UiPath (PATH): Reassessing Valuation After First GAAP Profit and Strong AI Partnership-Driven Momentum

UiPath (PATH) has been on investors’ radar after a strong quarter, where it flipped to GAAP profitability, lifted its outlook, and doubled down on AI partnerships that could extend its lead in automation.

See our latest analysis for UiPath.

That earnings beat and the flurry of AI integrations with players like Nvidia, Microsoft, Talkdesk, and Veeva have clearly shifted sentiment, with UiPath’s roughly 63% 3 month share price return and 29% one year total shareholder return signaling building momentum rather than a quick pop.

If this automation rally has your attention, it is a good time to scan other high growth tech names and discover high growth tech and AI stocks.

Yet with shares now trading above consensus targets after a 60% plus three month surge and UiPath finally posting GAAP profits, are investors still underestimating its AI runway, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 19.1% Overvalued

With UiPath closing at 18.98 dollars against a narrative fair value of 15.93 dollars, the current setup leans toward optimism being priced in.

New product launches such as Agent Builder and Agentic Orchestration, along with strategic partnerships like with Microsoft and Deloitte, are positioned to expand market opportunities, potentially increasing earnings through higher value deals.

Curious why this story supports a richer valuation despite modest revenue assumptions and thinner long term margins? The real twist lies in how future earnings power and a punchy profit multiple are being woven together. Want to see which specific growth levers and profitability upgrades anchor that fair value path, and how far expectations stretch beyond today’s profits?

Result: Fair Value of $15.93 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical delays in deal closures and FX headwinds squeezing reported growth could quickly undermine today’s upbeat expectations around UiPath’s AI-fueled momentum.

Find out about the key risks to this UiPath narrative.

Another Lens on Valuation

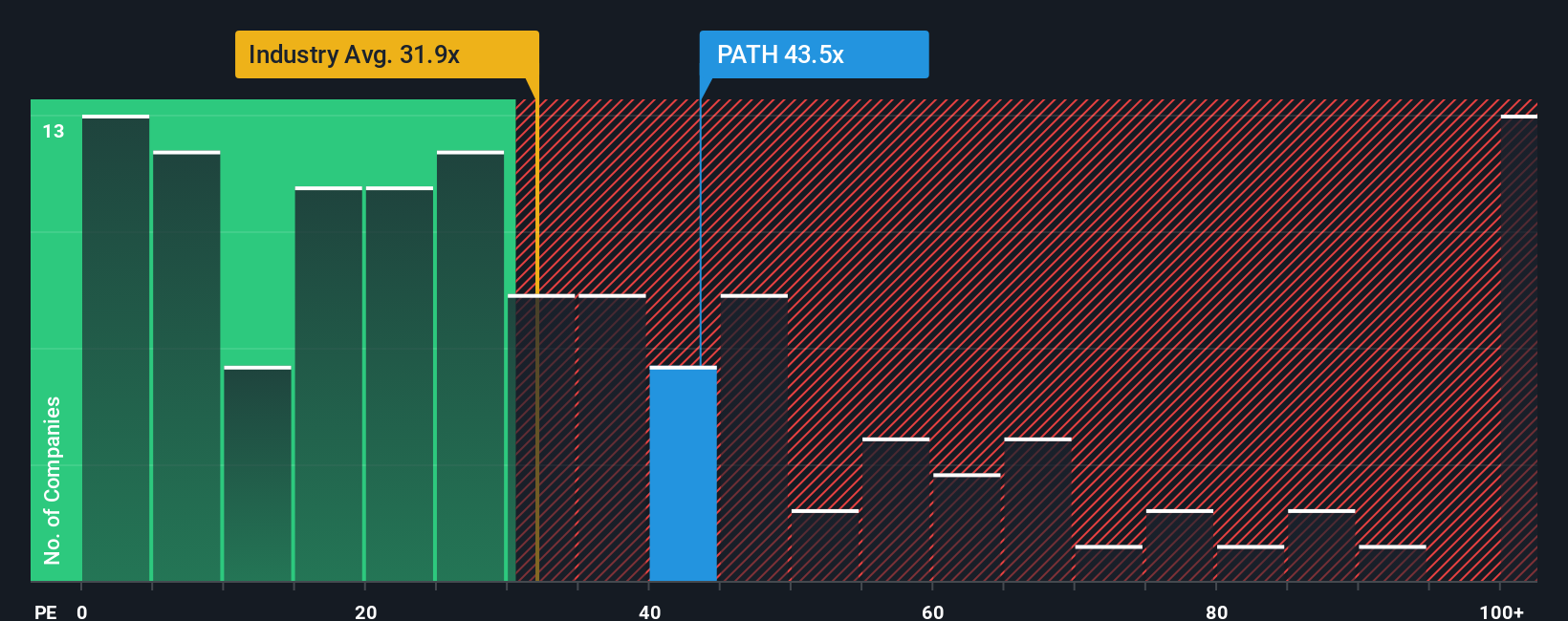

On earnings, UiPath screens expensive, with a 44.2x price to earnings ratio versus 32x for the US software sector and a 14.7x fair ratio our model suggests the market could gravitate toward. That gap implies any stumble in growth or AI sentiment could trigger a sharp rerating.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UiPath Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can quickly craft a personalized UiPath thesis in just a few minutes: Do it your way.

A great starting point for your UiPath research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop your research at UiPath. Use the Simply Wall St Screener to zero in on fresh, data driven opportunities that others may be overlooking.

- Capture hidden upside in mispriced opportunities by targeting these 903 undervalued stocks based on cash flows that pair solid fundamentals with attractive cash flow based valuations.

- Capitalize on the next wave of automation and innovation by scanning these 27 AI penny stocks shaping the future of intelligent software and infrastructure.

- Lock in reliable income potential by focusing on these 15 dividend stocks with yields > 3% that combine robust balance sheets with sustainable, higher yielding payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com