Is It Too Late to Consider Mercedes After Its Strong 2024 Share Price Run?

- If you are wondering whether Mercedes-Benz Group is still a value play after its strong run, or if the easy money has already been made, you are in the right place to unpack what the market is really pricing in.

- The stock has climbed 3.1% over the last week, 4.7% over the last month, and is up 18.4% over the past year, with a hefty 75.1% gain over five years that suggests the market has gradually been warming to its story.

- Recently, investors have been reacting to the company sharpening its focus on higher margin, luxury and electric models while continuing shareholder-friendly capital returns. This helps explain why the share price has been grinding higher rather than spiking on hype. At the same time, ongoing debates about the pace of EV adoption, competition from other global automakers, and the macro backdrop for European cyclicals are keeping a lid on runaway optimism and giving long term investors something to consider.

- Right now Mercedes-Benz Group scores a 4/6 valuation check. This suggests the market sees value in some areas but may be missing or overpricing others. In this article we will break down what different valuation methods say about the stock before finishing with a more nuanced way to think about fair value.

Approach 1: Mercedes-Benz Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by forecasting the cash it can generate in the future and discounting those cash flows back to their value in the present.

For Mercedes-Benz Group, the model starts with last twelve month free cash flow of about €13.0 billion and projects how this could evolve over time. Analyst estimates cover the next few years, suggesting free cash flow stepping down into the €4.7 to €6.3 billion range by 2027, with later years extrapolated by Simply Wall St, reaching around €7.1 billion by 2035. These future figures are discounted back using a required rate of return to arrive at an intrinsic value per share.

On this basis, the DCF model estimates fair value at roughly €73.58 per share, implying the stock is about 17.0% undervalued versus the current market price. In other words, investors today are paying less than what the projected cash flows suggest the business is worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mercedes-Benz Group is undervalued by 17.0%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Mercedes-Benz Group Price vs Earnings

For profitable companies like Mercedes-Benz Group, the price to earnings ratio is a useful yardstick because it directly links what investors are paying to the profits the business is generating today.

What counts as a normal or fair PE ratio depends on how quickly earnings are expected to grow and how risky those earnings are. Faster, more reliable growth usually justifies a higher multiple, while cyclical or uncertain earnings typically command a discount.

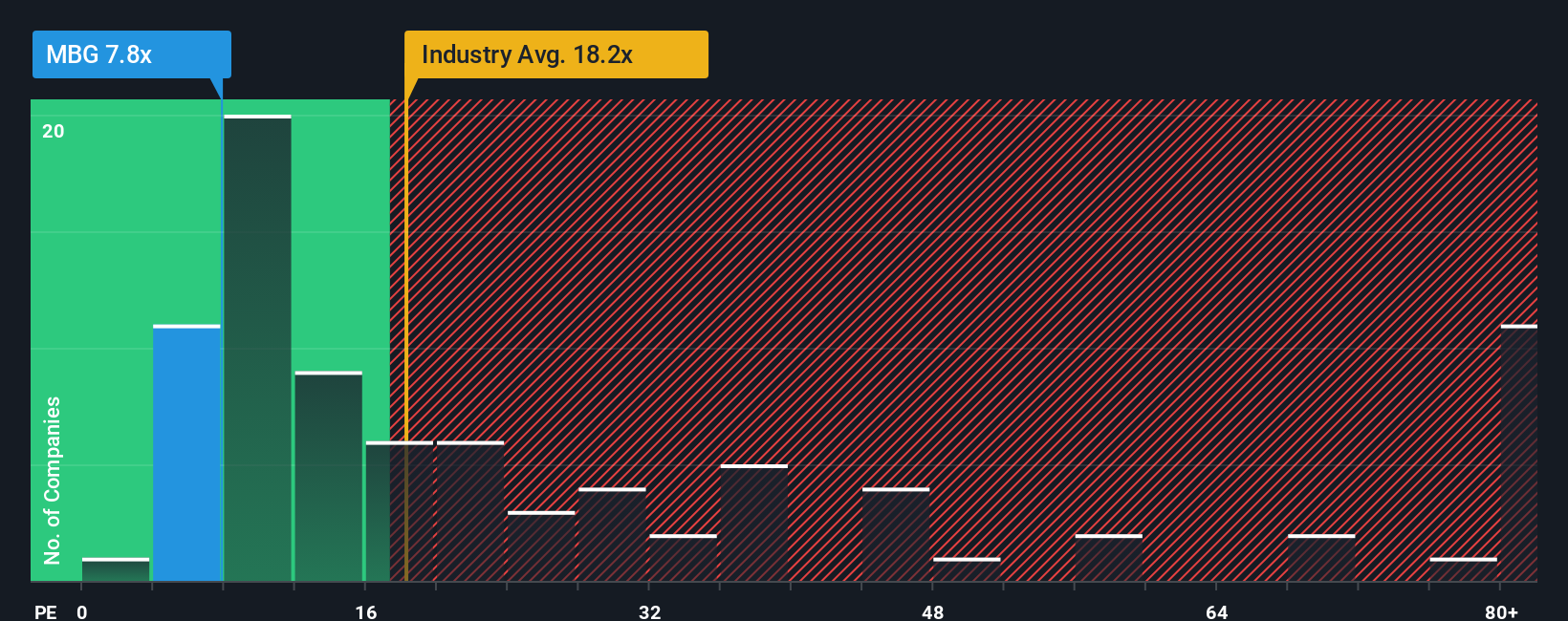

Mercedes-Benz Group currently trades on about 9.37x earnings, well below both the auto industry average of around 18.72x and the broader peer group average of roughly 19.15x. On the surface, that points to a sizeable discount versus listed competitors.

