Is Coterra Energy Attractively Priced After Strong Cash Returns and 5 Year 100% Gain?

- If you are wondering whether Coterra Energy is still a smart buy at around $26.86, you are not alone, and the numbers behind its valuation are more interesting than the headline price suggests.

- The stock has inched up 1.8% over the last week and 1.1% over the last month, and those modest near term moves sit on top of a 12.1% 1 year gain and a 100.9% rise over 5 years.

- Recent news flow around disciplined capital allocation, including continued focus on returning cash to shareholders through buybacks and dividends, has helped support sentiment toward Coterra. At the same time, coverage highlighting the company as a lower cost, gas weighted producer with meaningful oil optionality has framed it as a potential relative winner if energy markets stay volatile.

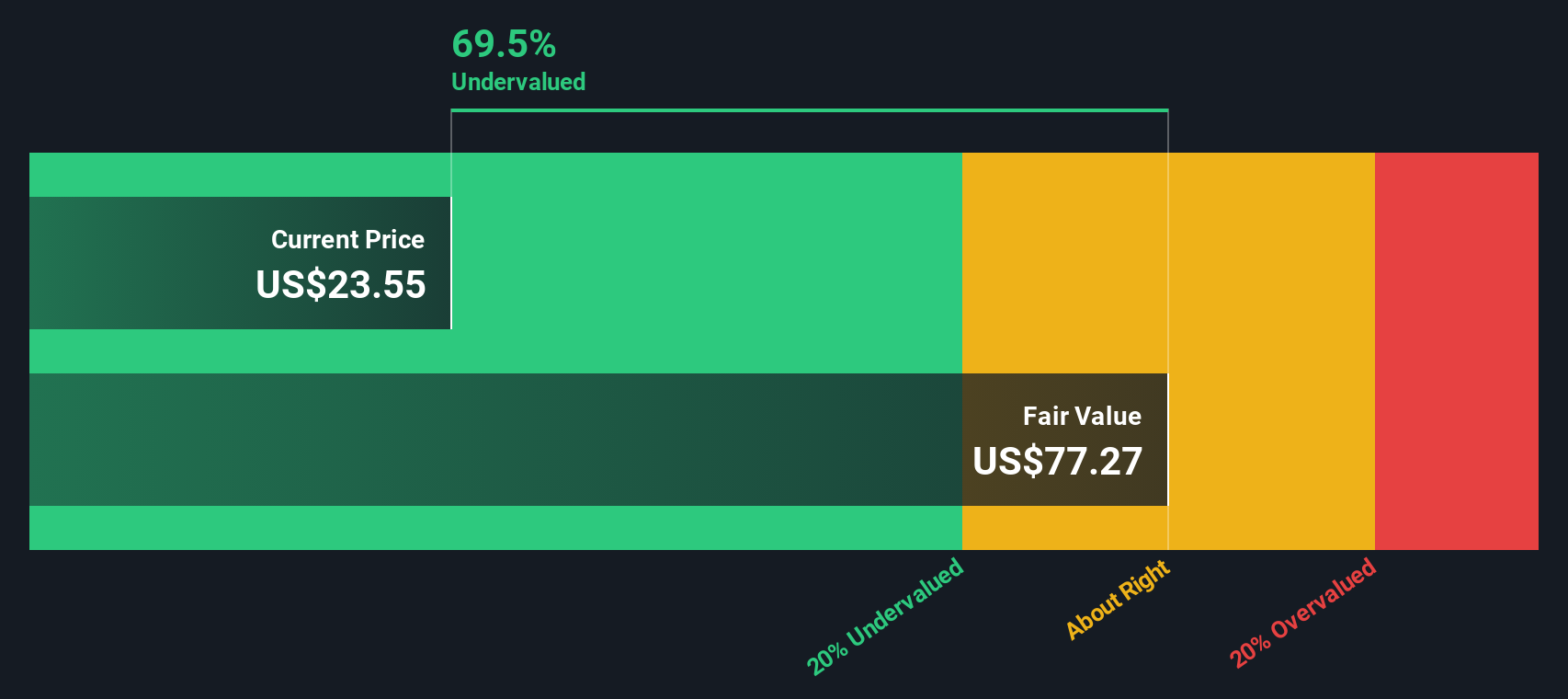

- On this framework, Coterra scores a 6/6 valuation check, which means it screens as undervalued across each of the key tests. Next, the analysis breaks down what that looks like under different valuation approaches before circling back to a more complete way of thinking about the company’s worth.

Approach 1: Coterra Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to their present value.

For Coterra Energy, the model starts with last twelve month Free Cash Flow of about $1.40 billion and projects this figure forward using analyst estimates for the next few years, then extrapolates out to 2035. On this basis, Coterra’s Free Cash Flow is expected to grow to roughly $3.88 billion in 2035.

