MakeMyTrip (NasdaqGS:MMYT): Taking a Fresh Look at Valuation Before the Next Earnings Report

MakeMyTrip (MMYT) edged about 2% higher as investors positioned ahead of its upcoming earnings report, where the market is watching for meaningful year over year changes in both earnings and revenue.

See our latest analysis for MakeMyTrip.

That small pre earnings bump comes after a much rougher stretch, with a 30 day share price return of minus 8.11% and a year to date share price return of minus 38.30%, even though the three year total shareholder return is still up a hefty 148.13%. This suggests long term momentum is intact but currently pausing as investors reassess near term growth and risk.

If MakeMyTrip’s recent swings have you rethinking concentration risk, it could be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas for your watchlist.

With earnings growth still robust and the share price trading well below consensus targets, investors face a key question: Is MakeMyTrip quietly undervalued ahead of its next results, or is the market already pricing in that future growth?

Most Popular Narrative: 35.9% Undervalued

With MakeMyTrip last closing at $71.71 against a narrative fair value of $111.90, the story frames today’s price as a sizeable markdown on future potential.

Ongoing investment in product innovation, particularly in AI powered personalization and user experience improvements, positions MakeMyTrip for higher conversion rates, better customer retention, and ultimately supports expanding net margins through improved operating leverage.

Want to see what kind of revenue runway and margin expansion are built into that view? The narrative focuses on bold compounding and a rich future profit multiple. Curious how those moving parts combine to justify such a steep gap to today’s share price? Click through to see the full set of assumptions driving that fair value.

Result: Fair Value of $111.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in domestic air travel and rising competition from global and local OTAs could quickly challenge the upbeat long term narrative.

Find out about the key risks to this MakeMyTrip narrative.

Another Angle on Valuation

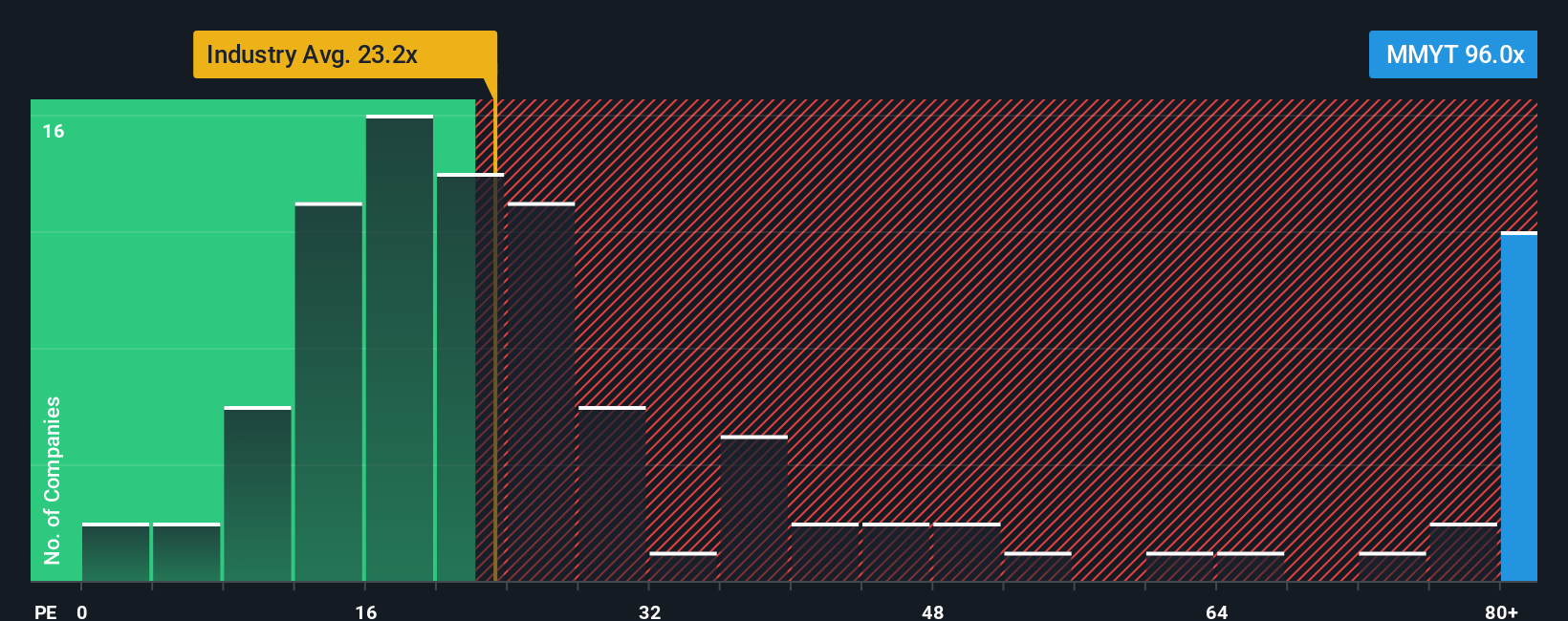

On earnings based metrics, MakeMyTrip looks stretched. The current price to earnings ratio of 89.2 times towers over both the US Hospitality sector at 23.4 times and peers at 20.6 times, while our fair ratio sits nearer 31.8 times, which hints at meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MakeMyTrip Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a complete view in just a few minutes by using Do it your way.

A great starting point for your MakeMyTrip research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh, data backed stock ideas before the crowd notices them.

- Target steady income by reviewing these 15 dividend stocks with yields > 3% that can strengthen your portfolio with reliable cash returns.

- Capture the next wave of innovation by researching these 27 AI penny stocks positioned to benefit from accelerating AI adoption across industries.

- Capitalize on market mispricing by scanning these 904 undervalued stocks based on cash flows that may offer strong upside based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com