Has the Recent Pullback Created a Fresh Opportunity in Crown Holdings Stock?

- Wondering if Crown Holdings is actually good value at around $94 a share, or if the easy money has already been made, you are not alone.

- Despite being up 16.0% year to date and 8.5% over the last year, the stock has cooled recently with a 4.0% dip over the past week and a 3.7% slide across the last month.

- Those moves have come as investors reassess packaging stocks more broadly, with Crown often in the conversation thanks to its global footprint and exposure to consumer staples. At the same time, the market has been rotating between defensives and cyclicals, which has added some extra noise to short term price action.

- Under the hood, Crown scores a full 6 out of 6 on our undervaluation checks, which makes it especially interesting for valuation focused investors. Next, we will unpack what different valuation approaches are saying about the stock, before finishing with an even more intuitive way to think about its true worth.

Approach 1: Crown Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth by projecting its future cash flows and then discounting those back to today in $ terms. For Crown Holdings, the model starts with last twelve months Free Cash Flow (FCF) of about $796 million and uses analyst forecasts for the next few years, then extrapolates further using Simply Wall St assumptions.

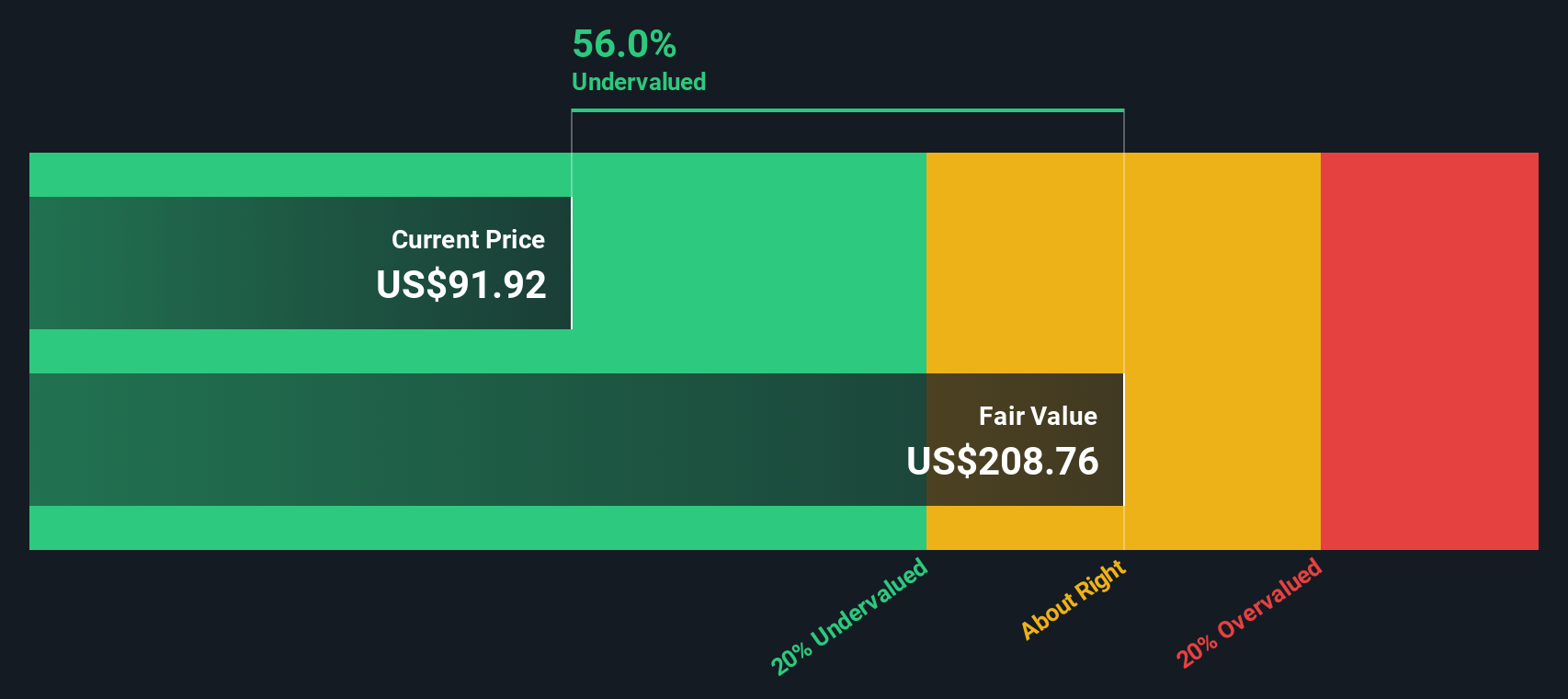

Under this 2 Stage Free Cash Flow to Equity approach, Crown’s FCF is projected to rise steadily, reaching around $1.38 billion by 2035 as cash flows compound over time. Each of these future cash flows is discounted back to reflect risk and the time value of money, producing an estimated intrinsic value of roughly $206.38 per share.

