Vulcan Materials (VMC): Reassessing Valuation After a Steady 2024 Climb and Recent Pullback

Vulcan Materials (VMC) has been quietly grinding higher this year, and its recent price action is giving investors a chance to reassess what they are really paying for its steady infrastructure exposure.

See our latest analysis for Vulcan Materials.

The 13.88% year to date share price return suggests momentum is still broadly constructive. However, the recent pullback toward 291.04 hints at investors periodically reassessing infrastructure demand and what they are willing to pay for Vulcan’s long term compounding, supported by a 120.45% five year total shareholder return.

If Vulcan’s steady climb has you thinking about what else could quietly outperform, this might be a good time to explore fast growing stocks with high insider ownership for more ideas.

With Vulcan growing earnings faster than revenue and trading about 10% below consensus targets but slightly above some intrinsic estimates, the real question is whether this pullback is a buying opportunity or whether markets are already pricing in future growth.

Most Popular Narrative: 8.4% Undervalued

With Vulcan Materials last closing at 291.04 and the most widely followed narrative pointing to fair value around 317.70, the valuation hinges on sustained infrastructure driven growth and rising profitability over the next several years.

Structural tailwinds from infrastructure resilience and the transition to green/renewable projects are driving long-term demand for aggregates in roads, storm-resistant infrastructure, and energy sites, enhancing Vulcan's long-term volume outlook and supporting higher blended pricing, which should lift both top-line revenue and profitability.

Curious how steady mid single digit revenue growth, rising margins, and a premium future earnings multiple can still add up to upside from here? The narrative stitches these moving parts into one bold valuation call, but the real intrigue lies in how far profit expectations stretch beyond today and what kind of multiple that future stream of earnings is assumed to command. If you want to see which assumptions really do the heavy lifting in that 317.70 fair value, you will need to dig into the full story.

Result: Fair Value of $317.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in residential construction recovery and heavy reliance on government infrastructure funding could quickly challenge those optimistic growth and valuation assumptions.

Find out about the key risks to this Vulcan Materials narrative.

Another Angle on Valuation

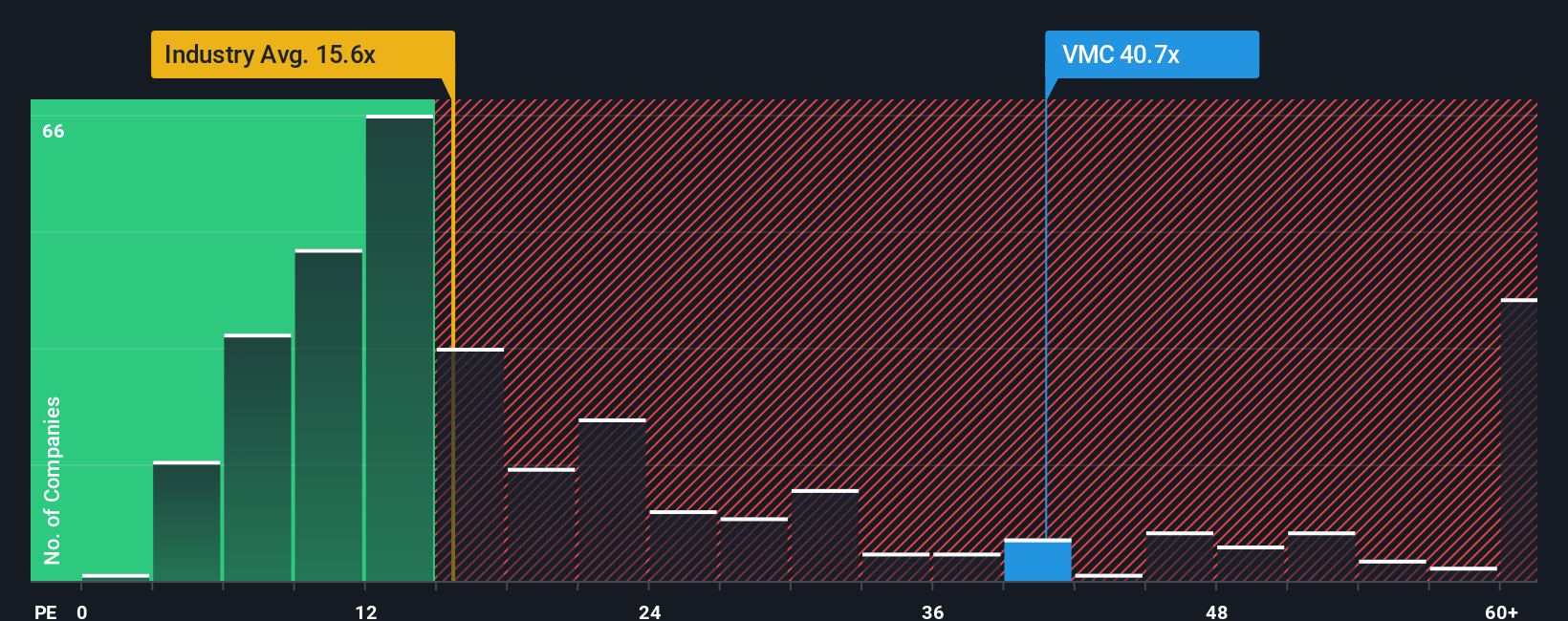

While the narrative points to about 8% upside, our earnings based lens tells a different story. Vulcan trades on a 34.7x price to earnings ratio, well above its 23.6x fair ratio, the 25.2x peer average, and the 14.9x global industry level. This implies meaningful de rating risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vulcan Materials Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a complete narrative in just a few minutes: Do it your way.

A great starting point for your Vulcan Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investing opportunities?

Before you move on, lock in your next edge by scanning fresh ideas on the Simply Wall St Screener, where data backed filters surface tomorrow’s potential winners.

- Target reliable cash flow by hunting for income opportunities through these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s long term resilience.

- Capitalize on breakthrough innovation by zeroing in on these 27 AI penny stocks that could reshape entire industries with scalable, high margin growth.

- Strengthen your value strategy by pinpointing these 906 undervalued stocks based on cash flows that markets may be mispricing right now, before attention and capital rush in.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com