Is It Too Late To Consider TSMC After Its Huge AI Fueled Share Price Surge?

- If you have been wondering whether Taiwan Semiconductor Manufacturing is still a smart buy after its huge run, you are not alone. That is exactly what this article will dig into.

- The stock has climbed 3.3% over the last week, 5.4% over the past month, and 49.8% year to date, building on gains of 59.0% over 1 year, 289.8% over 3 years, and 207.1% over 5 years.

- Recent headlines have highlighted TSM's central role in advanced chip manufacturing for AI data centers and leading edge smartphone processors, reinforcing its position as a critical supplier to tech giants. At the same time, ongoing geopolitical tensions around Taiwan and global efforts to diversify chip supply chains have kept risk perceptions and sentiment in constant motion.

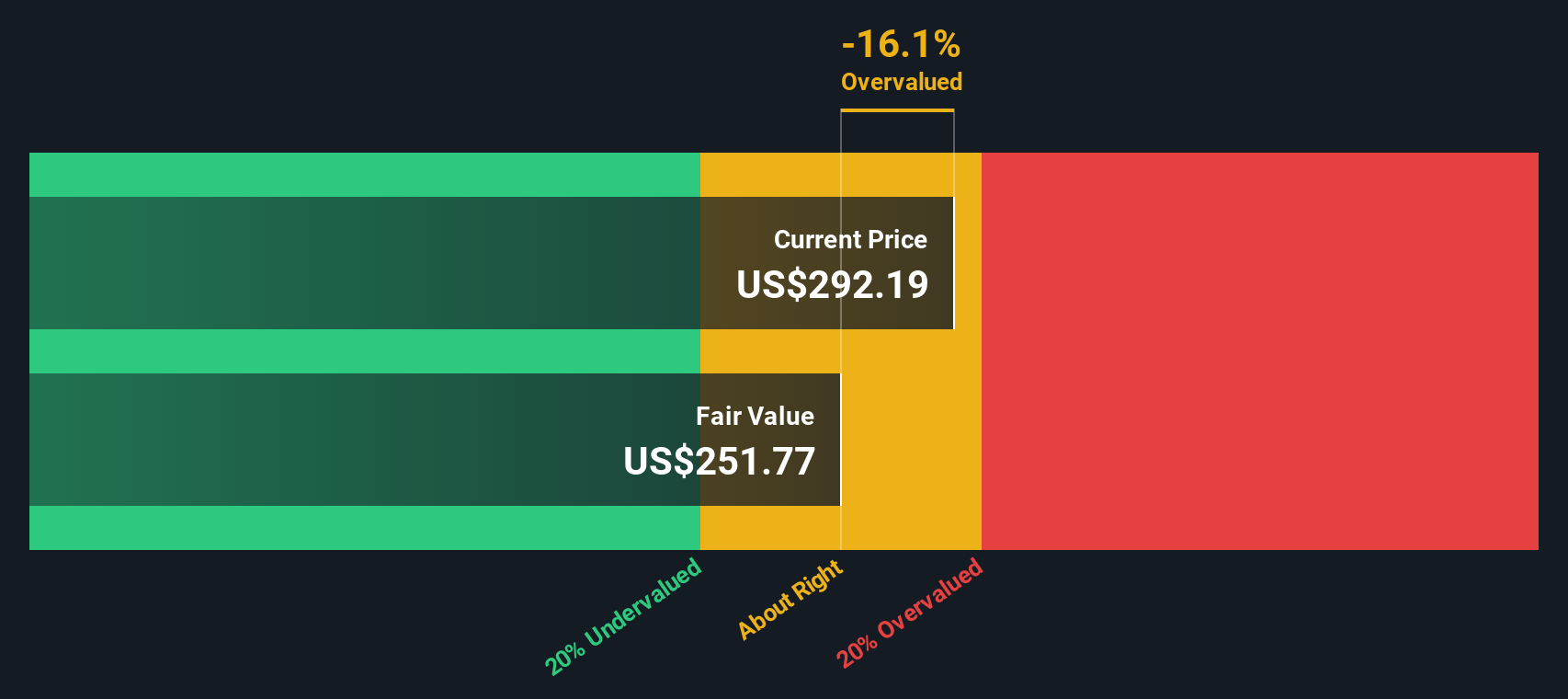

- On our framework, Taiwan Semiconductor Manufacturing earns a valuation score of 3 out of 6. This suggests the stock looks undervalued on some metrics but not all. In the sections ahead we will compare several valuation approaches before finishing with a more intuitive way to think about what this price really implies.

