Pure Storage (PSTG): Reassessing Valuation After a Sharp Pullback in Share Price

Pure Storage (PSTG) has quietly pulled back over the past month after a strong run this year, and that dip is exactly what has investors rethinking what they are willing to pay.

See our latest analysis for Pure Storage.

That recent 7 day share price return of minus 25.94 percent, on top of a 30 day share price return of minus 22.12 percent from a last close of 70.15 dollars, looks more like a sharp breather in a stock that still boasts a 5 year total shareholder return of 224.77 percent. This suggests momentum has cooled but the longer term growth story is very much intact.

If Pure Storage's pullback has you thinking about what else is moving in tech, this could be a good moment to explore high growth tech and AI stocks for other potential opportunities.

With shares now trading well below analyst targets yet still up strongly over the longer term, investors face a key question: is Pure Storage undervalued after this pullback or is the market already pricing in its future growth?

Most Popular Narrative: 26.3% Undervalued

With Pure Storage last closing at 70.15 dollars against a narrative fair value near 95 dollars, the story being told implies a sizable upside if its growth plan lands as expected.

The adoption of Pure's Enterprise Data Cloud architecture and software defined solutions is accelerating among large enterprises, driven by the need to manage rapidly growing and increasingly valuable data assets in the evolving AI economy; this positions Pure to capture rising long term revenue from digital transformation and AI/ML driven workloads.

Curious how this storage specialist earns a premium style valuation without mega cap scale yet? The answer lies in bold revenue trajectories, rising margins, and a future earnings multiple usually reserved for market darlings, all baked into one detailed growth roadmap that investors are quietly debating.

Result: Fair Value of $95.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks around the cloud transition and uncertain hyperscaler deal timing mean recurring revenue and margin expansion could easily fall short of current expectations.

Find out about the key risks to this Pure Storage narrative.

Another View: Rich Multiples, Different Story

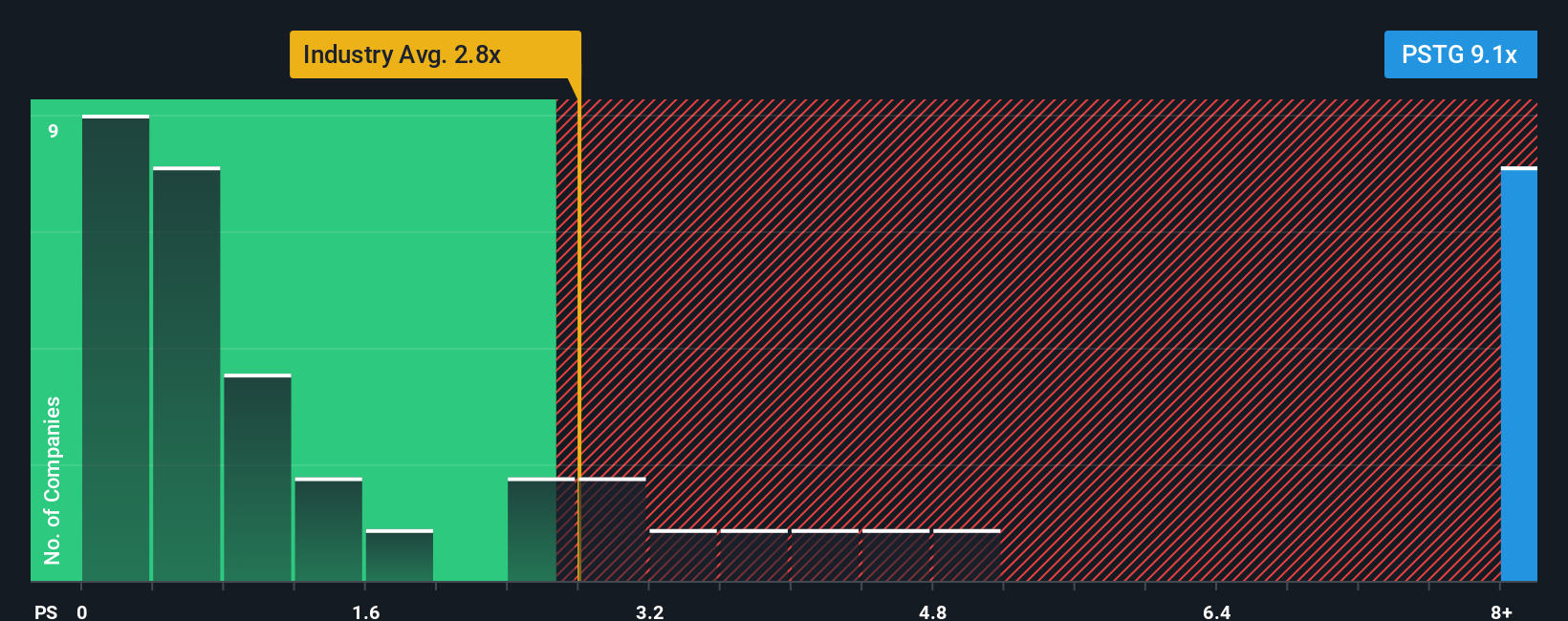

Look past the growth narrative, and Pure Storage looks pricey on sales. Its price to sales ratio sits around 6.7 times, far above the US tech average near 1.6 times and peers near 2.3 times, even if a fair ratio of 11.9 times hints at further upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pure Storage Narrative

If you see the numbers differently or want to stress test your own assumptions, you can spin up a fresh narrative in minutes, Do it your way.

A great starting point for your Pure Storage research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Turn today's research into action by scanning fresh opportunities on Simply Wall Street's powerful screener, so you never watch the next big winner pass by.

- Catch early stage potential with these 3588 penny stocks with strong financials that already show real financial strength instead of just speculative hype.

- Ride powerful structural trends by targeting these 30 healthcare AI stocks transforming how medicine is delivered, diagnosed, and personalized.

- Lock in dependable income streams through these 15 dividend stocks with yields > 3% that can support long term returns beyond short term price swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com