Ondas Holdings (ONDS): Reassessing Valuation After Revenue Surge, Upgraded Outlook, and New Defense Drone Contracts

Ondas Holdings (ONDS) just delivered a big revenue jump, raised its full year outlook, and backed it up with new government drone contracts and a strategic Ukrainian UAS investment, giving investors fresh reasons to revisit the stock.

See our latest analysis for Ondas Holdings.

The market seems to be waking up to this story, with a 30 day share price return of 55.25 percent and a year to date share price gain of 242.97 percent. The 1 year total shareholder return of 1009.2 percent suggests momentum has already been strong and is now being reinforced by contract wins and the Ukrainian UAS move.

If Ondas has put drones and autonomy on your radar, this could be a good time to explore other high growth tech names and discover high growth tech and AI stocks.

With revenue surging, guidance moving higher, and Wall Street lifting targets, investors now face a key question: Is Ondas still trading at a discount to its long-term potential, or is the market already pricing in years of growth?

Most Popular Narrative: 18% Undervalued

With Ondas Holdings last closing at $9.02 against a narrative fair value of $11.00, the story assumes more upside still lies ahead.

The analysts have a consensus price target of $2.5 for Ondas Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $3.0, and the most bearish reporting a price target of just $2.0.

Want to see what justifies paying up today for earnings that barely exist yet? The narrative leans on strong growth potential, richer margins, and a future multiple usually reserved for market favorites. Curious how those moving parts combine into that fair value call? Dive in to see the assumptions doing the heavy lifting.

Result: Fair Value of $11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, extended timelines at Ondas Networks or renewed geopolitical disruptions could derail that growth ramp and challenge both the backlog story and margin recovery assumptions.

Find out about the key risks to this Ondas Holdings narrative.

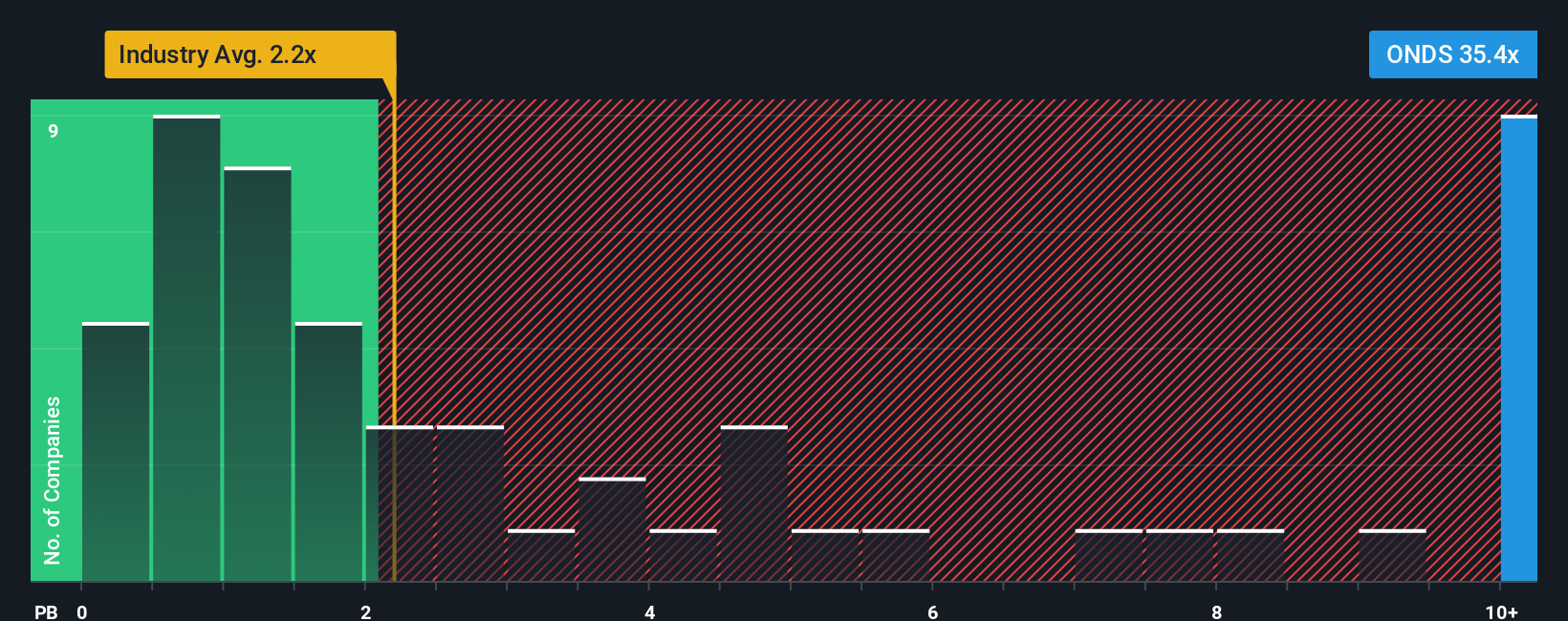

Another View: Rich On Book Value

While the narrative and our fair value work point to upside, Ondas looks expensive on a price to book basis at 6.9 times versus 3.7 times for peers and 2.0 times for the broader US communications group. If growth stumbles, could that premium unwind fast?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ondas Holdings Narrative

If you want to stress test these assumptions yourself instead of relying on ours, you can quickly build a custom Ondas view: Do it your way.

A great starting point for your Ondas Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop your research with Ondas alone; use the Simply Wall Street Screener to uncover other compelling, data driven opportunities that fit your strategy today.

- Capture deep value potential by targeting companies trading below intrinsic worth through these 904 undervalued stocks based on cash flows built to surface ideas others might be overlooking.

- Capitalize on the AI transformation by zeroing in on innovators powering automation and intelligent systems with these 27 AI penny stocks.

- Strengthen your income stream by focusing on reliable payouts and attractive yields via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com