Does The Market See AB InBev’s Value After Netflix Tie Up And Recent Share Slump?

- Wondering if Anheuser-Busch InBev is quietly trading below what it is really worth, or if the market already sees the upside you are hoping for?

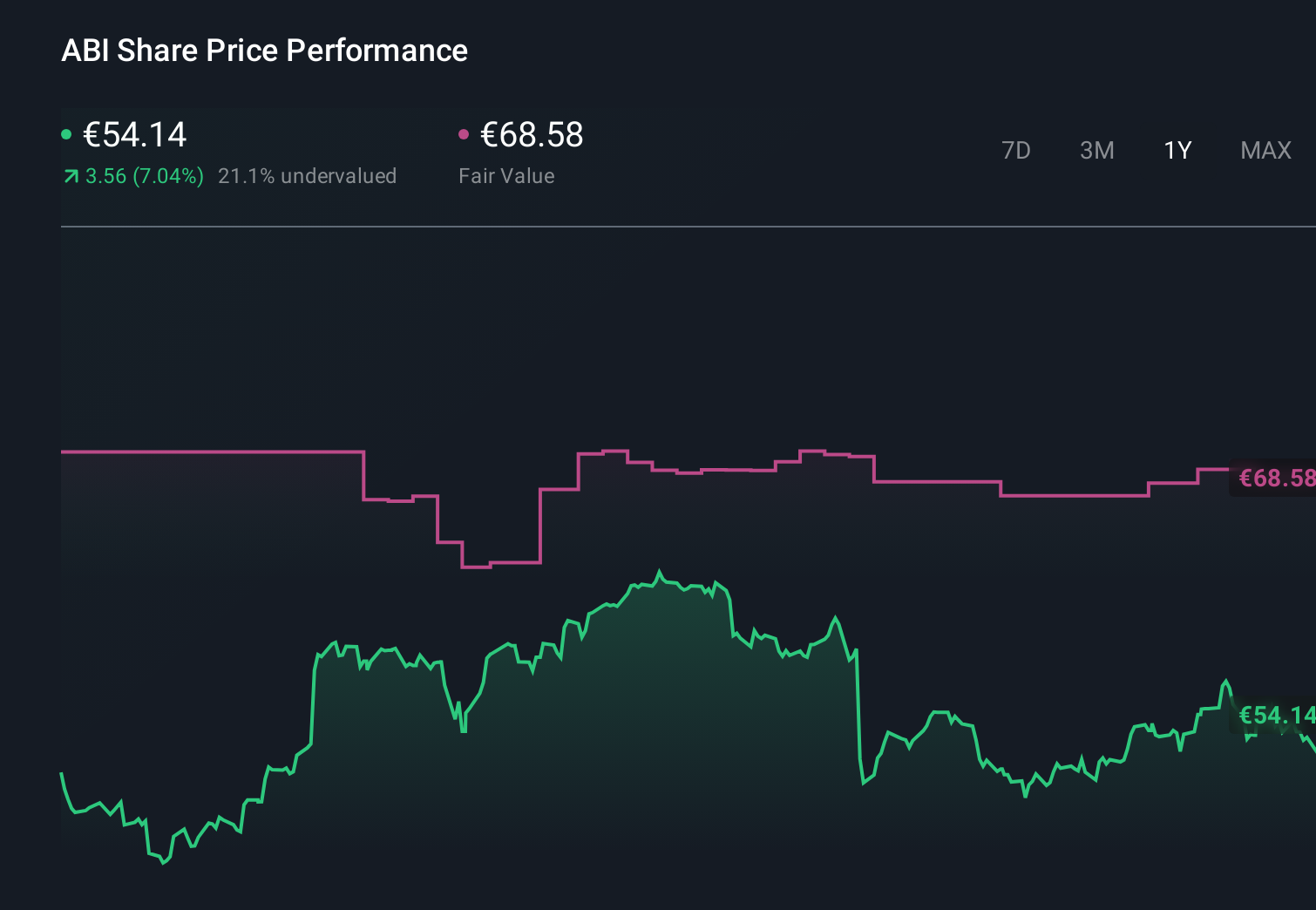

- Despite a modest 6.6% gain year to date and a 4.5% return over the last year, the stock has slipped recently, down 2.0% over the past week and 4.6% across the last month. These moves can influence how investors view both its growth potential and its risk profile.

- Recent headlines have focused on the company’s efforts to rebuild brand momentum in key markets and streamline its massive global portfolio. This signals a push to strengthen pricing power and margins. At the same time, ongoing conversations around consumer demand shifts and competition in premium and low-alcohol segments are keeping investors tuned in to how resilient its core business really is.

- On our framework, Anheuser-Busch InBev scores a 5/6 valuation score, suggesting it screens as undervalued on most of the key checks we use. Next, we break down those different valuation approaches, before finishing with an intuitive way to think about its true worth.

