Does D.R. Horton’s Mixed Valuation Signal Opportunity After Recent Share Price Swings?

- If you are wondering whether D.R. Horton at around $149 a share is a bargain or a value trap right now, you are not alone, and this breakdown is designed to address exactly that question.

- The stock is up 121.2% over five years and 76.2% over three years, but more recently it is down 5.7% over the last week, up 3.2% over the last month, and only 8.5% higher year to date. This suggests the market is rethinking its risk and growth expectations.

- Those swings are happening against a backdrop of cooling but still resilient US housing demand and ongoing debates about how higher-for-longer interest rates will shape homebuyer affordability and builder margins. At the same time, policy discussions around housing supply, including incentives for new construction and persistent inventory shortages in many markets, continue to support a structural case for large builders such as D.R. Horton.

- In our framework, D.R. Horton currently scores just 1 out of 6 on undervaluation checks. We will walk through what different valuation approaches are suggesting and then finish by exploring an additional way to think about this stock's underlying worth.

D.R. Horton scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: D.R. Horton Discounted Cash Flow (DCF) Analysis

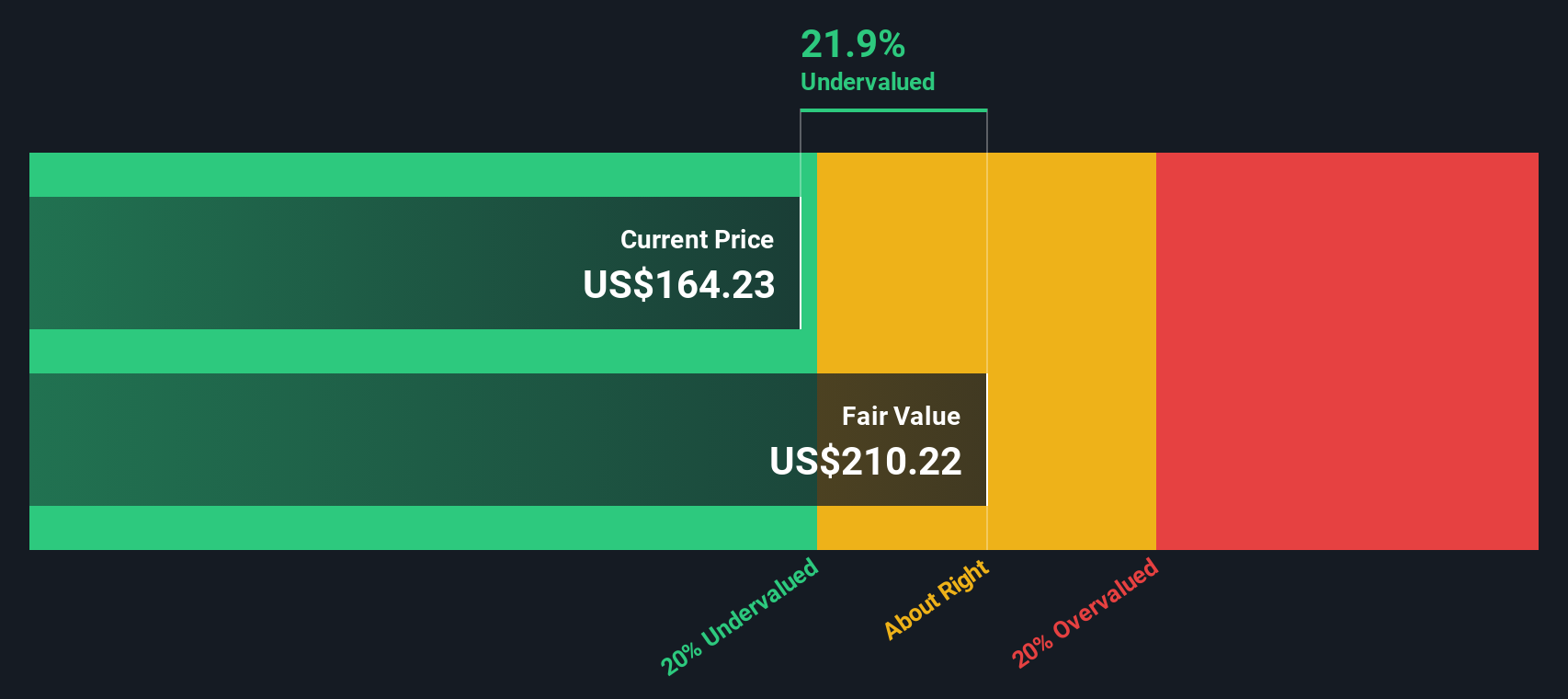

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting those back to today in $ terms. For D.R. Horton, the latest twelve month free cash flow is about $3.28 billion, and analysts expect this to moderate, with Simply Wall St extending those forecasts over the next decade using a two stage Free Cash Flow to Equity model.

In this framework, free cash flow is projected to be around $2.36 billion in 2035, with values gradually stepping down from current levels before stabilizing. These ten year projections, combined with an assumed discount rate and a terminal value, are used to calculate what those future $ cash flows are worth in today’s dollars.

