Is Hapag-Lloyd (XTRA:HLAG) Quietly Mispriced? A Fresh Look at Its Valuation After Recent Share Price Stabilisation

Hapag-Lloyd (XTRA:HLAG) has been quietly grinding higher, with the stock up around 1% today and roughly 4% over the past week, even as year to date performance remains negative.

See our latest analysis for Hapag-Lloyd.

That recent pop in the share price looks more like the start of stabilising momentum than a full trend change. A modest 3 month share price return contrasts sharply with the weak year to date share price return and still solid 5 year total shareholder return.

If Hapag-Lloyd has you watching global trade more closely, it could be a good moment to compare it with other major carriers and logistics names across aerospace and defense stocks.

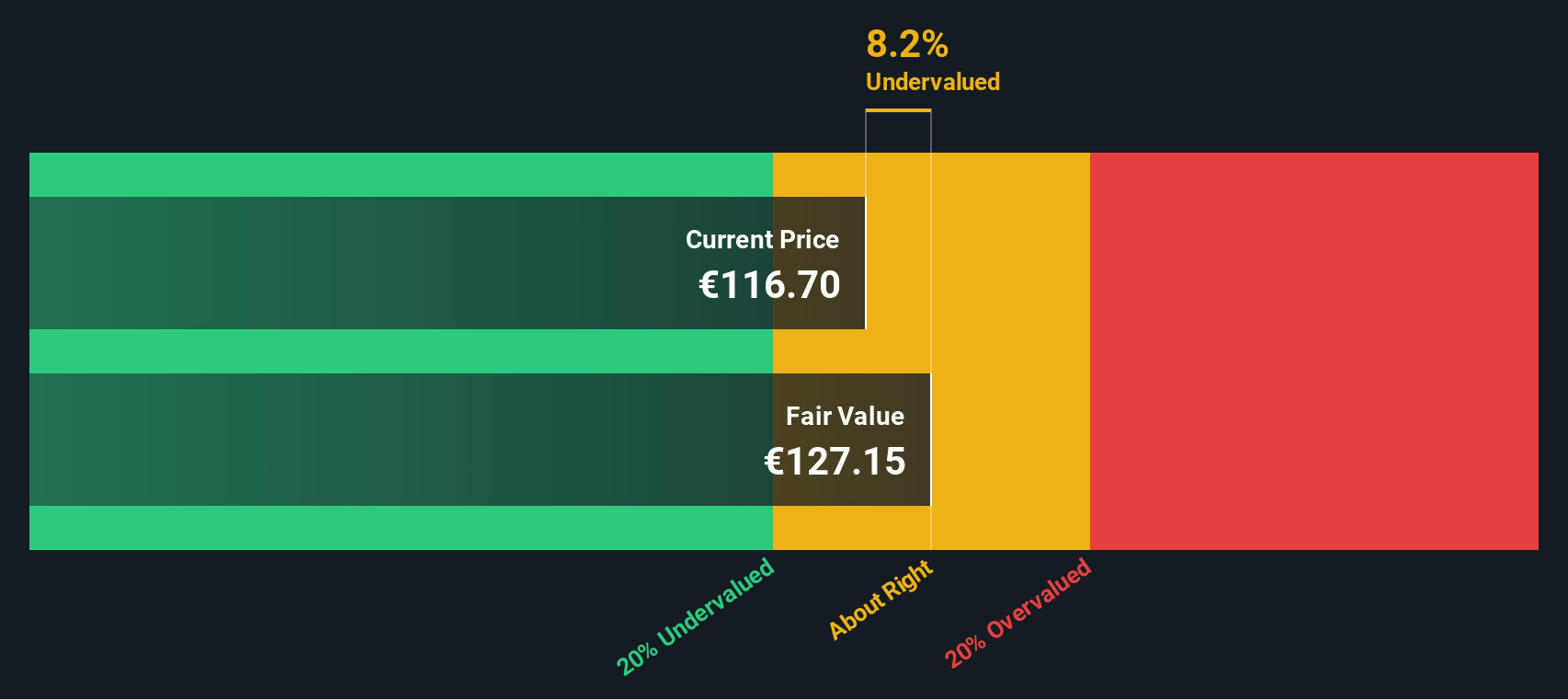

With shares still well below their highs but the business proving more resilient than headline revenue suggests, the key question now is whether Hapag-Lloyd is quietly undervalued or if the market already reflects its next phase of growth.

Most Popular Narrative: 16.3% Overvalued

Compared with Hapag-Lloyd's last close at €120.70, the most closely followed narrative sees fair value closer to €103.80, implying the recent rebound might be running ahead of fundamentals.

The market appears to be pricing in ongoing robust container shipping demand driven by globalization and e-commerce tailwinds, but forward commentary from management suggests volume growth is likely to moderate in H2 and beyond, with Hapag-Lloyd expecting only moderate increases above a ~3% industry trend, pressuring future revenue growth.

Curious how shrinking revenues, thinner margins, and a richer future earnings multiple can still justify today’s price tag? Want to see the exact trade off baked into that 2028 earnings and valuation bridge, and how a higher discount rate reshapes the upside case? The full narrative unpacks the numbers driving this call.

Result: Fair Value of €103.82 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained trade growth and faster than expected cost savings from fleet modernization and digital upgrades could support earnings and challenge that cautious valuation stance.

Find out about the key risks to this Hapag-Lloyd narrative.

Another View, SWS DCF Signals Undervaluation

While analyst narratives see Hapag-Lloyd trading roughly 16% above their fair value estimate, our DCF model points the other way. It suggests shares at €120.70 sit about 12% below an intrinsic value of €137.79. Which story do you think the market will ultimately follow?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hapag-Lloyd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hapag-Lloyd Narrative

If you see things differently or want to stress test your own assumptions using the same data, you can build a complete narrative in minutes: Do it your way.

A great starting point for your Hapag-Lloyd research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity when you can scan the market for fresh ideas; use the Simply Wall St Screener to spot what others overlook.

- Capture potential income by targeting these 15 dividend stocks with yields > 3% that can strengthen your portfolio with reliable cash flow while others chase riskier bets.

- Ride structural growth trends by focusing on these 30 healthcare AI stocks that pair innovation with real-world demand in an essential sector.

- Seize early growth stories by zeroing in on these 3595 penny stocks with strong financials before broader market attention changes valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com