W. P. Carey (WPC): Assessing Valuation After a Recent 3% Pullback and Strong Year-to-Date Gains

W. P. Carey (WPC) has quietly pulled back about 3 % over the past month, even as its year to date return remains close to 20 %, prompting a fresh look at the REIT’s income and valuation setup.

See our latest analysis for W. P. Carey.

That recent 3 % pullback in the share price sits against a much stronger backdrop, with a near 20 % year to date share price return and a 1 year total shareholder return above 23 %. This suggests momentum is cooling a bit, but longer term income sentiment remains constructive as investors reassess valuation and interest rate risk.

If W. P. Carey has you rethinking income and defensiveness, it could be a smart time to broaden your watchlist and discover fast growing stocks with high insider ownership.

With W. P. Carey trading just below analyst targets yet showing a hefty intrinsic discount, has the recent pullback opened a genuine value gap, or is the market already pricing in the REIT’s next phase of growth?

Most Popular Narrative: 6.5% Undervalued

With the narrative fair value sitting modestly above W. P. Carey’s last close, the setup implies patient income investors are being paid to wait for execution.

Analysts are assuming W. P. Carey's revenue will grow by 8.1% annually over the next 3 years.

Analysts assume that profit margins will increase from 20.5% today to 33.8% in 3 years time.

If you are curious what has to go right for those richer margins and faster earnings to materialize, and why the multiple still edges higher into the future, you can dig into the full narrative for the detailed roadmap behind this valuation call.

Result: Fair Value of $69.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could be challenged if tenant credit weakens or if higher long term interest rates squeeze spreads on new net lease deals.

Find out about the key risks to this W. P. Carey narrative.

Another Lens on Valuation

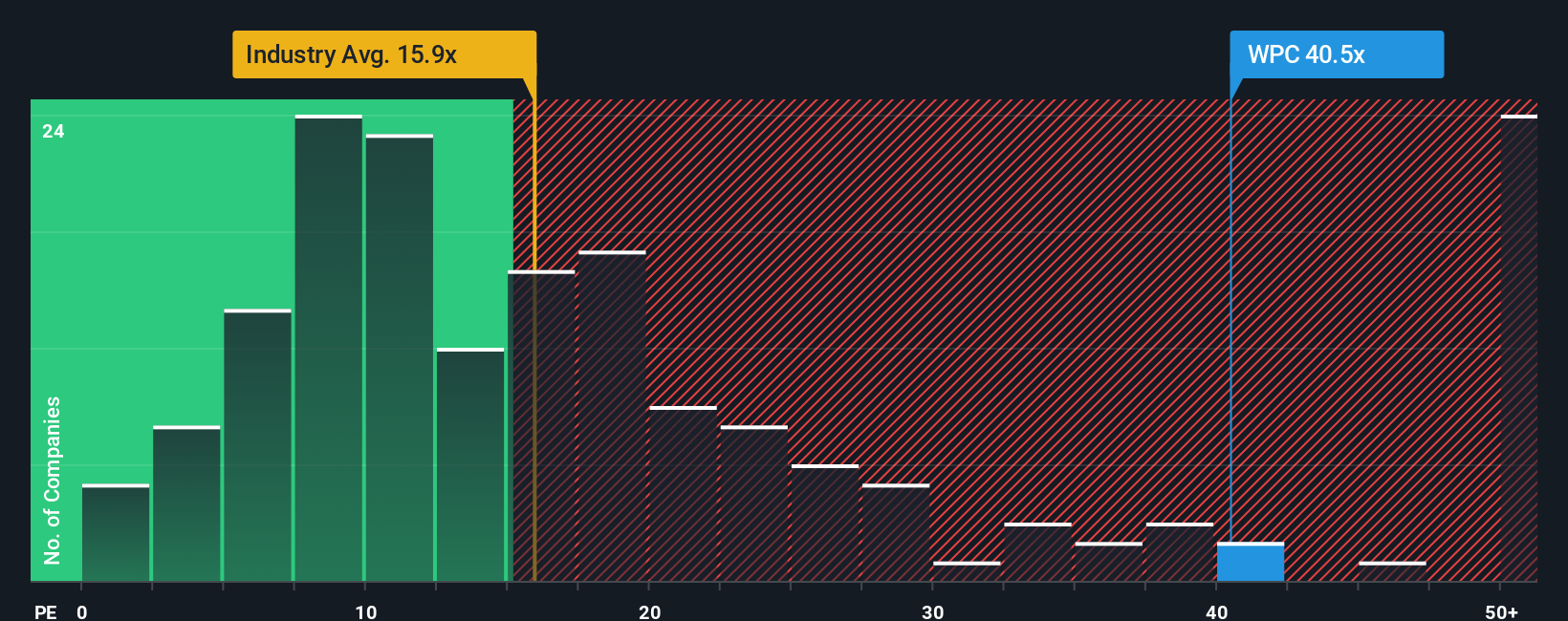

Multiples tell a very different story. At about 39 times earnings versus 29.1 times for peers and a 36 times fair ratio, W. P. Carey screens as expensive, implying less margin for error if growth or margins disappoint from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own W. P. Carey Narrative

If you see the story differently or want to stress test the assumptions with your own numbers, you can build a personalized view in minutes: Do it your way.

A great starting point for your W. P. Carey research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, put Simply Wall Street’s powerful Screener to work and uncover new stocks that match your return goals and risk comfort.

- Capture potential mispricings by targeting companies trading below their intrinsic value using these 903 undervalued stocks based on cash flows that highlight compelling cash flow opportunities.

- Position your portfolio for innovation by focusing on breakthrough machine learning and automation leaders through these 27 AI penny stocks that spotlight tomorrow’s growth engines.

- Lock in reliable income streams by zeroing in on companies with robust payouts via these 15 dividend stocks with yields > 3% offering yields above 3 % with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com