That exercise produces an estimated intrinsic value of roughly $116.38 per share. With the current market price sitting around $149, the DCF implies the stock is about 28.3% above its calculated fair value, suggesting investors are paying a premium relative to these cash flow based assumptions.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests D.R. Horton may be overvalued by 28.3%. Discover 903 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: D.R. Horton Price vs Earnings

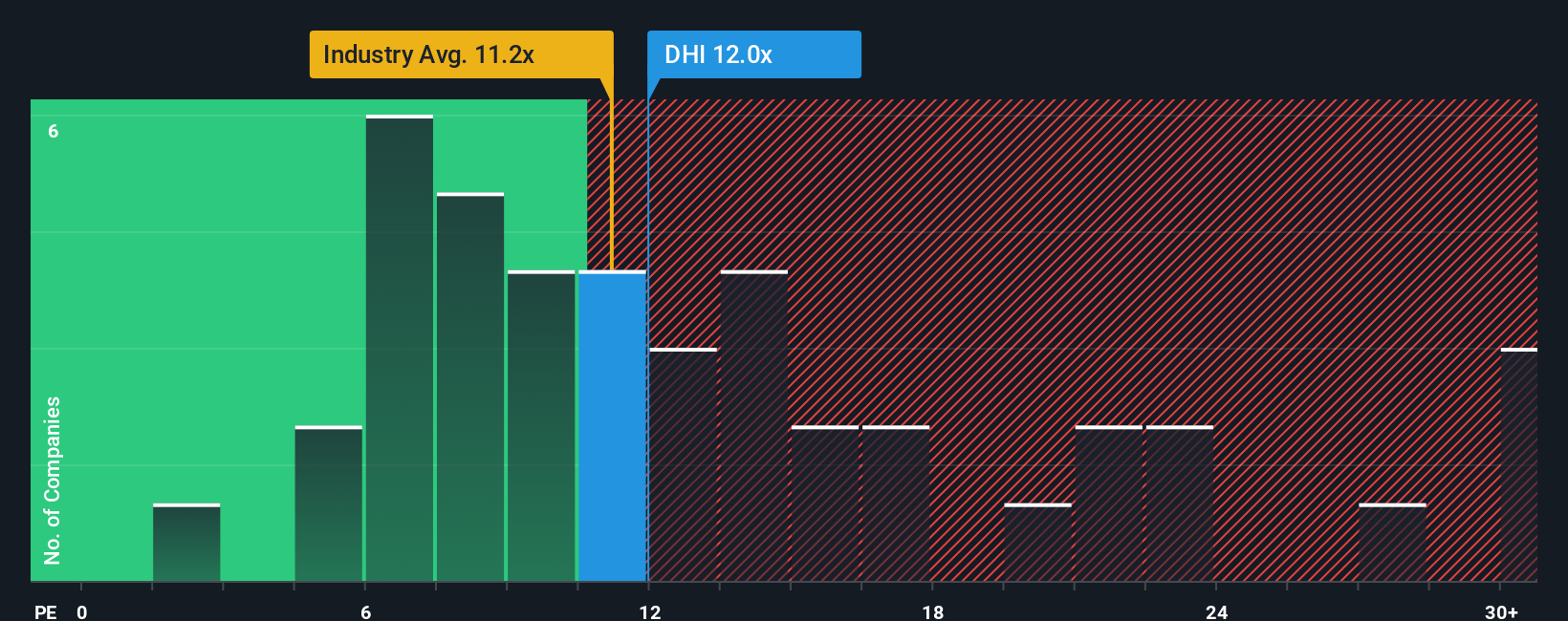

For a profitable company like D.R. Horton, the price to earnings ratio is a practical way to gauge how much investors are paying for each dollar of current profits. It condenses the market’s view on growth potential and risk into a single number, with higher multiples typically reflecting stronger expected growth or lower perceived risk.

D.R. Horton currently trades on a PE of about 12.17x. That is modestly above the Consumer Durables industry average of around 10.99x and close to the broader peer group average of roughly 10.97x. This suggests investors are willing to pay a small premium versus comparable homebuilders. Simply Wall St’s proprietary Fair Ratio for D.R. Horton is materially higher at 21.52x. This indicates that, when factoring in elements like earnings growth prospects, profitability, business risks, industry, and market capitalization, the stock could arguably justify a much richer multiple than where it trades today.

Because the Fair Ratio integrates these company specific drivers rather than relying solely on broad peer or industry comparisons, it offers a more tailored view of value. On this basis, D.R. Horton’s current 12.17x multiple sits well below the 21.52x Fair Ratio, which points to a stock that appears attractively priced on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your D.R. Horton Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of D.R. Horton’s story with a concrete forecast for its revenue, earnings, and margins, and then translate that into a Fair Value you can compare with today’s share price to decide whether to buy, hold, or sell. A Narrative on Simply Wall St’s Community page captures your assumptions about how factors like housing demand, interest rates, and margins will evolve, turns those into a dynamic financial model, and continually updates that Fair Value as fresh data comes in, such as new earnings or major housing news. For example, one D.R. Horton Narrative might lean bullish, assuming lower interest rates, resilient demand, and a Fair Value near $199. A more cautious Narrative could emphasize affordability pressures, slower growth, and a Fair Value closer to $110. Seeing these side by side helps you quickly understand where your own view sits on that spectrum and what that implies for action today.

Do you think there's more to the story for D.R. Horton? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com