Xylem (XYL): Assessing Valuation After a Recent 9% Share Price Pullback

Xylem (XYL) has been drifting lower this month, slipping roughly 9% even as its longer term track record remains solid. That disconnect is catching investors attention and raises a fresh valuation question.

See our latest analysis for Xylem.

The recent 9% slide over the past month sits against a much stronger backdrop, with the share price still up around 18% year to date and a 1 year total shareholder return of roughly 8%, suggesting momentum has cooled but the longer term thesis remains intact.

If Xylem’s move has you rethinking where growth and quality intersect, this could be a good moment to explore fast growing stocks with high insider ownership as potential next ideas.

With earnings still growing, a strong long term track record, and shares trading at a noticeable discount to analyst targets, is Xylem now a quietly undervalued compounder, or has the market already priced in its next leg of growth?

Most Popular Narrative: 18.5% Undervalued

With Xylem last closing at $136.95 against a narrative fair value of about $168.06, the current pullback sits at the center of a sizeable valuation gap.

The company's operational simplification and implementation of the 80/20 model is already delivering record on time performance, increased productivity, and measurable margin improvements, signaling sustainable cost efficiencies and enhanced net margins moving forward. Successful post acquisition integration of Evoqua and revenue synergies from services expansion are accelerating Xylem's shift toward more recurring, higher margin aftermarket and services revenue streams, boosting earnings stability and long term profitability.

Want to see what happens when disciplined cost cutting, steady infrastructure demand and a premium future earnings multiple all come together in one model? Unpack the full valuation playbook.

Result: Fair Value of $168.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent funding delays and execution risks around integration and simplification efforts could yet challenge Xylem's margin expansion and premium multiple narrative.

Find out about the key risks to this Xylem narrative.

Another Take On Valuation

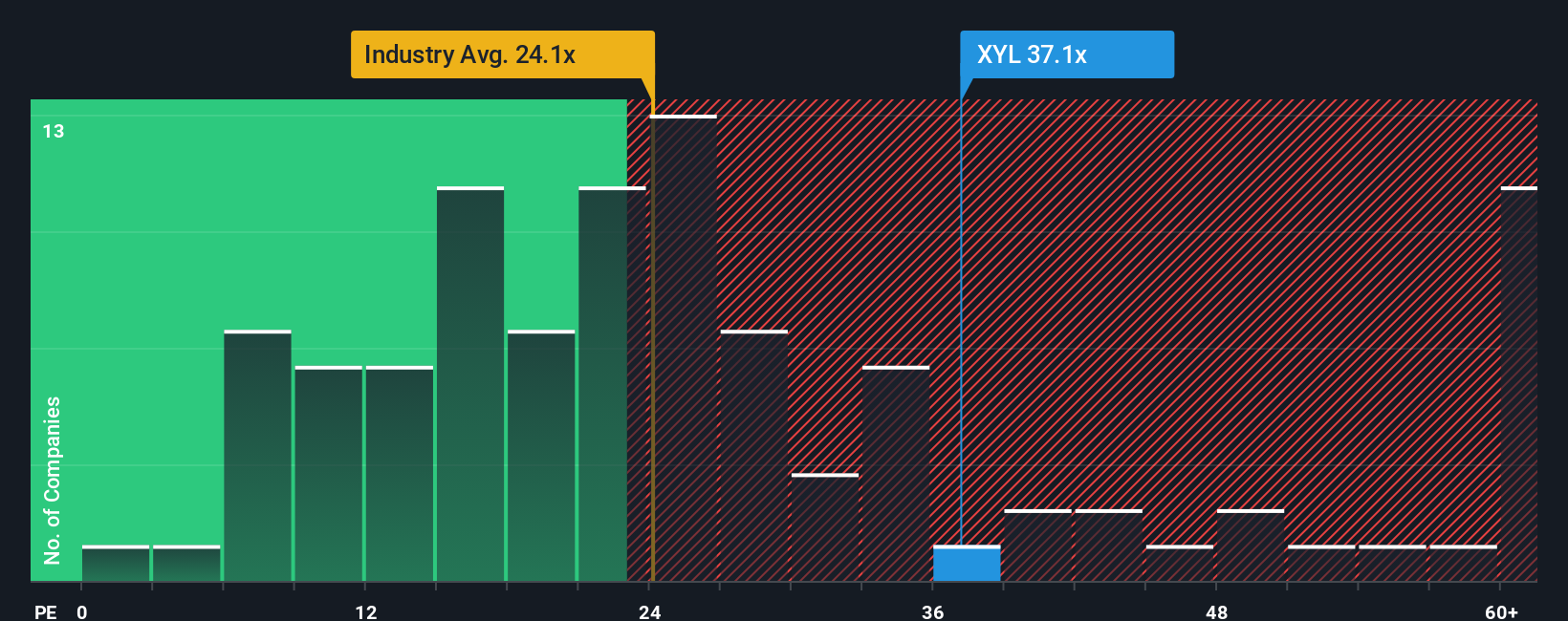

Step away from narrative fair value and the earnings multiple tells a different story. Xylem trades on about 35.2 times earnings, versus an industry average near 25.1 times and peer average around 31 times, while our fair ratio sits closer to 28.4 times.

That premium suggests investors are already paying up for execution and resilience, leaving less room for error if growth or margins disappoint. Is this a quality premium worth backing, or a valuation that needs earnings to catch up before buying more aggressively?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xylem Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can build a custom view in under three minutes: Do it your way.

A great starting point for your Xylem research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall Street Screener to uncover focused, data driven stock ideas tailored to your strategy.

- Capitalize on mispriced quality by targeting these 904 undervalued stocks based on cash flows that could offer stronger upside relative to their cash flow potential.

- Ride the next wave of innovation by zeroing in on these 27 AI penny stocks positioned at the forefront of artificial intelligence adoption.

- Strengthen your income stream by filtering for these 15 dividend stocks with yields > 3% that can potentially boost returns while markets stay volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com