The three-year decline in earnings might be taking its toll on Emkay Global Financial Services (NSE:EMKAY) shareholders as stock falls 10% over the past week

Emkay Global Financial Services Limited (NSE:EMKAY) shareholders might be concerned after seeing the share price drop 11% in the last month. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. The share price marched upwards over that time, and is now 258% higher than it was. After a run like that some may not be surprised to see prices moderate. Only time will tell if there is still too much optimism currently reflected in the share price.

Since the long term performance has been good but there's been a recent pullback of 10%, let's check if the fundamentals match the share price.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years of share price growth, Emkay Global Financial Services actually saw its earnings per share (EPS) drop 5.4% per year.

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Therefore, we think it's worth considering other metrics as well.

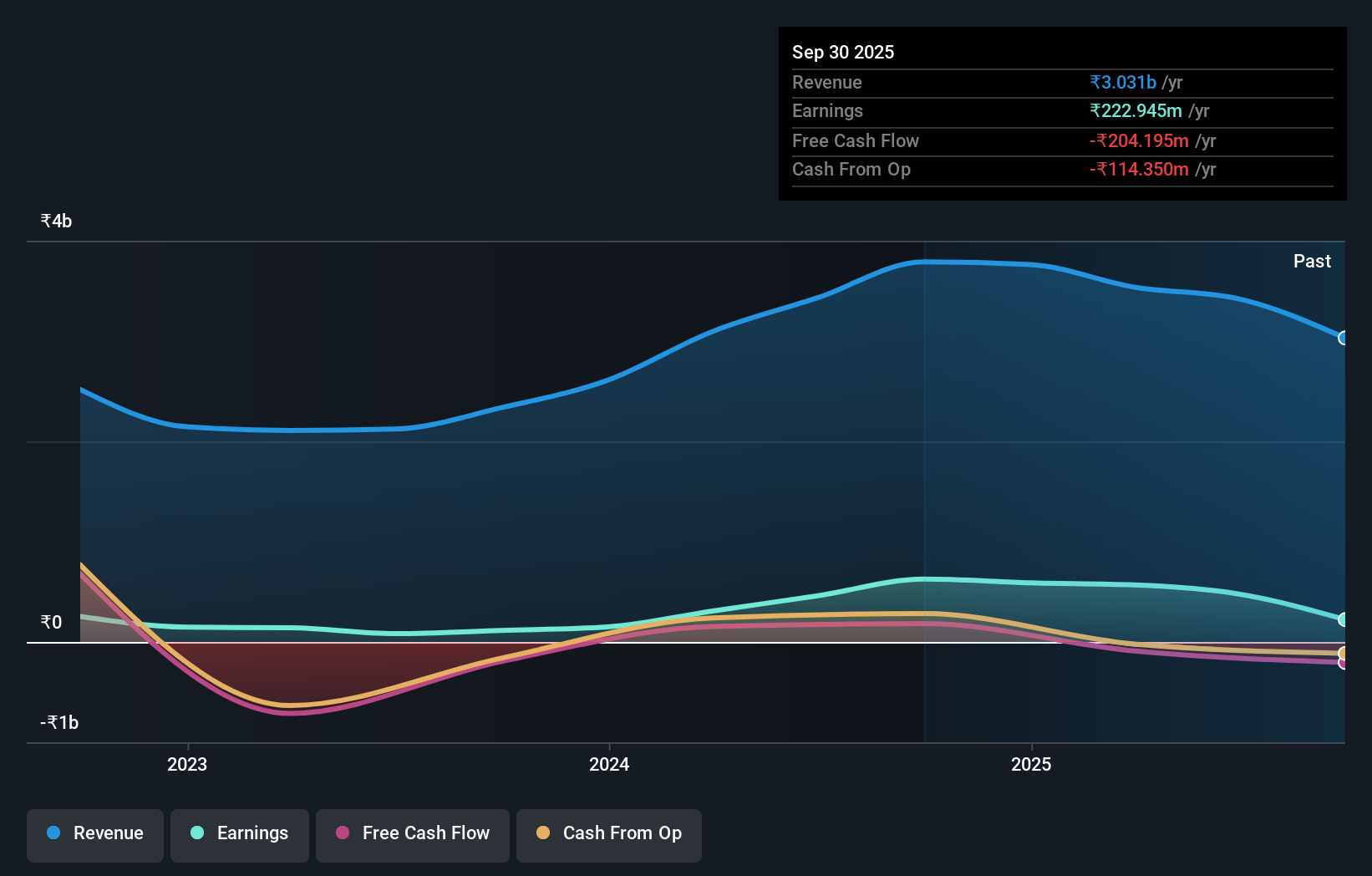

The modest 0.6% dividend yield is unlikely to be propping up the share price. It could be that the revenue growth of 18% per year is viewed as evidence that Emkay Global Financial Services is growing. If the company is being managed for the long term good, today's shareholders might be right to hold on.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Emkay Global Financial Services the TSR over the last 3 years was 272%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that Emkay Global Financial Services shareholders are down 23% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 1.4%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 30%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Emkay Global Financial Services better, we need to consider many other factors. For instance, we've identified 4 warning signs for Emkay Global Financial Services (1 is concerning) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.