Is Novo Nordisk Still Attractively Priced After Recent Share Price Swings?

- Wondering if Novo Nordisk is still worth buying after all the excitement around weight loss and diabetes treatments, or if the best days are already priced in.

- The stock has been choppy recently, down 2.6% over the last week but still up 2.7% over the past month, and longer term it has swung from a 53.8% gain over five years to a steep 60.7% drop in the last year, which says a lot about shifting expectations and risk appetite.

- Those moves sit against a backdrop of ongoing buzz around its GLP 1 diabetes and obesity drugs, expanding supply capacity, and continued regulatory activity. This keeps investors focused on how durable its competitive edge really is. At the same time, policy debates about drug pricing and access, plus intensifying competition in weight loss treatments, have added a new layer of uncertainty to how much future growth should be worth today.

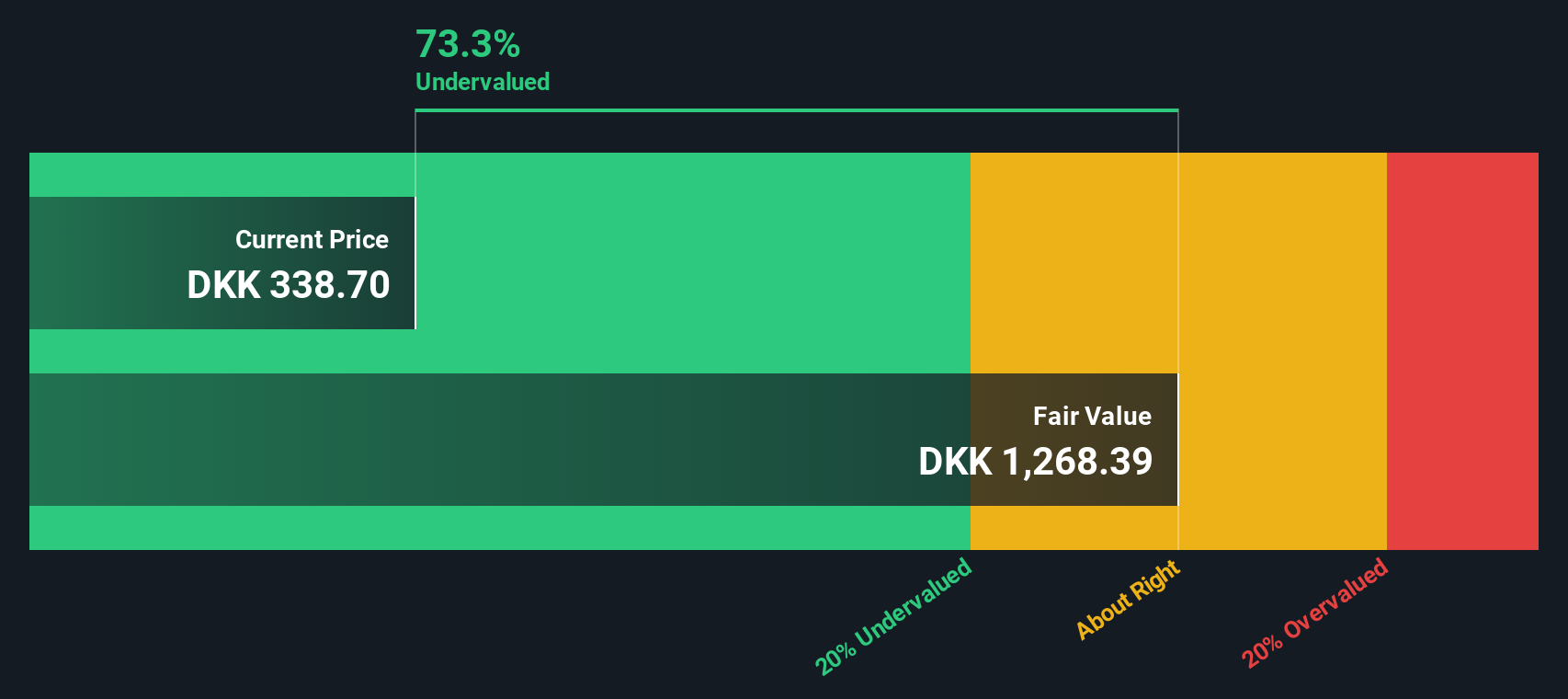

- Right now, Novo Nordisk scores a solid 5/6 valuation check, suggesting it screens as undervalued on most of our tests. Next we will unpack what that means across different valuation approaches, before finishing with a more holistic way to think about the company’s true worth.

Find out why Novo Nordisk's -60.7% return over the last year is lagging behind its peers.

Approach 1: Novo Nordisk Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in DKK.

Novo Nordisk currently generates roughly DKK 67.6 billion in free cash flow, and analysts and internal estimates see this rising steadily over the next decade. Projections suggest free cash flow could exceed DKK 190 billion by 2035, with the first few years based on analyst forecasts and the later years extrapolated using Simply Wall St growth assumptions.

