Uravi Defence and Technology Limited's (NSE:URAVIDEF) 30% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/ERatio

Unfortunately for some shareholders, the Uravi Defence and Technology Limited (NSE:URAVIDEF) share price has dived 30% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 64% share price decline.

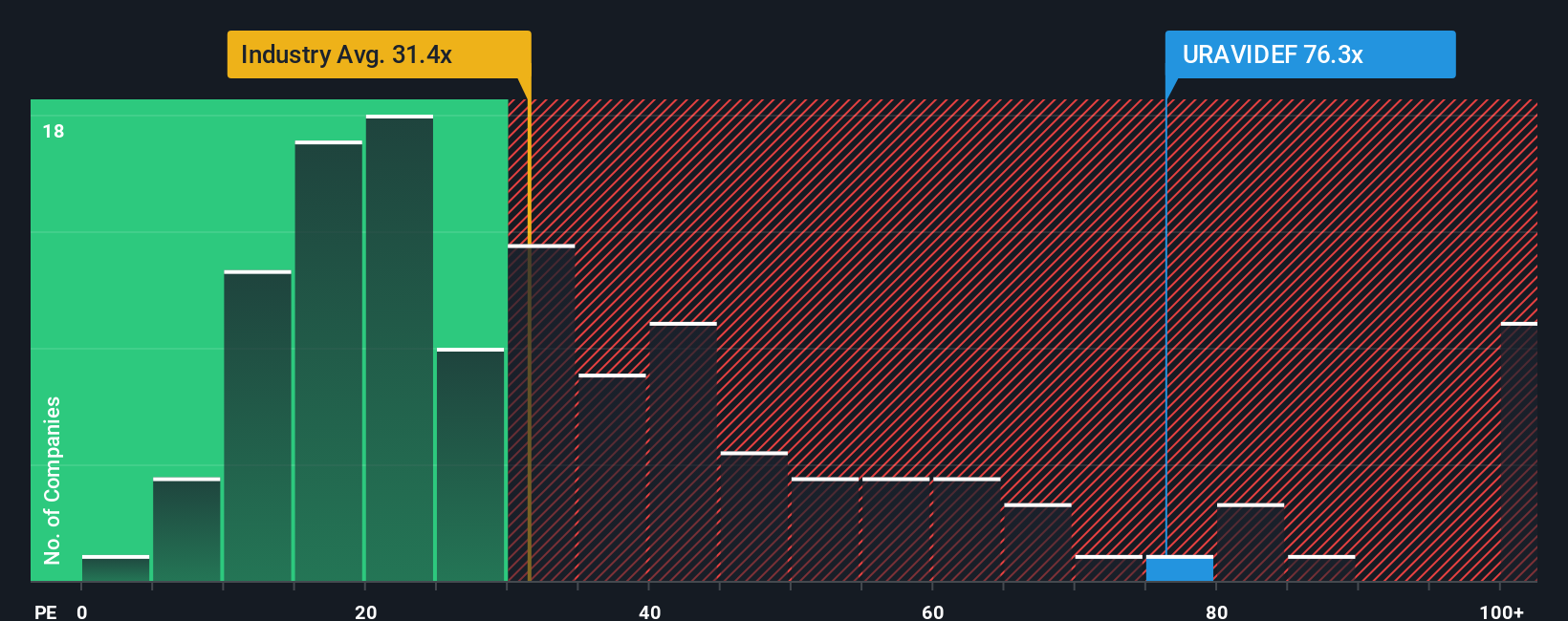

Even after such a large drop in price, Uravi Defence and Technology may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 76.3x, since almost half of all companies in India have P/E ratios under 25x and even P/E's lower than 14x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Earnings have risen firmly for Uravi Defence and Technology recently, which is pleasing to see. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Uravi Defence and Technology

Is There Enough Growth For Uravi Defence and Technology?

The only time you'd be truly comfortable seeing a P/E as steep as Uravi Defence and Technology's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 28% last year. The latest three year period has also seen an excellent 100% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's curious that Uravi Defence and Technology's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent earnings trends would weigh down the share price eventually.

The Key Takeaway

Uravi Defence and Technology's shares may have retreated, but its P/E is still flying high. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Uravi Defence and Technology currently trades on a higher than expected P/E since its recent three-year growth is only in line with the wider market forecast. When we see average earnings with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Uravi Defence and Technology is showing 2 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.