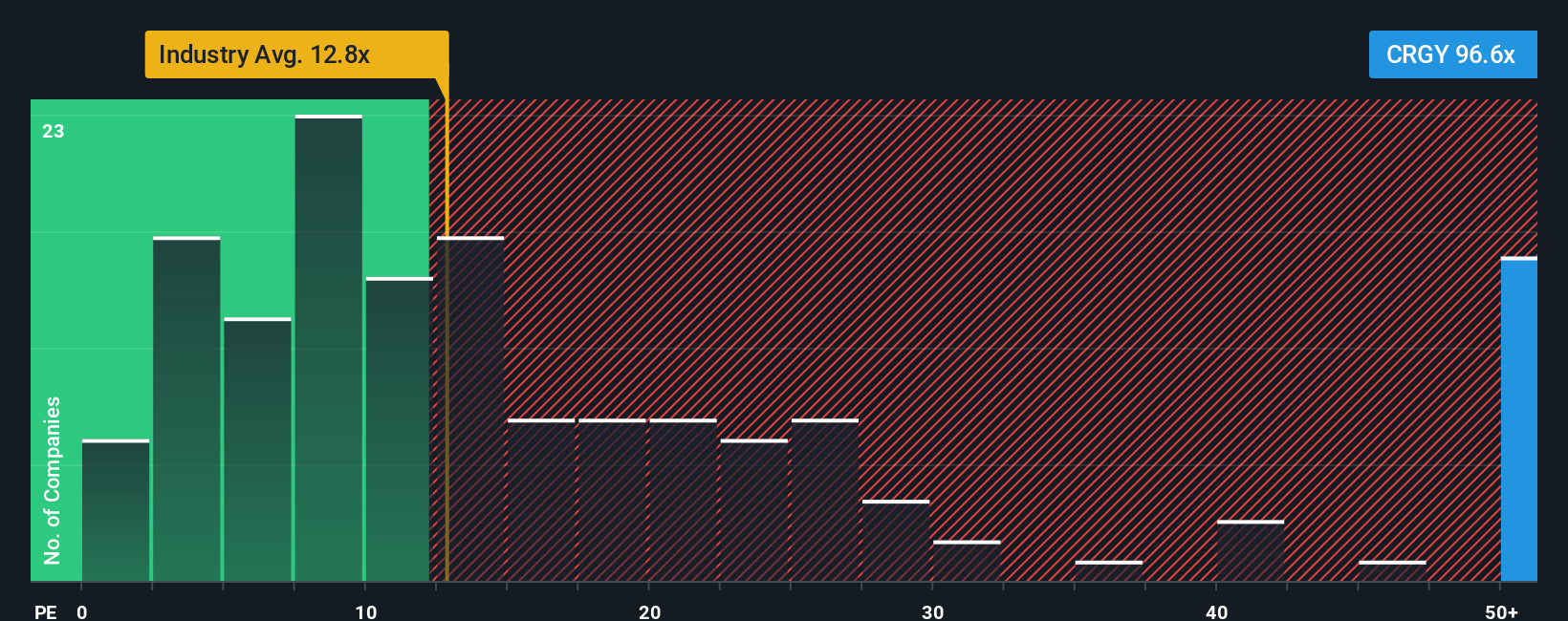

Despite the bullish fair value around the mid teens, Crescent trades on a steep 107.3 times earnings versus peers at about 9.9 times and a fair ratio of 22 times. That gap points to real downside risk if earnings disappoint or the market cuts this premium. Which story do you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Crescent Energy Narrative

If you see the story differently or simply prefer to dig into the numbers yourself, you can craft a personalized view in just minutes: Do it your way.

A great starting point for your Crescent Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before momentum shifts again, consider your next move using targeted screeners that surface opportunities most investors overlook, so your capital is always working harder.

- Explore potential multi baggers early by scanning these 3595 penny stocks with strong financials built on resilient balance sheets and real operating strength, not just hype.

- Focus on the AI wave by filtering for these 27 AI penny stocks positioned at the intersection of data, automation, and scalable business models.

- Support your long term income strategy by targeting these 15 dividend stocks with yields > 3% that combine meaningful yields with sustainable payout coverage.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com