Enbridge (TSX:ENB): Valuation Check as Dividend Hike Extends 31-Year Growth Streak

Enbridge (TSX:ENB) just extended its dividend growth streak to 31 years, with the board approving a higher quarterly payout that underscores steady cash flow visibility and keeps income focused investors paying close attention.

See our latest analysis for Enbridge.

Despite a slightly softer recent patch, with modest negative short term share price returns even after the latest dividend news, Enbridge’s year to date share price gain and strong multi year total shareholder returns suggest momentum in the income story is still very much intact.

If Enbridge’s steady income profile appeals to you, this could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With analysts seeing only modest upside to their price targets, yet Enbridge still trading at a steep discount to some intrinsic value estimates, investors face a key question: is this a genuine value opportunity or is future growth already priced in?

Most Popular Narrative Narrative: 6.5% Undervalued

With Enbridge last closing at CA$65.87 against a narrative fair value of about CA$70.45, the story leans toward modest upside grounded in future earnings power.

Disciplined capital allocation, a growing secured project backlog with higher risk adjusted returns, and stable balance sheet management are set to drive predictable dividend growth and increasing free cash flow per share, addressing any current undervaluation as future earnings visibility strengthens.

Want to see how steady revenue, rising margins, and a rich earnings multiple all fit together in this valuation puzzle? The narrative lays out a detailed roadmap of shrinking top line, expanding profits, and a future earnings multiple that leans more toward premium utilities than traditional pipelines. Curious which assumptions have to hold for that fair value to stick? Dive in to unpack the full playbook behind this target.

Result: Fair Value of $70.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that roadmap could be derailed by tougher permitting and environmental rules, or by faster decarbonisation that leaves legacy pipeline assets underutilised.

Find out about the key risks to this Enbridge narrative.

Another Angle on Valuation

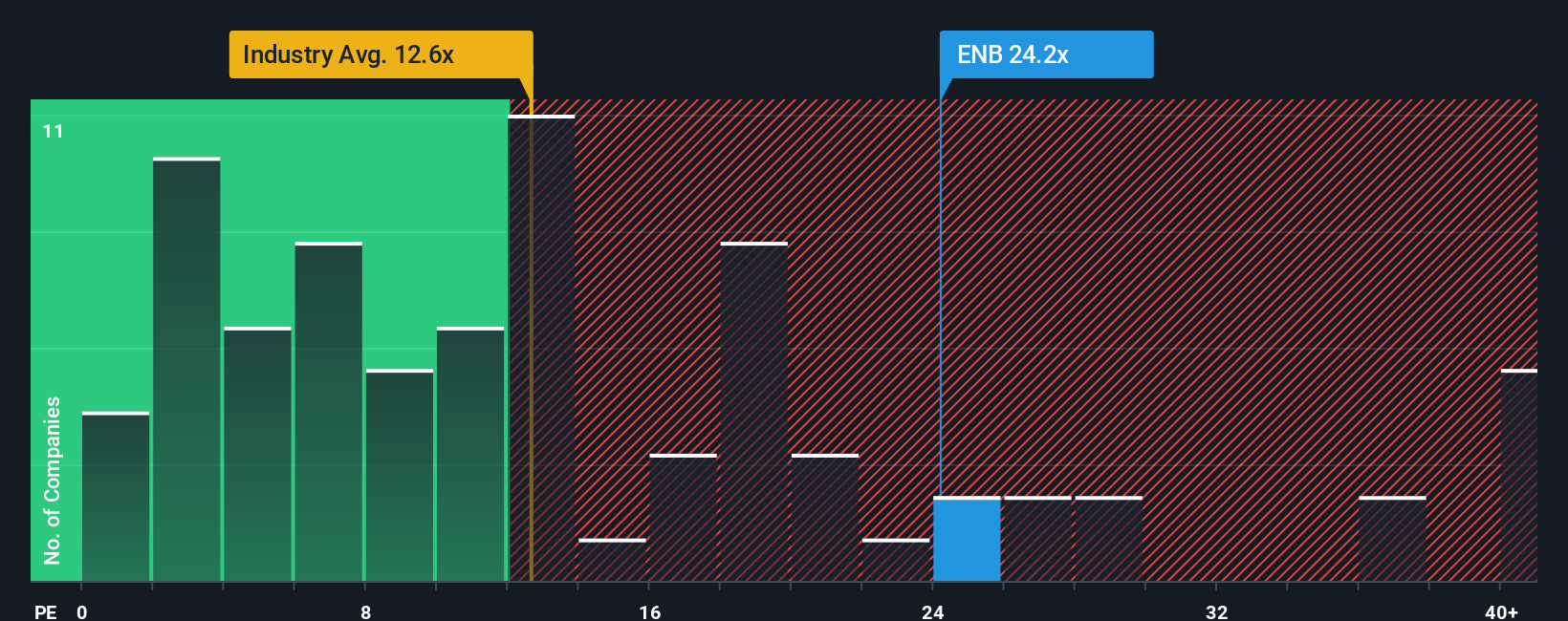

On earnings, Enbridge looks anything but cheap, trading at about 25.7 times profits versus a 20.1 times peer average and a 20.7 times fair ratio. That gap points to real downside risk if sentiment cools, even if income investors stay loyal to the dividend. The key question is which story you trust.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enbridge Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a personalised Enbridge narrative in just minutes: Do it your way.

A great starting point for your Enbridge research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at Enbridge, you might miss compelling opportunities, so use the Simply Wall St Screener to uncover fresh stocks that fit your strategy.

- Capture potential rebounds by targeting mispriced businesses through these 903 undervalued stocks based on cash flows that pair solid fundamentals with attractive cash flow-driven valuations.

- Ride powerful income streams by scanning these 15 dividend stocks with yields > 3% that offer yields above 3 percent backed by sustainable payout profiles.

- Position ahead of financial disruption by focusing on these 80 cryptocurrency and blockchain stocks linked to blockchain infrastructure, digital payments, and emerging Web3 ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com