Using a 2 Stage Free Cash Flow to Equity model, these projected cash flows are discounted to arrive at an estimated intrinsic value of about DKK 1,044 per share. Compared to the current share price, the model implies the stock trades at roughly a 71.4% discount, indicating investors are paying far less than the value suggested by long term cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novo Nordisk is undervalued by 71.4%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Novo Nordisk Price vs Earnings

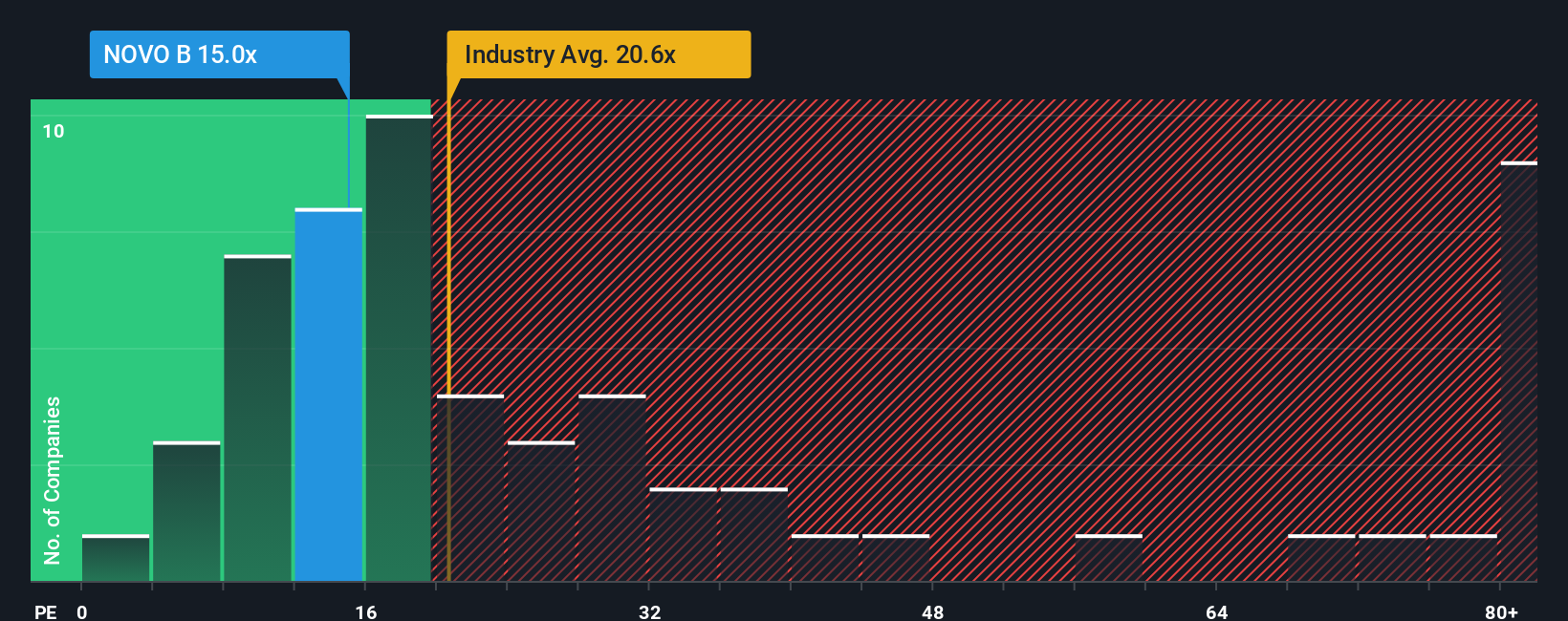

For a profitable, established business like Novo Nordisk, the price to earnings (PE) ratio is a useful way to gauge how much investors are willing to pay for each unit of current earnings. It naturally captures the market’s view on both the quality and sustainability of profits.

In general, faster, more reliable earnings growth and lower perceived risk justify a higher PE. Slower or less predictable growth, plus higher risk, should mean a lower, more conservative multiple. Novo Nordisk currently trades on about 12.8x earnings, which is well below the Pharmaceuticals industry average of roughly 22.6x and also below the broader peer group average of around 26.0x. This suggests the market is pricing in more caution than many rivals.

Simply Wall St’s Fair Ratio framework goes a step further. It estimates what a more tailored PE should be, based on Novo Nordisk’s specific earnings growth outlook, profitability, industry, market cap, and risk profile, rather than relying on blunt peer or sector comparisons. For Novo Nordisk, the Fair Ratio is about 26.1x, noticeably above the current 12.8x. This points to meaningful upside on an earnings based view.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Novo Nordisk Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce Narratives, a simple way for you to tell the story behind your numbers by linking your view of a company’s future revenue, earnings and margins to a concrete forecast and fair value. This is all within an easy to use tool on Simply Wall St’s Community page that helps you decide when to buy or sell by comparing your Fair Value to today’s Price, updates automatically as fresh news or earnings arrive, and can look very different from one investor to the next. For example, one Novo Nordisk Narrative may assume rapid GLP 1 expansion, rising margins and a Fair Value above DKK 1,000, while another may assume slower growth, more pricing pressure and a Fair Value closer to DKK 400.

Do you think there's more to the story for Novo Nordisk? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com