Approach 1: Anheuser-Busch InBev Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects the cash a company is expected to generate in the future and then discounts those cash flows back to today, aiming to estimate what the entire business is really worth right now.

Anheuser-Busch InBev generated trailing twelve month free cash flow of about $10.9 billion, and analyst expectations plus Simply Wall St extrapolations point to this rising to roughly $12.7 billion by 2027 and around $16.3 billion in 2035. These projections assume steady but moderating growth in free cash flow over the coming decade as the business matures while continuing to expand its cash generation.

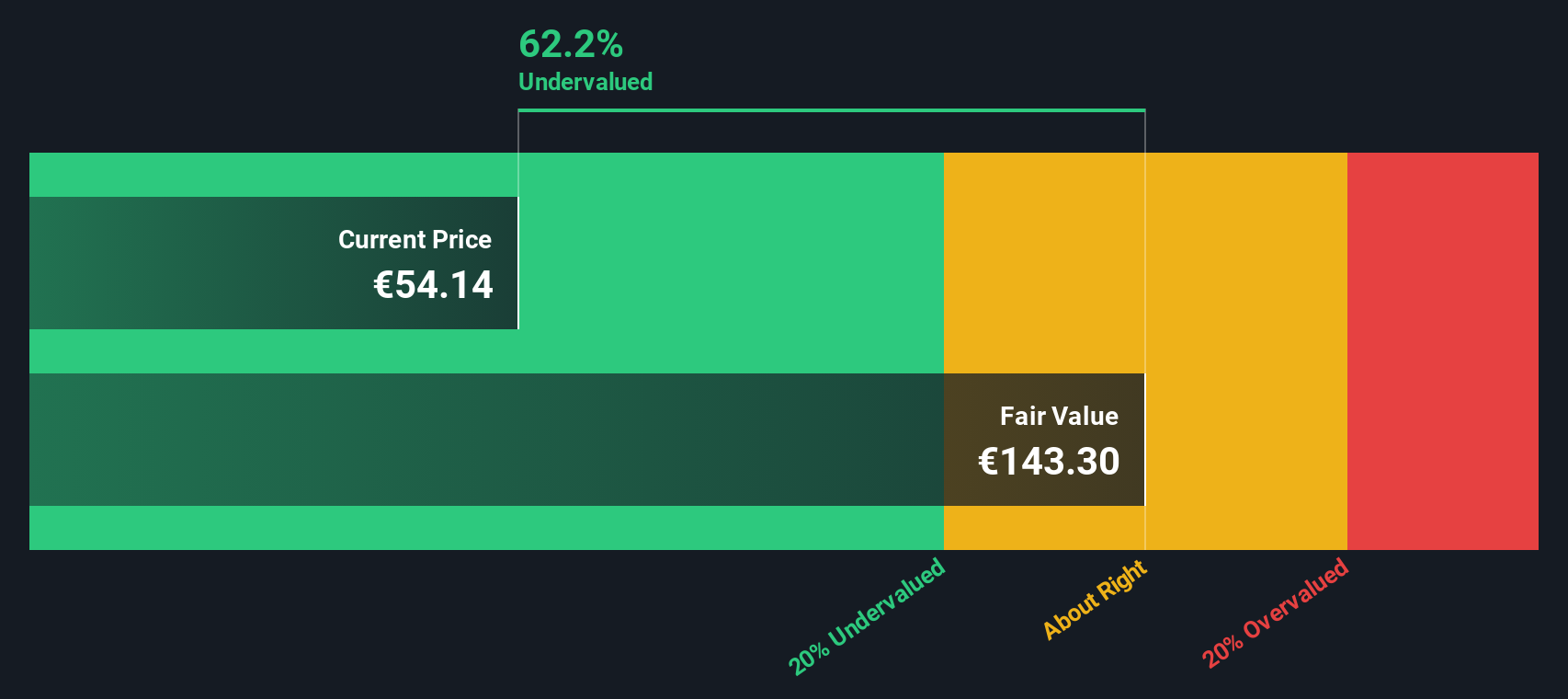

Using a 2 Stage Free Cash Flow to Equity model and discounting those future cash flows back to today gives an estimated intrinsic value of €144.39 per share. Compared with the current market price, this suggests the stock is trading at a roughly 64.0% discount to its DCF-based fair value, indicating potential upside if the cash flow projections prove accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Anheuser-Busch InBev is undervalued by 64.0%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Anheuser-Busch InBev Price vs Earnings