Compared with the current share price around $94, the model suggests Crown Holdings is trading at about a 54.4% discount to its estimated fair value. This indicates a potentially meaningful margin of safety for long term investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Crown Holdings is undervalued by 54.4%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Crown Holdings Price vs Earnings

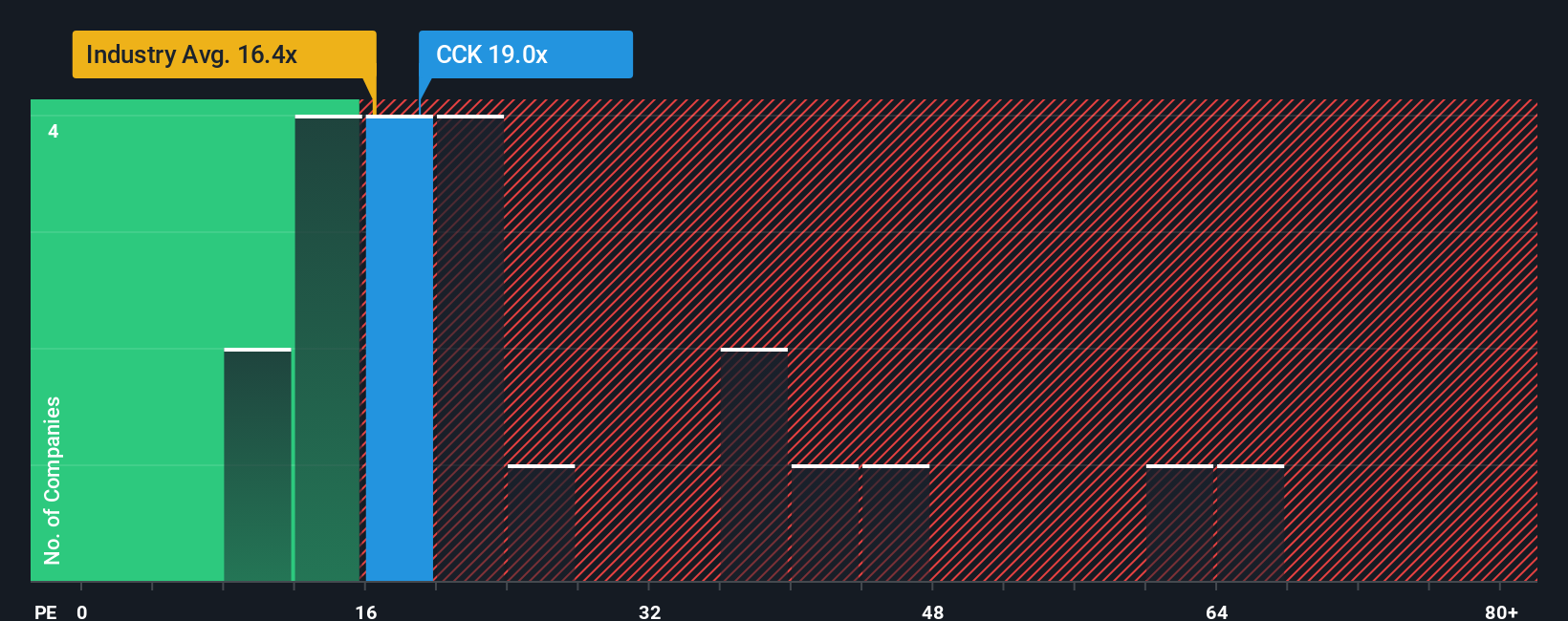

For profitable companies like Crown Holdings, the price to earnings ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current profits. A higher PE can be justified when a business has stronger growth prospects or lower perceived risk. Slower growth or higher risk usually warrants a lower, more conservative PE.

Crown currently trades on a PE of about 11.4x, which is below both the Packaging industry average of roughly 15.4x and well below the broader peer group average of about 59.0x. To go beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio of 17.1x, which estimates the PE Crown should trade on given its earnings growth outlook, profitability, industry, size and risk profile. This Fair Ratio is more informative than raw peer or industry multiples because it explicitly factors in company specific fundamentals rather than assuming all packaging businesses deserve the same valuation.

Comparing the Fair Ratio of 17.1x with the current 11.4x suggests the market is valuing Crown Holdings below what its fundamentals might warrant. This points to potential upside if sentiment normalizes.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Crown Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Crown Holdings with the numbers behind its future.

A Narrative is your story about a company, where you spell out what you think will happen to its revenue, earnings and profit margins and then translate that view into a fair value estimate.

On Simply Wall St’s Community page, Narratives make this process accessible by guiding you from a company’s story, to a financial forecast, to a clear Fair Value that you can compare directly with today’s share price to help you assess whether Crown looks suitable as a buy, hold or sell candidate.

Because Narratives on the platform are updated dynamically when new information, such as earnings results, news or guidance changes, arrives, your fair value view automatically stays in sync with the latest data instead of going stale.

For example, one Crown Holdings Narrative might assume strong demand for sustainable metal packaging, rising margins and a fair value near the upper analyst target of about $140. In contrast, a more cautious Narrative could focus on input cost inflation, regional risks and slower growth, supporting a fair value closer to the lower target around $110.

Do you think there's more to the story for Crown Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com