Nuvation Bio (NUVB): Reassessing Valuation After Safusidenib Data and Taletrectinib China Reimbursement News

Nuvation Bio (NUVB) has been on traders radar after two catalysts landed almost back to back: encouraging phase 2 data for Safusidenib in IDH1 mutant gliomas, and China reimbursement news for partner drug taletrectinib.

See our latest analysis for Nuvation Bio.

Those twin catalysts have lit a fire under sentiment, with an 81.4 percent 1 month share price return and a 206.43 percent 1 year total shareholder return suggesting momentum is clearly building rather than fading.

If Nuvation Bio’s surge has you thinking about where else growth and innovation could surprise, this is a good moment to scan healthcare stocks for your next idea.

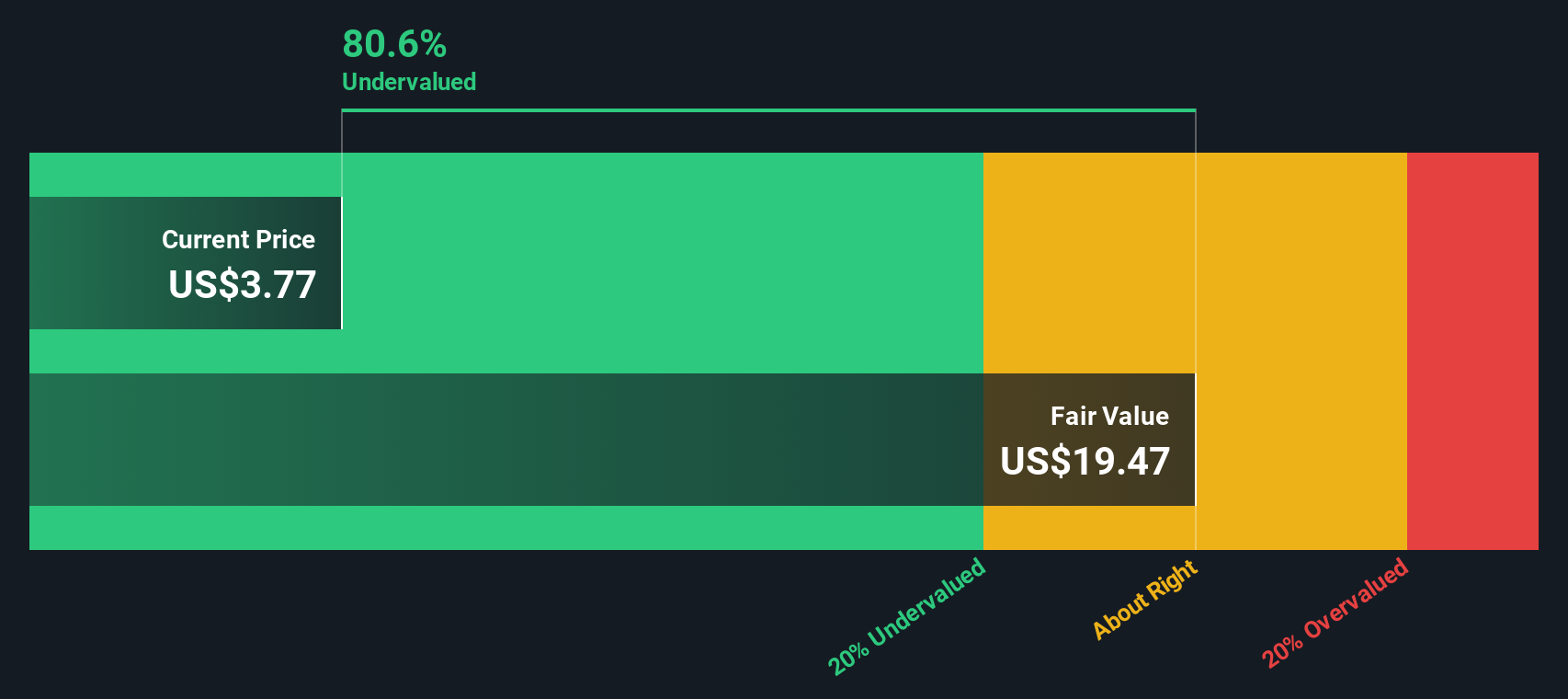

With shares still trading at a discount to analyst targets despite a multi-bagger run, the key debate now is whether Nuvation Bio remains underestimated or if the market is already factoring in years of future growth.

Price to Book of 9x: Is it justified?

On a price to book basis, Nuvation Bio looks slightly cheaper than its peers but far richer than the broader US pharmaceuticals sector at the current 8.58 dollar share price.

The price to book ratio compares a company’s market value to its net assets, a useful yardstick for early stage biopharma where traditional earnings multiples are less meaningful.

At 9 times book value versus a peer average of 10.8 times, investors are paying a modest discount to similar companies. This hints that the market is not fully pricing in its forecast revenue and earnings ramp. Yet that same 9 times multiple towers over the 2.6 times industry average, signaling expectations that Nuvation Bio’s pipeline and growth prospects justify a premium that many mature drug makers do not command.

Set against the sector backdrop, that gap to the wider pharmaceuticals industry is striking. This suggests investors see Nuvation Bio less as a typical drug developer and more as a high growth platform that must keep delivering clinical and commercial progress to defend its elevated valuation.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 9x (OVERVALUED)

However, clinical setbacks for Safusidenib or taletrectinib, or a sharp deterioration in cash burn and funding conditions, could quickly challenge today’s premium expectations.

Find out about the key risks to this Nuvation Bio narrative.

Another Angle, Our DCF Fair Value

While a 9 times book value looks stretched against the wider sector, our DCF model suggests a very different picture, with fair value closer to 31.99 dollar per share. If both numbers cannot be right, which one is misreading Nuvation Bio’s future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nuvation Bio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nuvation Bio Narrative

If you want to dig into the numbers yourself and reach your own conclusions, you can build a personalized view in just minutes, Do it your way.

A great starting point for your Nuvation Bio research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you can explore potential opportunities by scanning targeted stock lists on Simply Wall Street, or you could miss the market’s next big move.

- Consider early-stage opportunities by reviewing these 3595 penny stocks with strong financials that pair small price tags with surprisingly solid fundamentals.

- Explore the automation theme by screening these 27 AI penny stocks that focus on real world applications of machine intelligence.

- Assess ways to strengthen your income stream by targeting these 15 dividend stocks with yields > 3% that may offer higher yields than some bonds and savings accounts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com