Approach 1: Taiwan Semiconductor Manufacturing Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Taiwan Semiconductor Manufacturing, this 2 Stage Free Cash Flow to Equity model is based on free cash flow forecasts and longer term extrapolations.

TSMC generated trailing twelve month free cash flow of roughly NT$802.4 Billion. Analysts and model estimates project this to grow steadily, reaching around NT$3.27 Trillion in free cash flow by 2035, with detailed projections stepping up through the late 2020s and early 2030s. Earlier years rely more heavily on analyst estimates, while the later years are extrapolated by Simply Wall St based on expected growth rates.

After discounting these future cash flows back to today, the model arrives at an intrinsic value of about $220.45 per share. Compared with the current market price, this implies the stock is roughly 36.9% overvalued on a DCF basis, suggesting the market is already pricing in very optimistic cash flow growth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Taiwan Semiconductor Manufacturing may be overvalued by 36.9%. Discover 904 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Taiwan Semiconductor Manufacturing Price vs Earnings

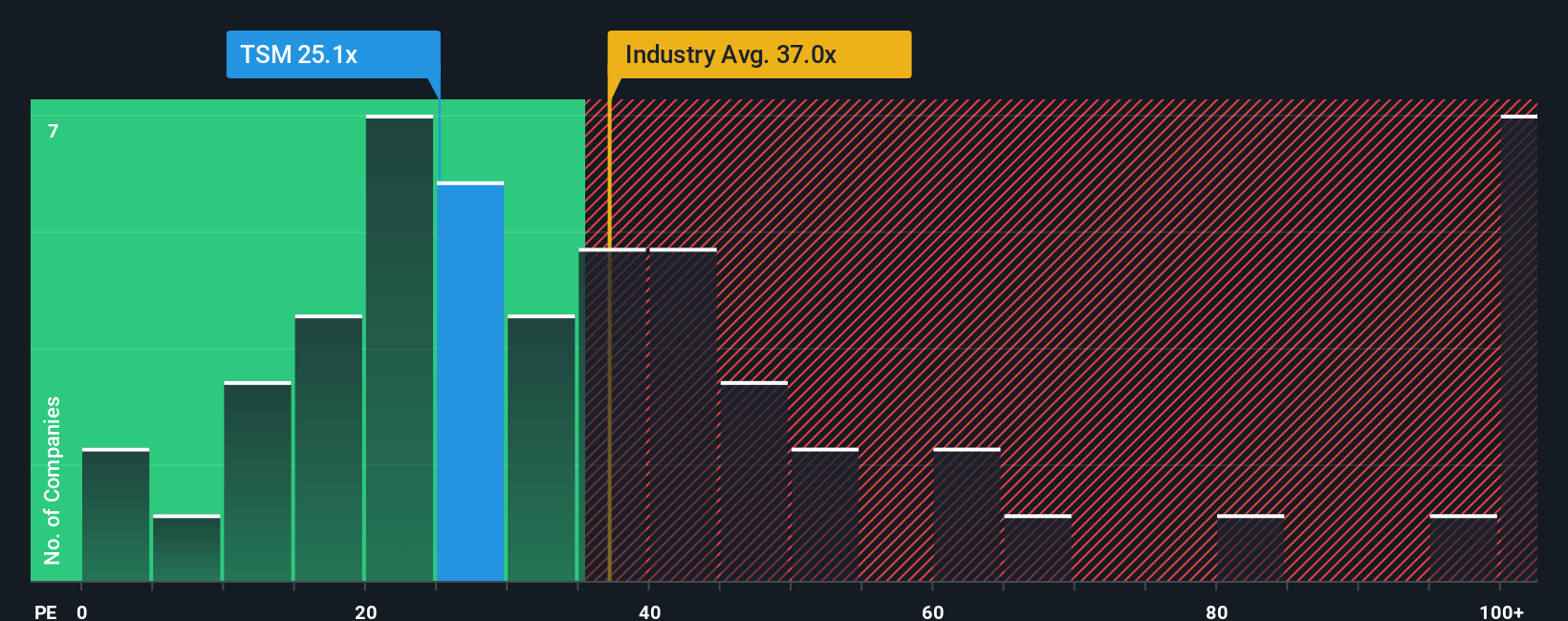

For profitable companies like TSMC, the price to earnings (PE) ratio is a useful way to gauge whether investors are paying a reasonable price for each dollar of current earnings. A higher PE can be justified when markets expect stronger, more durable growth and see fewer risks, while slower growth or elevated uncertainty usually warrants a lower, more conservative PE.

TSMC currently trades on a PE of about 24.7x. That sits well below the broader Semiconductor industry average of roughly 38.0x and is also cheaper than the peer group average of around 70.5x. This suggests the market is assigning a discount despite TSMC’s leading position. To refine this view, Simply Wall St uses a proprietary “Fair Ratio”, which estimates what PE a stock should trade on after accounting for its earnings growth outlook, profitability, industry structure, size and risk profile.

This Fair Ratio for TSMC is approximately 37.8x, implying the shares would trade noticeably higher if they were priced in line with their fundamentals on this framework. Because the actual PE of 24.7x is well below the Fair Ratio, the multiple based analysis points to the stock being undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Taiwan Semiconductor Manufacturing Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page. Here