Mama's Creations (MAMA) Q3: Strong Revenue Growth Tests Bullish Margin Expansion Narrative

Mama's Creations (MAMA) just posted its Q3 2026 numbers, with revenue of about $47.3 million, basic EPS of $0.01, and net income of $0.5 million, setting the stage for investors to parse how the growth story is holding up. The company has seen quarterly revenue move from $31.5 million in Q3 2025 to $47.3 million in the latest quarter, while EPS shifted from $0.01 to $0.01 and net income from $0.4 million to $0.5 million, giving a clearer read on how much of the top line is actually making it through to the bottom line. All in, these results put the focus firmly on how sustainably Mama's Creations can defend and enhance its margins as it chases growth.

See our full analysis for Mama's Creations.With the headline numbers on the table, the next step is to see how this latest report lines up against the dominant narratives around Mama's Creations, and where the data might challenge what investors think they know.

See what the community is saying about Mama's Creations

Revenue Jumps 50 percent YoY to 47.3 million

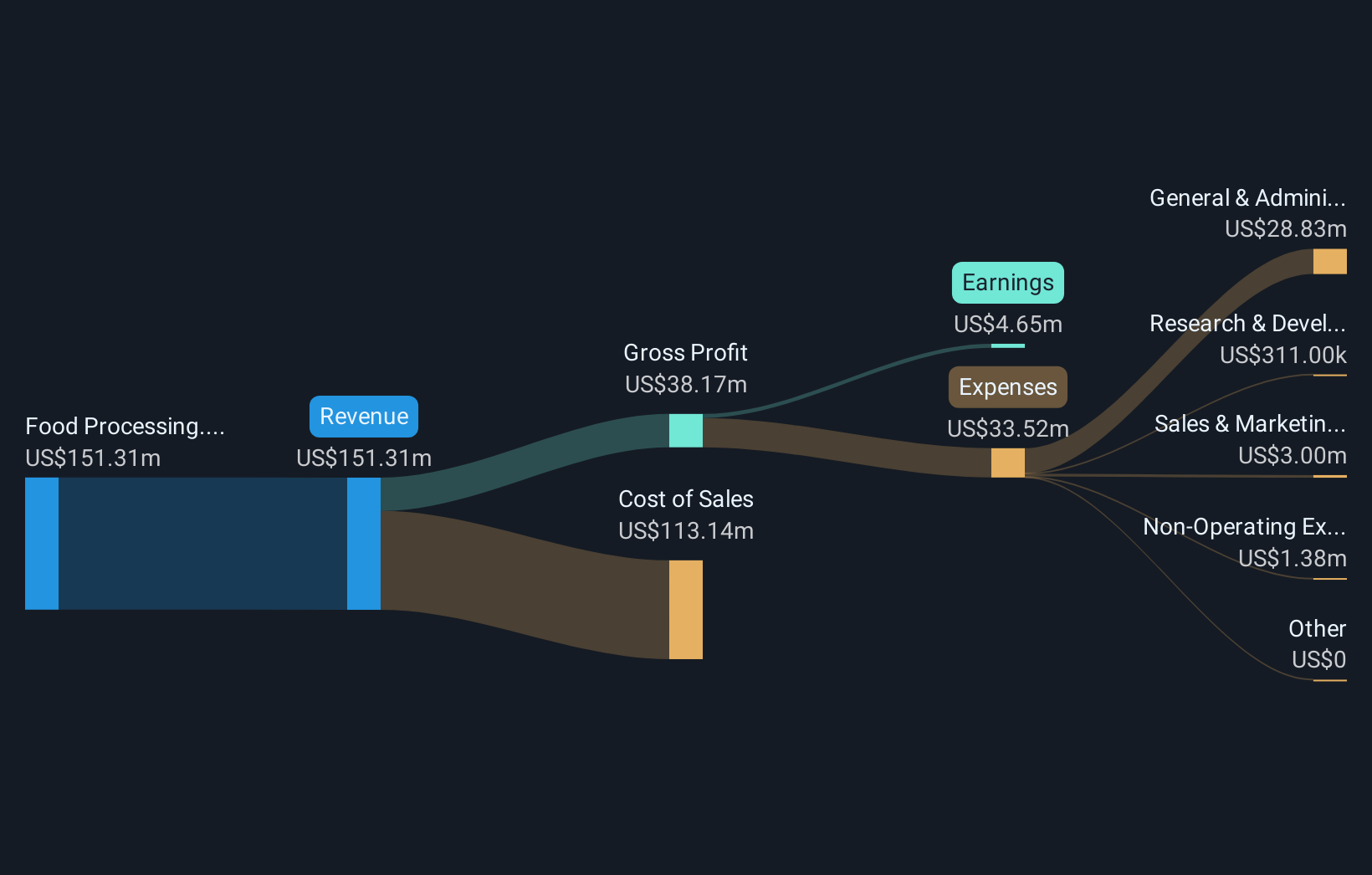

- Top line has climbed from 31.5 million in Q3 2025 to 47.3 million in Q3 2026, a roughly 50 percent year on year increase, while trailing twelve month revenue has risen to 151.3 million from 123.3 million four quarters ago.

- Consensus narrative says acquisitions and new retail partnerships should fuel future revenue gains, and the latest step up in sales appears to fit that story, yet

- trailing twelve month revenue growth of about 22.0 percent a year is lower than the single quarter jump, hinting that not every period will see this kind of surge

- management still needs to show that growth from Crown I and other acquisitions can be repeated without integration issues undermining those higher sales levels

Net Margin Sits Around 3 percent on 151.3 million Sales

- On a trailing twelve month basis, net income excluding extra items stands at 4.7 million on 151.3 million of revenue, which is roughly a 3.1 percent net margin and only slightly above the 3.0 percent margin reported a year earlier.

- Supporters argue that automation and procurement scale should lift margins over the next 12 to 18 months, but

- the current 3.1 percent net margin still sits well below management’s goal of returning to mid or high 20 percent gross margins, so most of the margin improvement is still ahead rather than in the numbers today

- recent quarterly net income dipped from 1.6 million in Q4 2025 to 0.5 million in Q3 2026 even as revenue grew, which challenges the more bullish expectation of a smooth march higher in profitability

125x P E Versus Modest 3.1 percent Margin

- The stock trades on a trailing P E of 125.1 times against a 3.1 percent net margin and 4.7 million of trailing net income, while the DCF fair value of 15.60 sits just above the current 14.32 share price and analysts see upside toward 17.60.

- Critics highlight that this multiple is far above the US Food industry average of 20.6 times, and that tension matters because

- even with forecast earnings growth of about 52.3 percent per year and revenue growth of 22.1 percent per year, the valuation already bakes in a lot of that improvement compared with peers on roughly 40.9 times earnings

- if net margins do not expand meaningfully from the current 3.1 percent toward the 5.7 percent analysts project in three years, the combination of a 125.1 times multiple and relatively small absolute profit base of 4.7 million could leave little room for error

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mama's Creations on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot a different angle in these numbers? Use that perspective to quickly build your own narrative in just a few minutes, then Do it your way.

A great starting point for your Mama's Creations research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Mama's Creations pairs rapid revenue growth with thin, volatile margins and a rich earnings multiple, leaving little room for operational missteps or valuation disappointment.

If that mix of lofty expectations and fragile profitability feels risky, use our these 903 undervalued stocks based on cash flows to quickly zero in on stocks where robust fundamentals and more reasonable prices work harder in your favor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com