When all of these future cash flows are discounted back, the DCF model indicates an intrinsic value of about $102.49 per share. Compared with the recent share price around $26.86, this implies the stock is roughly 73.8% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coterra Energy is undervalued by 73.8%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Coterra Energy Price vs Earnings

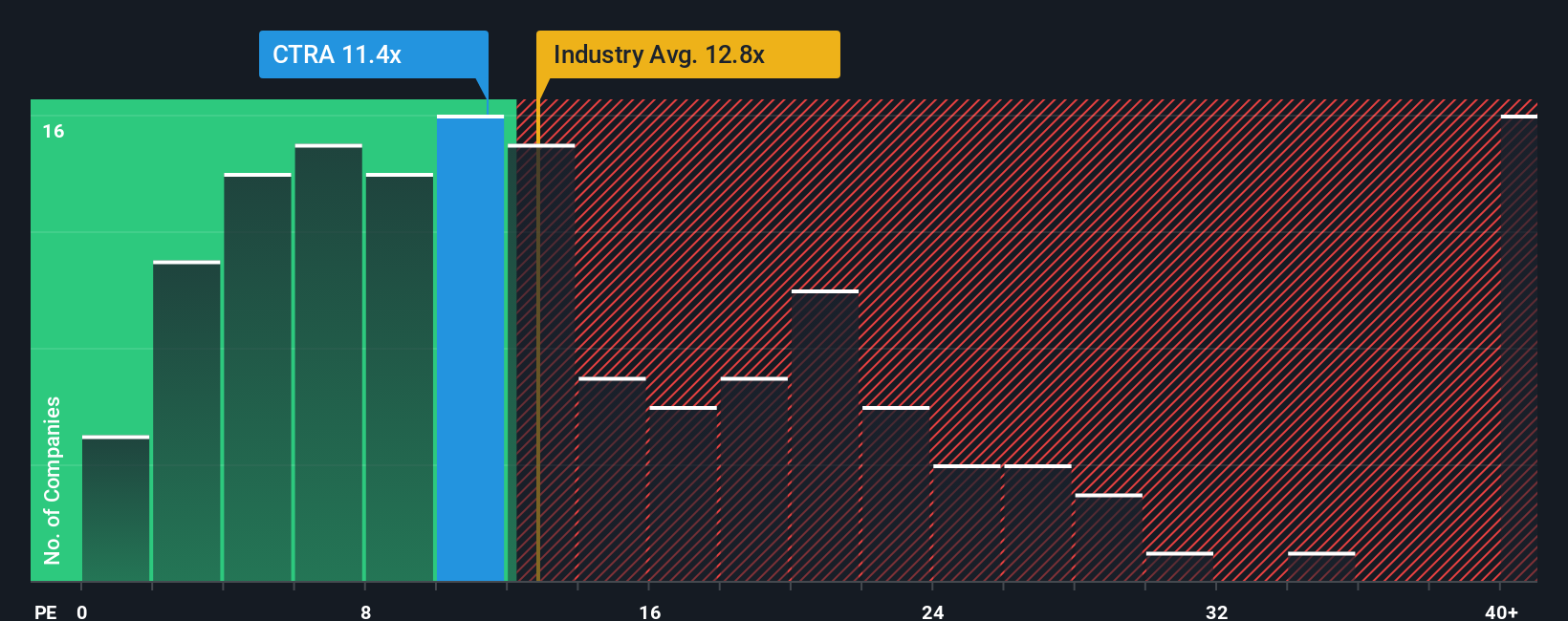

For a profitable business like Coterra, the price to earnings, or PE, ratio is a useful way to see how much investors are willing to pay for each dollar of current profits. In general, companies with stronger growth prospects and lower perceived risk tend to justify a higher, or more expensive, PE multiple, while slower growth or higher uncertainty usually calls for a lower, more conservative PE.

Coterra currently trades on a PE of about 12.4x. That is slightly below the broader Oil and Gas industry average of roughly 13.5x and well below the 32.5x average of its wider peer group, suggesting the market is not paying a premium for its earnings today. To refine this view, Simply Wall St uses a proprietary Fair Ratio, which estimates what a more appropriate PE should be after adjusting for factors such as Coterra’s earnings growth outlook, profitability, risk profile, industry and market cap. In Coterra’s case, the Fair Ratio is 19.3x, comfortably above the current 12.4x. On this framework, the stock appears undervalued on earnings, as the market appears to be pricing in more caution than the fundamentals may warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coterra Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to write the story behind your numbers by connecting your view of Coterra’s future revenues, earnings and margins to a financial forecast and then to a Fair Value that you can easily compare with today’s share price to decide whether to buy, hold or sell.

On Simply Wall St’s Community page, used by millions of investors, Narratives turn this process into an accessible tool that automatically refreshes as new information like earnings or news arrives, so your Fair Value stays aligned with the latest data instead of going stale.

For example, one Coterra Narrative on the platform currently assumes a Fair Value of about $25.55 per share based on moderate growth and disciplined capital efficiency, while another sees closer to $32.32 per share driven by stronger LNG demand and expanded buybacks, showing how two investors can reasonably look at the same business and reach different, clearly articulated valuations.

For Coterra Energy, here are previews of two leading Coterra Energy Narratives:

Fair value: $32.32

Implied undervaluation vs current price: 16.9%

Forecast revenue growth: 11.64%

- Views Coterra as a structurally advantaged producer, using advanced drilling, diversified assets and a balanced commodity mix to deliver stable cash flow and durable growth.

- Emphasizes disciplined capital allocation, with a stronger balance sheet enabling higher buybacks and dividends that support long term EPS growth and shareholder returns.

- Flags key risks including sustained low gas prices, operational issues in select assets, regulatory and leasing uncertainty, and the eventual impact of Tier 1 inventory decline on costs and margins.

Fair value: $25.55

Implied overvaluation vs current price: 5.4%

Forecast revenue growth: 12%

- Recognizes LNG contracts, high return projects like Windham Row, and operational efficiencies as positives that can affect earnings and free cash flow over the medium term.

- Stresses that exposure to volatile and sometimes weak regional gas prices, plus execution and regulatory risks around LNG and new developments, could limit upside.

- Argues that while margins and valuation multiples can change as efficiency and diversification progress, the current price already reflects much of this optimism, leaving limited margin of safety.

Do you think there's more to the story for Coterra Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com