Is It Too Late To Consider McDonald's After Five Year 62.1% Share Price Surge?

- If you have ever looked at McDonald's and wondered whether a global fast food icon can still be a value play, you are exactly who this breakdown is for.

- The stock has quietly climbed to around $310.79, with returns of 3.3% over the last week, 3.7% over the last month, 6.2% year to date, 5.8% over 1 year, and 62.1% over 5 years, which naturally raises questions about how much upside is left.

- Recent headlines have focused on McDonald's ongoing menu innovation and digital initiatives, from expanding delivery and loyalty programs to testing new store formats aimed at faster service. At the same time, debates around consumer spending resilience and pricing power in a higher cost environment have added extra intrigue to every move in the share price.

- Right now, McDonald's scores a 2/6 valuation check score, suggesting only some signals of undervaluation. We will break down what different valuation approaches are saying and, by the end, look at a more insightful way to think about what the stock is really worth.

McDonald's scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: McDonald's Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to a present value.

For McDonald's, the latest twelve month Free Cash Flow is about $7.8 billion. Analysts and model estimates see this rising steadily, with projections around $8.6 billion in 2026 and roughly $10.7 billion by 2028, all in $. Beyond the analyst window, Simply Wall St extrapolates further growth, with estimated Free Cash Flow reaching about $14.4 billion in 2035.

Rolling these projections into a 2 Stage Free Cash Flow to Equity model yields an estimated intrinsic value of $261.06 per share. Compared with the current share price near $310.79, the DCF implies the stock is roughly 19.1% overvalued. This suggests that a large portion of the anticipated future growth may already be reflected in the current share price.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests McDonald's may be overvalued by 19.1%. Discover 903 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: McDonald's Price vs Earnings

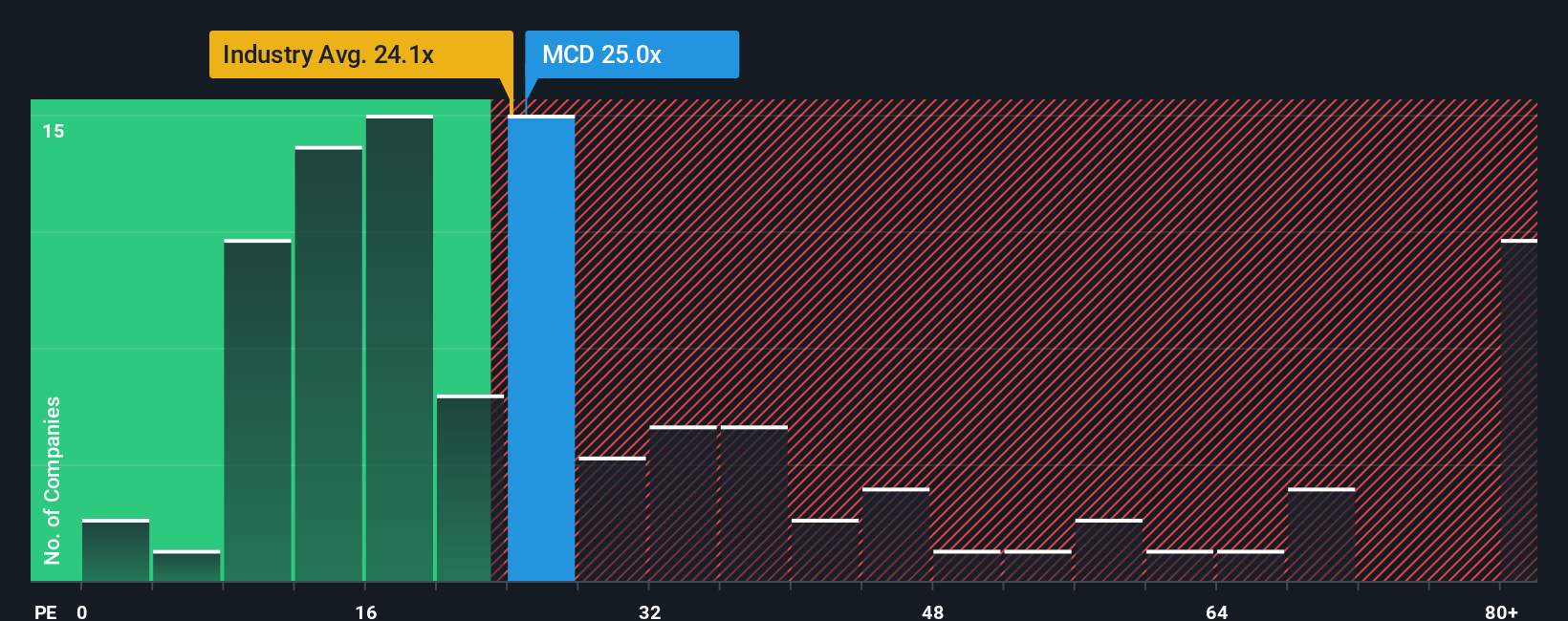

For a mature, consistently profitable business like McDonald's, the Price to Earnings (PE) ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current earnings. Higher growth and lower perceived risk generally justify a higher PE, while slower growth or elevated risks usually call for a lower, more conservative multiple.

McDonald's currently trades at about 26.3x earnings, above the broader Hospitality industry average of roughly 23.4x, but well below its peer group average near 55.4x. To refine this view, Simply Wall St uses a proprietary Fair Ratio, which estimates what a justified PE multiple should be, given the company’s earnings growth outlook, profitability, industry context, size, and risk profile. This is more informative than simple peer or industry comparisons, which can be skewed by outliers or structural differences between businesses.

For McDonald's, the Fair Ratio is around 30.6x, moderately higher than the current 26.3x. That suggests the market is not overpaying for the company’s earnings and may even be applying a small discount relative to its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your McDonald's Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of McDonald's business to a financial forecast and a Fair Value estimate. A Narrative is your story behind the numbers, where you spell out what you believe about McDonald's future revenue growth, earnings, and margins, and then translate that into a Fair Value that you can compare against today’s share price to decide whether to buy, hold, or sell. On Simply Wall St, Narratives live in the Community page and are used by millions of investors as an easy, visual tool to turn views like “international expansion and digital will drive steady growth” or “value menus will pressure margins” into concrete forecasts and valuations. These Narratives update dynamically as new earnings, news, or macro data comes in, so your McDonald's view can evolve in real time. You can quickly see why one investor’s bullish Narrative might support a Fair Value closer to $373, while a more cautious Narrative might point to something nearer $260 instead.

Do you think there's more to the story for McDonald's? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com