Caleres (CAL) Q3 2026 Margin Collapse Reinforces Bearish Profitability Narratives

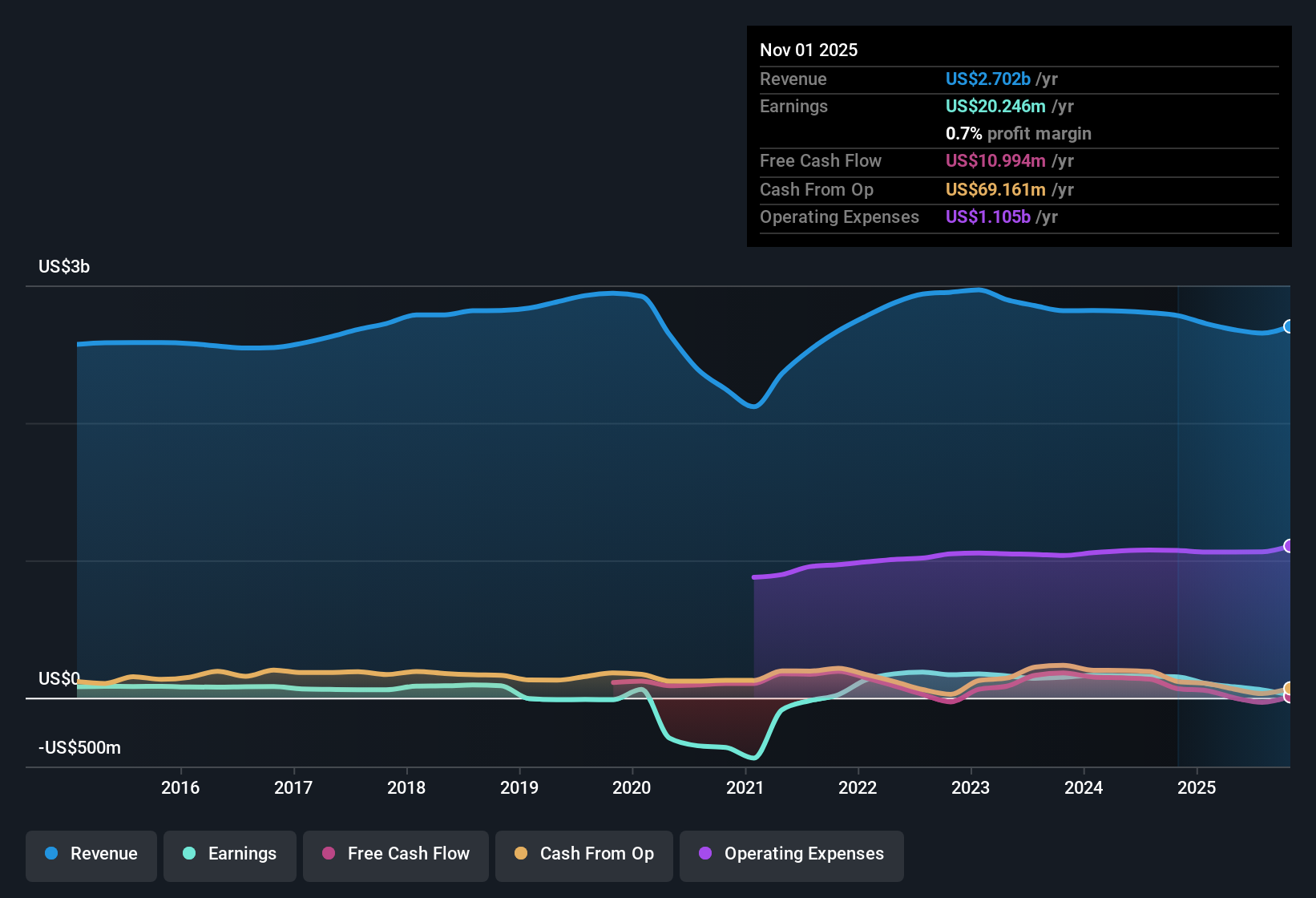

Caleres (CAL) opened Q3 2026 with total revenue of about $790 million and EPS of $0.07, while trailing twelve month revenue stood at roughly $2.7 billion with EPS of $0.52, setting a cautious tone around profitability. The company has seen revenue move from $741 million and EPS of $1.20 in Q3 2025 to $790 million and EPS of $0.07 in Q3 2026, a shift that leaves investors watching how much of the story is about topline resilience versus pressure further down the income statement. With net margins now thin and earnings quality clouded by unusual items, this latest print puts the spotlight firmly on how sustainable Caleres's current margin profile really is.

See our full analysis for Caleres.With the numbers on the table, the next step is to line them up against the most widely held narratives around Caleres to see which stories still hold up and which ones the latest margin trends start to challenge.

See what the community is saying about Caleres

Margins Squeezed to 0.6 Percent

- Over the last 12 months, Caleres earned $17.1 million of net income on about $2.7 billion of revenue, which works out to a slim 0.6 percent net profit margin versus 5.5 percent a year earlier.

- Consensus narrative expects supply chain diversification and premium brand expansion to eventually help margins, yet the recent margin compression

- Contrasts with the idea that expanding contemporary and premium brands will quickly translate into stronger profitability, because net income has fallen from $152.0 million to $17.1 million on a trailing basis.

- Shows that, even with revenue around $2.7 billion, the current business mix has not yet produced the sturdier margin profile that the consensus view is hoping for.

Debt Coverage Risk vs Dividend and DCF Upside

- The stock yields 2.2 percent, trades at about $12.74 per share, and sits roughly 69 percent below the $41.30 DCF fair value estimate while debt is flagged as not well covered by operating cash flow.

- Bears focus on weak cash flow coverage of debt, and that concern lines up with the sharp drop in trailing net income

- With net income down from over $100 million to $17.1 million on a trailing basis, there is less profit available to support both debt obligations and dividends, which strengthens the cautious view.

- At the same time, the large gap between the current share price and DCF fair value means that if cash generation stabilizes, it could materially soften the bearish argument about long term downside.

Valuation Premium and the 24.2 Million One Off

- Caleres trades on a trailing P E of 25.2 times, above the 18.9 times US Specialty Retail average but below the 38.6 times peer group average, and recent earnings include a $24.2 million one off loss that depressed profit.

- Bulls point to strategic expansion, like international sneaker growth and new premium partnerships, but the current valuation is being supported on thinner earnings

- The $24.2 million unusual loss reduces trailing net income from what would otherwise have been materially higher than $17.1 million, which partly explains the elevated P E multiple.

- Given analysts expect only about 1.6 percent annual revenue growth, the premium to the broader industry multiple will likely depend on whether these expansion plans can lift earnings closer to the DCF fair value narrative over time.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Caleres on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? In just a few minutes you can test your own angle, shape the story, and share it with the community: Do it your way.

A great starting point for your Caleres research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Explore Alternatives

Caleres is wrestling with sharply compressed margins, weaker earnings, and strained debt coverage, leaving its balance sheet and overall financial resilience under question.

If you want businesses where leverage is less of a worry and cash generation looks sturdier, use our solid balance sheet and fundamentals stocks screener (1937 results) now to focus on companies built to handle pressure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com