A Look at Mitsubishi UFJ (TSE:8306) Valuation Following Board Talks on a Potential Share Buyback

Mitsubishi UFJ Financial Group (TSE:8306) recently held a board meeting on November 14 to discuss a potential common stock repurchase, putting shareholder returns and management confidence back in the spotlight for investors.

See our latest analysis for Mitsubishi UFJ Financial Group.

The repurchase discussion comes after a strong run, with the stock delivering a 33.84% year to date share price return and a 42.24% one year total shareholder return, suggesting recent momentum has been positive.

If this kind of capital return story interests you, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

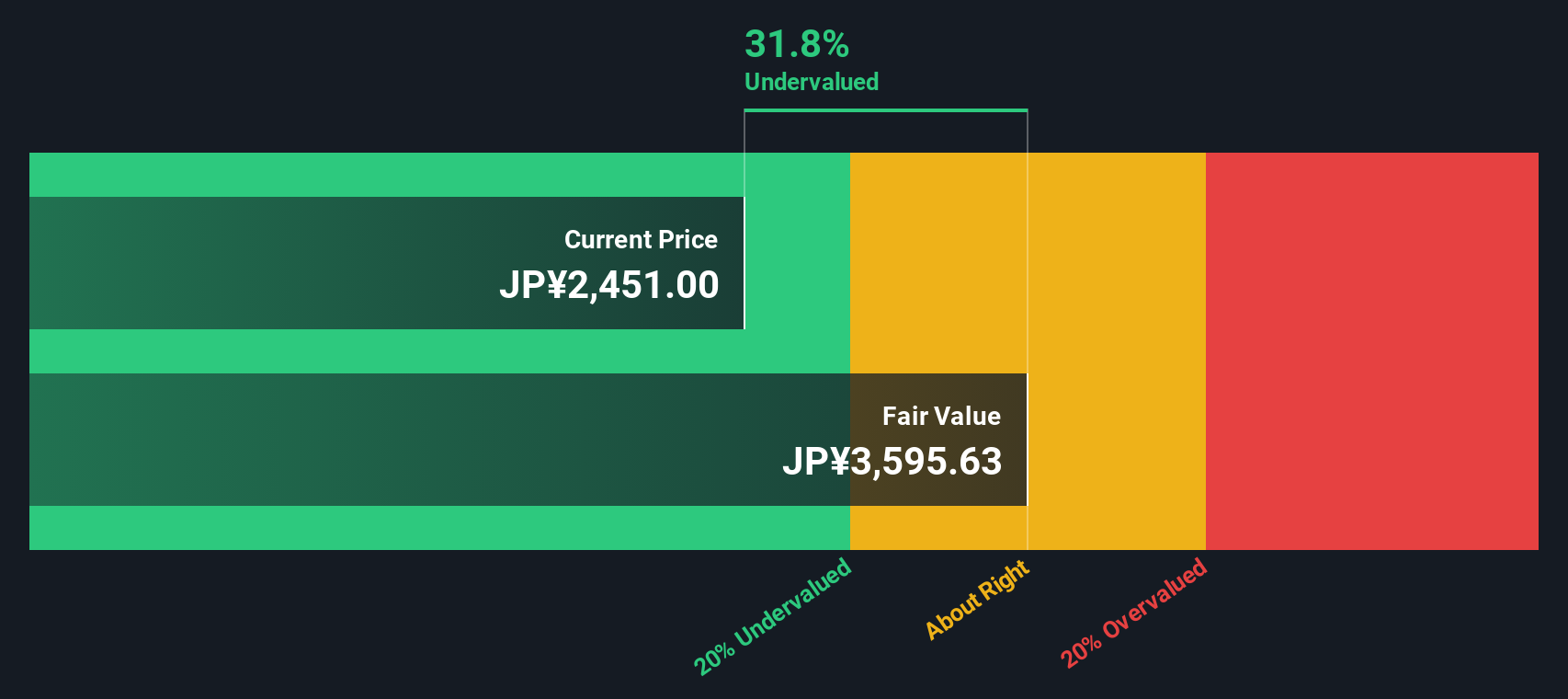

Yet with Mitsubishi UFJ trading close to analyst targets but still at a sizable discount to some intrinsic estimates, investors now face a key question: is there genuine upside left here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 0.6% Overvalued

With Mitsubishi UFJ Financial Group closing at ¥2,486 against a narrative fair value of ¥2,470, the current price sits almost exactly on that roadmap.

The analysts have a consensus price target of ¥2317.273 for Mitsubishi UFJ Financial Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥2700.0, and the most bearish reporting a price target of just ¥1830.0.

Want to see what justifies a higher fair value than that consensus band? The narrative leans on rising margins, steady growth, and a bold future earnings multiple. Curious which assumptions really move the needle here?

Result: Fair Value of ¥2,470 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in net interest income from US bond exposure, or weaker equity sale gains, could quickly undermine the earnings and valuation narrative.

Find out about the key risks to this Mitsubishi UFJ Financial Group narrative.

Another Lens, Same Stock

Our SWS DCF model paints a very different picture, suggesting Mitsubishi UFJ could be worth around ¥3,675 per share, implying it is materially undervalued relative to today’s price. When one model says overvalued and another suggests opportunity, which story do you trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsubishi UFJ Financial Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsubishi UFJ Financial Group Narrative

If you see the numbers differently, or would rather dig into the figures yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Mitsubishi UFJ Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Smart investors rarely stop at one opportunity, so take the next step now and use the Simply Wall St Screener to uncover fresh, data driven ideas before others do.

- Capture potential mispricings by targeting these 903 undervalued stocks based on cash flows that may offer stronger upside than widely followed blue chips.

- Ride structural growth trends by focusing on these 30 healthcare AI stocks reshaping diagnostics, treatment, and medical efficiency worldwide.

- Position yourself at the intersection of finance and innovation with these 80 cryptocurrency and blockchain stocks tapping into blockchain, digital assets, and next generation payment rails.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com