Academy Sports (ASO) Margin Compression Reinforces Cautious Growth Narratives After Q3 2026 Results

Academy Sports and Outdoors (ASO) has posted its Q3 2026 numbers with revenue of about $1.4 billion and EPS of roughly $1.07, giving investors a fresh read on how demand is holding up across the year. The company has seen revenue move from roughly $1.34 billion in Q3 2025 to about $1.38 billion in Q3 2026, while EPS shifted from around $0.94 to $1.07 over the same period, setting a clear baseline for how the business is tracking through the current cycle as margins do the heavy lifting in the background.

See our full analysis for Academy Sports and Outdoors.With the latest quarter in focus, the next step is to line these results up against the dominant narratives around Academy Sports and Outdoors to see which storylines the numbers actually support and which ones start to look stretched.

See what the community is saying about Academy Sports and Outdoors

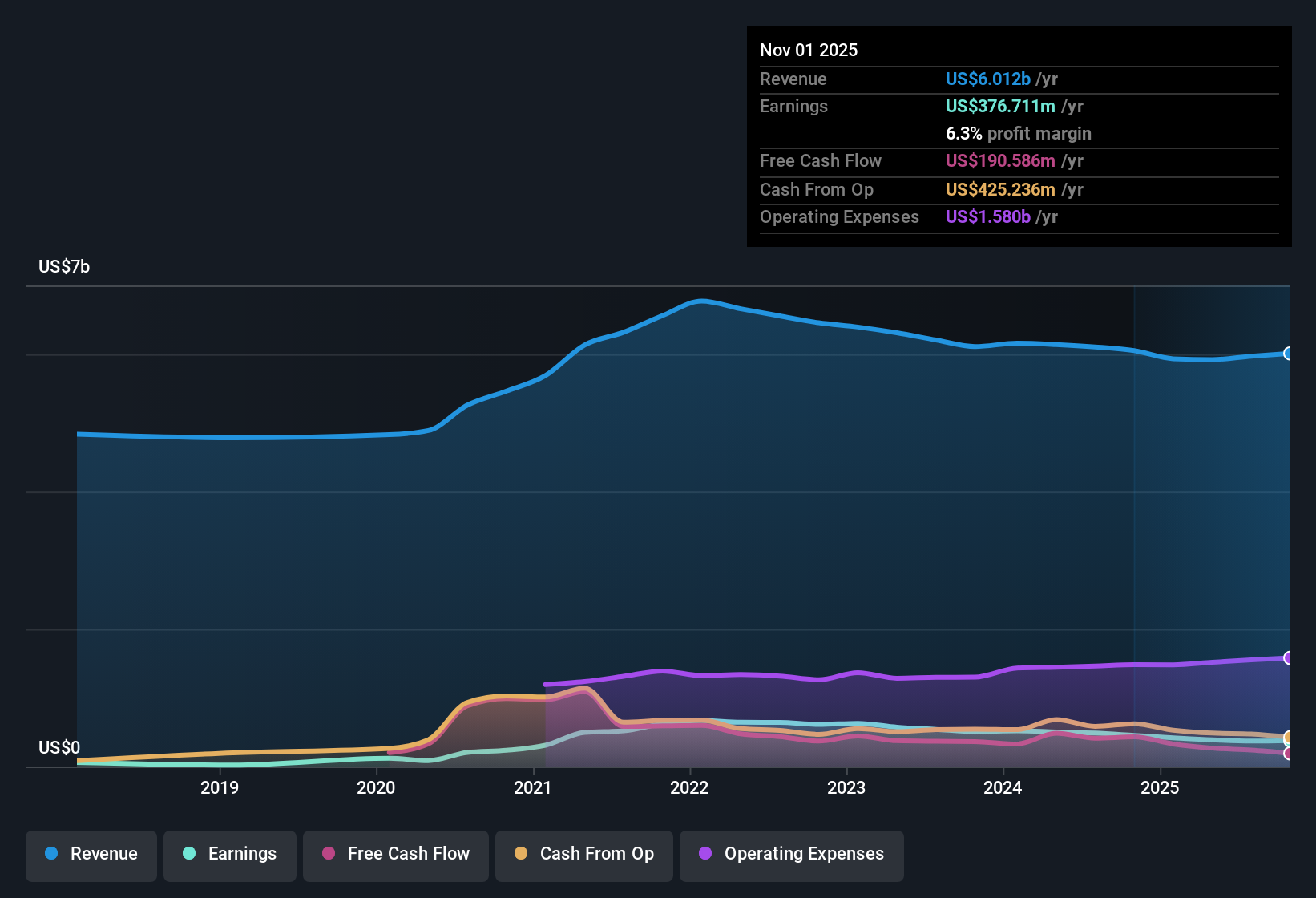

Margins Ease Back To 6.3%

- On a trailing basis, net profit margin is 6.3%, down from 7.5% a year ago, even though trailing revenue is about $6.0 billion and net income is roughly $377 million.

- Bears focus on that drop in margin and note that five year earnings have slipped about 2.9% per year,

- which lines up with concerns about cost pressures from tariffs, labor and shipping weighing on profitability despite solid headline sales,

- and leaves less room for error if promotional intensity picks up further in Academy’s core Southeast and South Central regions.

TTM EPS Of $5.59 Versus Slower Growth

- Over the last twelve months, basic EPS totals about $5.59 on $6.0 billion of revenue, while forward forecasts call for revenue growth of roughly 6.3% and earnings growth of about 6.65% per year, both slower than the broader US market.

- The consensus narrative highlights e commerce momentum and new store expansion as key growth drivers,

- yet the modest forecast growth rates versus the wider market suggest those catalysts are expected to produce steady rather than rapid gains from today’s earnings base,

- and reliance on higher income customers and vendor partnerships could cap upside if those groups pull back or shift more spend elsewhere.

Cheap At 9.4x Earnings

- Shares trade on a trailing P E of 9.4 times, well below peer and industry averages near 18.5 to 18.9 times, and sit under both an analyst price target of $57.65 and a DCF fair value of about $66.94 versus the current price of $53.07.

- Bulls argue that this discount does not match Academy’s described high quality earnings and ongoing efficiency investments,

- pointing to expectations for earnings to rise from roughly $371 million today to $460.3 million by 2028 while the multiple would still be only about 9.2 times on those future profits,

- and to initiatives in private label, loyalty programs and supply chain that are aimed at supporting margins even as revenue growth runs a bit below the broader market.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Academy Sports and Outdoors on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to dig into the data, frame your own view, and share your version of the story: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Academy Sports and Outdoors.

Explore Alternatives

Academy’s slowing earnings trend, thinner margins and modest growth outlook versus the wider market suggest its future returns may be steadier than exciting.

If you are looking for stronger momentum and clearer upside potential, use our high growth potential stocks screener (46 results) to quickly uncover established businesses geared for faster earnings growth than Academy currently offers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com