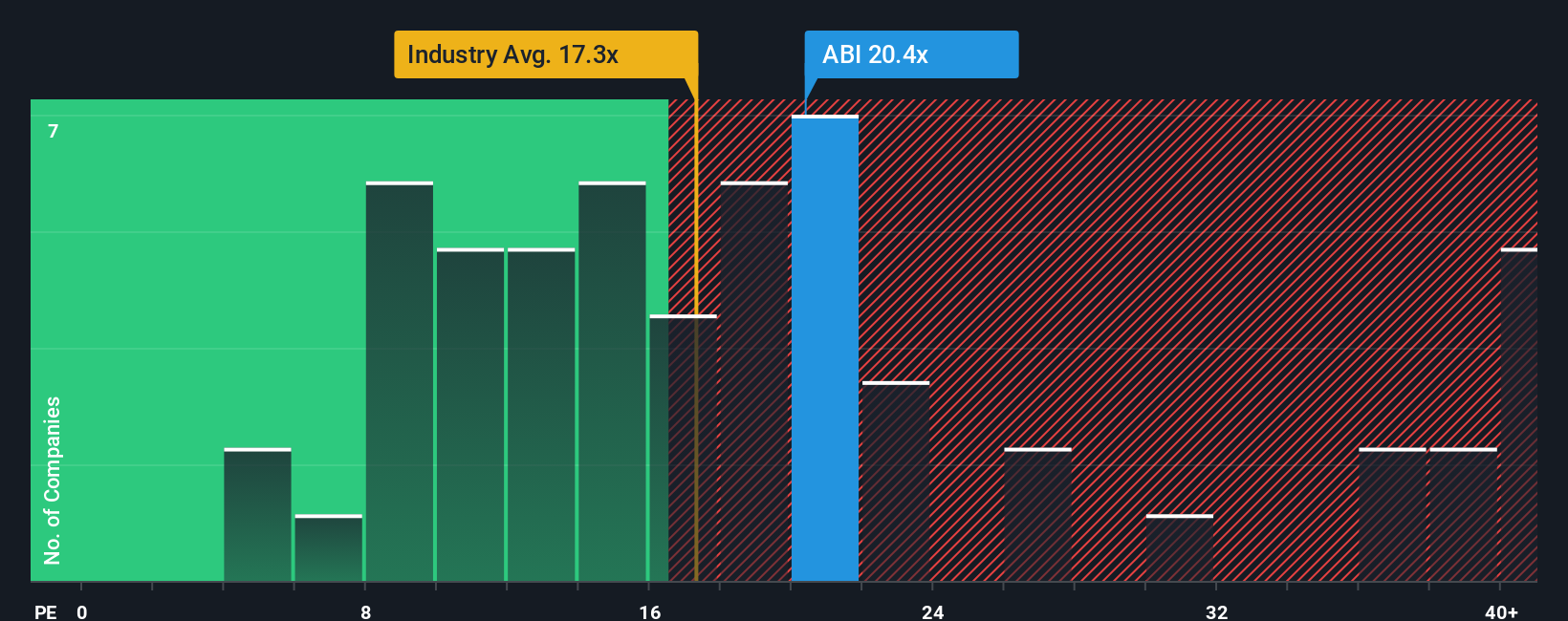

For a profitable, relatively mature business like Anheuser-Busch InBev, the price to earnings ratio is a useful way to gauge valuation because it directly links what investors pay today to the company’s current earning power. In general, faster earnings growth and lower perceived risk justify a higher PE, while slower growth or elevated risk usually warrant a lower, more conservative multiple.

Right now, Anheuser-Busch InBev trades on a PE of about 19.37x. That is above the broader Beverage industry average of roughly 17.39x, but below the peer group average of around 22.66x, suggesting the market is pricing it as stronger than the typical industry player, yet not as richly as some key rivals. Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE the stock should reasonably trade on, given its earnings growth profile, profitability, industry, market cap and risk factors. On this approach, Anheuser-Busch InBev’s Fair Ratio is estimated at 36.60x, which is materially higher than its current 19.37x multiple. This indicates the shares appear undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Anheuser-Busch InBev Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Anheuser-Busch InBev’s future with a concrete financial forecast and fair value estimate.

A Narrative is your story behind the numbers, where you spell out how you think revenue, earnings and margins will evolve, and the platform then turns that story into a forecast and an implied fair value that you can compare to today’s share price.

Narratives live inside the Simply Wall St Community page. They are an easy, accessible tool used by millions of investors to decide when a stock looks attractive to buy, hold or sell based on the gap between Fair Value and current Price.

Because Narratives are updated dynamically as new information comes in, such as earnings, news or guidance, your view of Anheuser-Busch InBev can automatically stay current without you rebuilding your model from scratch.

For example, one Anheuser-Busch InBev Narrative might lean optimistic, assuming the share buyback, Netflix partnership and premium growth justify a fair value near €78.81. A more cautious investor, focused on leverage and emerging market risks, might set their Narrative closer to €54.84. Both are using the same framework to turn their story into numbers.

Do you think there's more to the story for Anheuser-Busch InBev? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com