you describe your story for a company and link that perspective to specific assumptions about its future revenue, earnings and margins. These then flow through to a financial forecast, a Fair Value estimate and finally a clear buy or sell signal when you compare that Fair Value to today’s Price. All of this automatically updates as new news or earnings arrive. For example, one TSMC investor might build a very bullish Narrative around AI demand, diversified fabs and premium margins that supports a Fair Value near $310 per share, while a more cautious investor might focus on geopolitical risk, capex pressure and normalized growth to arrive at a much lower Fair Value closer to $118. Both can quickly see whether the current market price fits their story or tells them it is time to wait or take profits.

For Taiwan Semiconductor Manufacturing, we will make it really easy for you with previews of two leading Taiwan Semiconductor Manufacturing Narratives:

🐂 Taiwan Semiconductor Manufacturing Bull Case

Fair value: $310.00

Implied undervaluation vs last close: -2.6%

Revenue growth used in this narrative: 0%

- Positions TSMC as the central, dominant foundry at the core of the global AI and semiconductor ecosystem, with leading edge nodes and a blue chip customer base.

- Highlights powerful financials, high margins, strong balance sheet, disciplined capital allocation, and a long record of stable dividends and high returns on equity.

- Acknowledges geopolitical, currency, and customer concentration risks but argues that the company’s moat and execution make it a relatively low risk way to gain exposure to AI infrastructure growth.

🐻 Taiwan Semiconductor Manufacturing Bear Case

Fair value: $118.40

Implied overvaluation vs last close: 155.0%

Revenue growth used in this narrative: -23.21%

- Assumes the chip industry continues to grow and TSMC maintains leadership, but argues that a more conservative multiple and earnings outlook cap fair value well below the current price.

- Emphasizes heavy dependence on a small number of major customers, exposure to a single key equipment supplier, and significant geopolitical risk around Taiwan as structural vulnerabilities.

- Sees TSMC as fundamentally strong with solid dividends and a strong balance sheet, yet views the margin of safety as thin and the stock as materially overvalued relative to long term risk and return assumptions.

Do you think there's more to the story for Taiwan Semiconductor Manufacturing? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com