Simply Wall St also estimates a Fair Ratio of 12.84x using a proprietary framework that incorporates Mercedes-Benz Group’s earnings growth outlook, margins, risk profile, industry and market cap. This tailored Fair Ratio is more informative than simple peer or sector comparisons because it adjusts for the company’s specific strengths and vulnerabilities rather than assuming all automakers deserve the same multiple.

Comparing the Fair Ratio of 12.84x with the current 9.37x suggests the market is still pricing Mercedes-Benz Group at a discount to where it arguably should trade.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mercedes-Benz Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your own story about a company, tied directly to assumptions about its future revenue, earnings and margins, and then translated into a clear fair value that you can compare with today’s share price to decide whether to buy, hold or sell.

On Simply Wall St’s Community page, millions of investors build Narratives by linking what they believe about Mercedes-Benz Group’s strategy, risks and opportunities to a financial forecast, and the platform dynamically refreshes those Narratives when new information like earnings updates, tariff news or China demand headlines arrive, so their fair value estimates stay current.

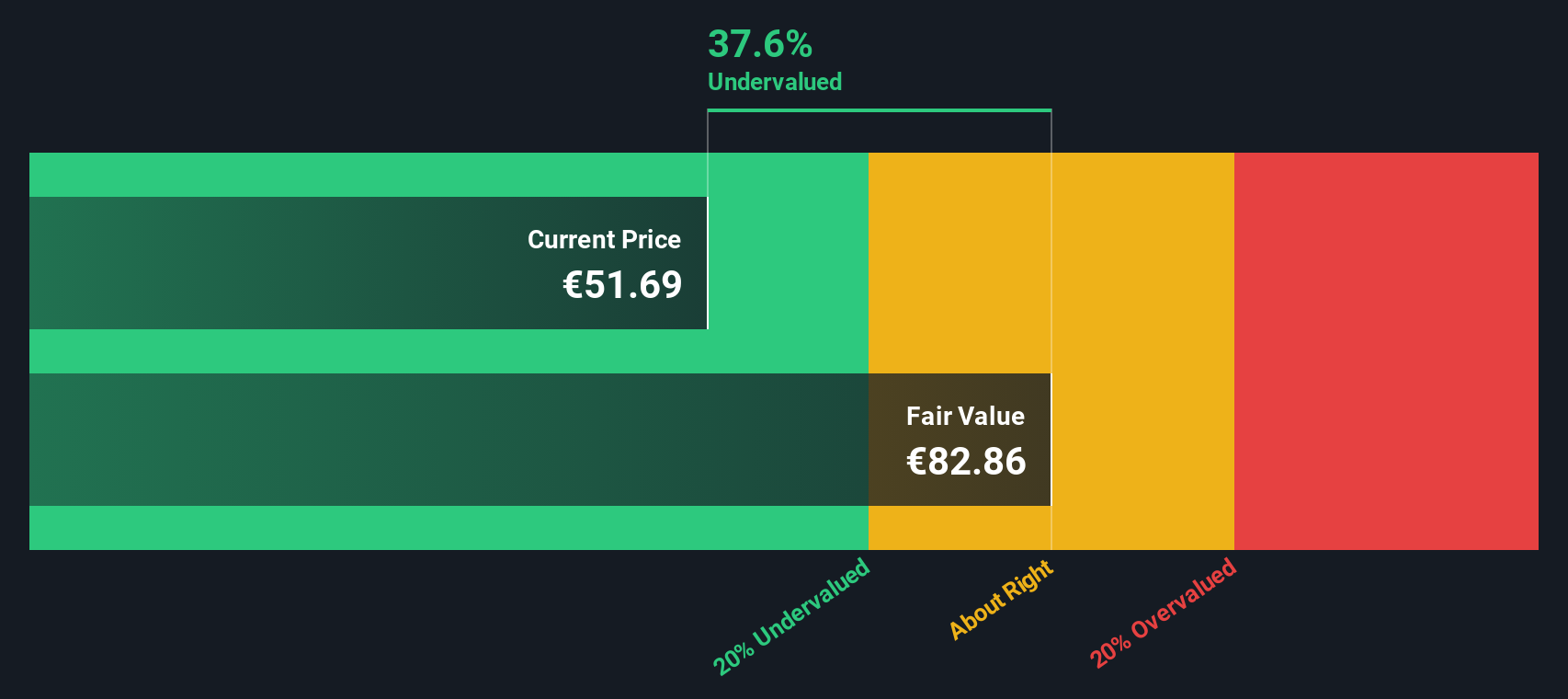

For example, one investor might focus on the rollout of over 25 new EV models, premium pricing and software driven margins to justify a higher fair value closer to the most optimistic analyst target near €83. Another may emphasize China softness, tariff risks and heavy electrification spending to anchor a far more cautious view closer to the low end near €40. This illustrates how different, clearly articulated Narratives can coexist and help each investor act with conviction.

Do you think there's more to the story for Mercedes-Benz Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com