Kohl's (KSS) Valuation Check After Fresh Analyst ‘Sell’ Rating and Weaker Sales Outlook

Analyst Downgrade Sparks Fresh Scrutiny Of Kohl's Stock

Kohl's (KSS) slipped about 3% after a fresh analyst consensus tagged the stock with a Sell rating, pointing to expected drops in comparable and net sales alongside thinning cash reserves.

See our latest analysis for Kohl's.

Despite the downgrade, Kohl's recent 30 day share price return of 37.6% and roughly 67% year to date gain suggest strong short term momentum. However, the five year total shareholder return remains negative, highlighting a still fragile long term story.

If this retail volatility has you reassessing your options, it could be a good time to explore fast growing stocks with high insider ownership as a source of fresher momentum ideas.

With Kohl's trading above analyst targets but at a steep discount to some intrinsic value estimates, investors face a pivotal question: is this a mispriced turnaround story, or has the market already baked in any realistic rebound?

Most Popular Narrative: 7% Overvalued

With Kohl's last closing at $23.41 against a narrative fair value near $21.82, the storyline leans cautious while still baking in a modest recovery.

The company's ability to swiftly adapt its promotional strategy (e.g., reintroducing coupon eligibility across more brands and categories), reengage previously disengaged core customers, and show progressive improvement in traffic trends suggests potential for stabilization and sequential improvement in revenue, especially if macroeconomic pressures ease.

Want to see what really powers that fair value? The narrative quietly leans on a disciplined earnings path and a future profit multiple that clashes with today’s skepticism. Curious how those assumptions fit together?

Result: Fair Value of $21.82 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, meaningful upside could emerge if Sephora shop-in-shop performance exceeds expectations and proprietary brands drive stronger margins and traffic than forecast.

Find out about the key risks to this Kohl's narrative.

Another Angle On Value

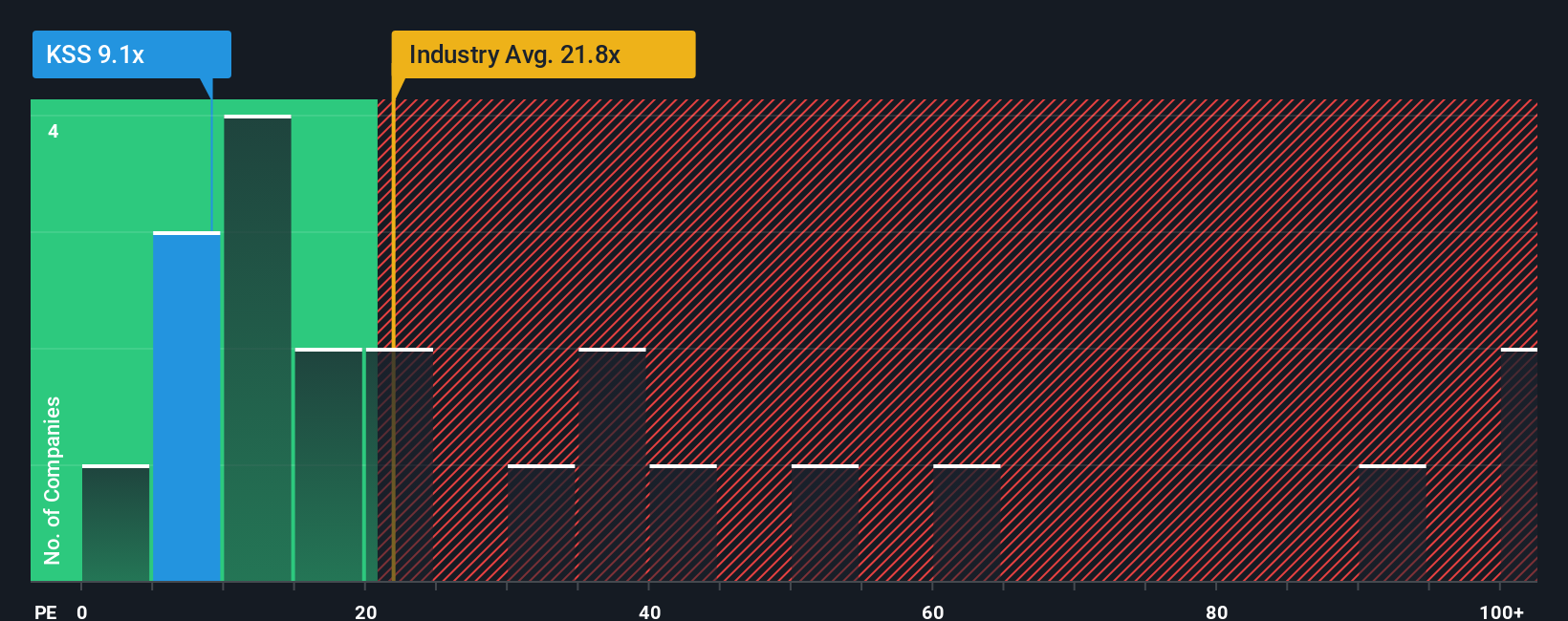

While the narrative fair value suggests Kohl's is about 7% overvalued, the earnings multiple tells a different story. At roughly 13.5 times earnings, the stock trades well below both peers at 21.6 times and a fair ratio of 20 times, which hints the market may be underpricing a steady, low growth retailer. Which lens do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kohl's Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Kohl's. Harness the Simply Wall St Screener now to uncover fresh opportunities that could reshape your portfolio before the market catches on.

- Explore potential mispriced opportunities by targeting companies that look cheap on cash flow with these 903 undervalued stocks based on cash flows before sentiment fully turns.

- Seek the next income trend by hunting for reliable payout candidates via these 15 dividend stocks with yields > 3% that keep cash flowing into your account.

- Position yourself early in digital finance by scanning these 80 cryptocurrency and blockchain stocks for businesses aiming to build real value behind the headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com