Asian Dividend Stocks To Consider In December 2025

As global markets closely monitor the final Federal Reserve meeting of the year with hopes for an interest rate cut, Asian markets are also navigating a complex landscape marked by mixed economic signals, such as China's ongoing property crisis and Japan's potential monetary tightening. In this environment, dividend stocks can offer a measure of stability and income, making them an attractive option for investors looking to balance growth with reliable returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.86% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.94% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.74% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.46% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.87% | ★★★★★★ |

Click here to see the full list of 1037 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Computer Institute of Japan (TSE:4826)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Computer Institute of Japan, Ltd. offers system development and related services in Japan with a market cap of ¥29.68 billion.

Operations: The company's revenue is primarily derived from its System Development and Services segment, totaling ¥27.25 billion.

Dividend Yield: 3%

Computer Institute of Japan offers a stable dividend profile with payments consistently growing over the past decade. Despite a relatively low yield of 3.05% compared to top-tier dividend payers in Japan, the dividends are well-covered by earnings and cash flows, with payout ratios around 52%. Recent financial guidance anticipates net sales of ¥28.5 billion and operating profit of ¥2.25 billion for fiscal year ending June 2026, supporting its reliable dividend strategy amidst share price volatility.

- Navigate through the intricacies of Computer Institute of Japan with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Computer Institute of Japan shares in the market.

Nippon Thompson (TSE:6480)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Thompson Co., Ltd. operates under the IKO brand, specializing in the development, manufacturing, and sale of needle roller bearings, linear motion rolling guides, precision positioning tables, and machine components across Japan and various international markets with a market cap of ¥53.35 billion.

Operations: Nippon Thompson Co., Ltd.'s revenue is primarily derived from its Bearings and other segment, contributing ¥51.46 billion, followed by its Mechanical parts segment at ¥6.47 billion.

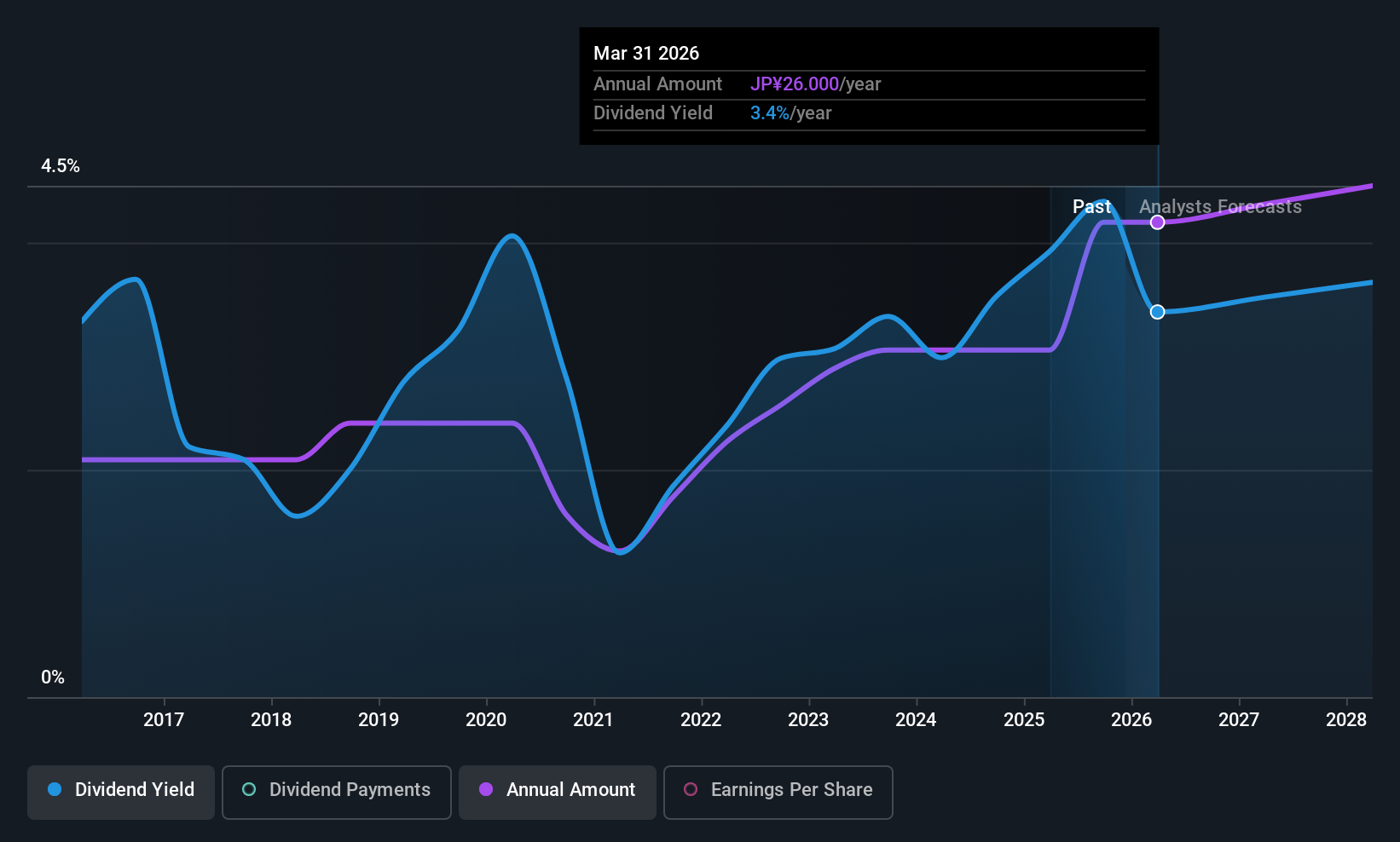

Dividend Yield: 3.7%

Nippon Thompson's dividend yield of 3.66% ranks in the top 25% of Japanese dividend payers, though its payments have been volatile over the past decade. Despite this instability, dividends are well-supported by a cash payout ratio of 49.1% and an earnings payout ratio of 58.9%. Recent guidance revisions suggest stronger financial performance, with expected net sales reaching ¥60.5 billion and operating profit at ¥3.1 billion for fiscal year ending March 2026, indicating potential for continued dividend support.

- Take a closer look at Nippon Thompson's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Nippon Thompson shares in the market.

Ryoden (TSE:8084)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ryoden Corporation operates in various sectors including factory automation systems, cooling and heating systems, ICT, building systems, smart-agriculture, green network, healthcare, and electronics both in Japan and internationally with a market cap of ¥73.19 billion.

Operations: Ryoden Corporation's revenue is primarily derived from its Electronics segment at ¥116.65 billion, followed by Factory Automation Systems at ¥48.39 billion, Refrigeration and Cooling Building Systems at ¥34.62 billion, and X - Tech at ¥8.60 billion.

Dividend Yield: 4%

Ryoden's dividend yield of 4.01% places it in the top quartile of Japanese dividend payers, although past payments have been inconsistent. However, recent increases from ¥53 to ¥68 per share indicate a positive trend. The dividends are well-covered by earnings and cash flows, with payout ratios of 53.2% and 17.8%, respectively. Revised guidance projects strong profitability for fiscal year ending March 2026, suggesting potential stability in future dividends despite historical volatility.

- Delve into the full analysis dividend report here for a deeper understanding of Ryoden.

- In light of our recent valuation report, it seems possible that Ryoden is trading behind its estimated value.

Turning Ideas Into Actions

- Click here to access our complete index of 1037 Top Asian Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com