Top Middle Eastern Dividend Stocks Yielding Up To 6.6%

As Gulf markets show resilience ahead of the Federal Reserve's policy meeting, investors are keenly observing how potential U.S. interest rate changes could impact regional economies, particularly those with currencies pegged to the dollar. In this environment, dividend stocks can offer a stable income stream and serve as a hedge against market volatility, making them an attractive option for those looking to balance growth with reliable returns.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.50% | ★★★★★★ |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.12% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.29% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.63% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.49% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.51% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.12% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 8.12% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.75% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.69% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Emirates Driving Company P.J.S.C (ADX:DRIVE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emirates Driving Company P.J.S.C., along with its subsidiaries, focuses on managing and developing motor vehicle driving training in the United Arab Emirates, with a market cap of AED3.34 billion.

Operations: Emirates Driving Company P.J.S.C. generates revenue primarily from its Car and Other Related Services segment, amounting to AED738.10 million.

Dividend Yield: 5.5%

Emirates Driving Company P.J.S.C. offers a mixed dividend profile. While its dividends are covered by earnings and cash flows, the track record has been volatile over the past decade, with notable drops exceeding 20% annually. Despite this, recent earnings growth of 20.5% and trading at 34.7% below fair value suggest potential for improvement. The company's dividend yield (5.48%) remains below the top tier in the AE market but is supported by strong financial performance in recent quarters.

- Click here to discover the nuances of Emirates Driving Company P.J.S.C with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Emirates Driving Company P.J.S.C's current price could be quite moderate.

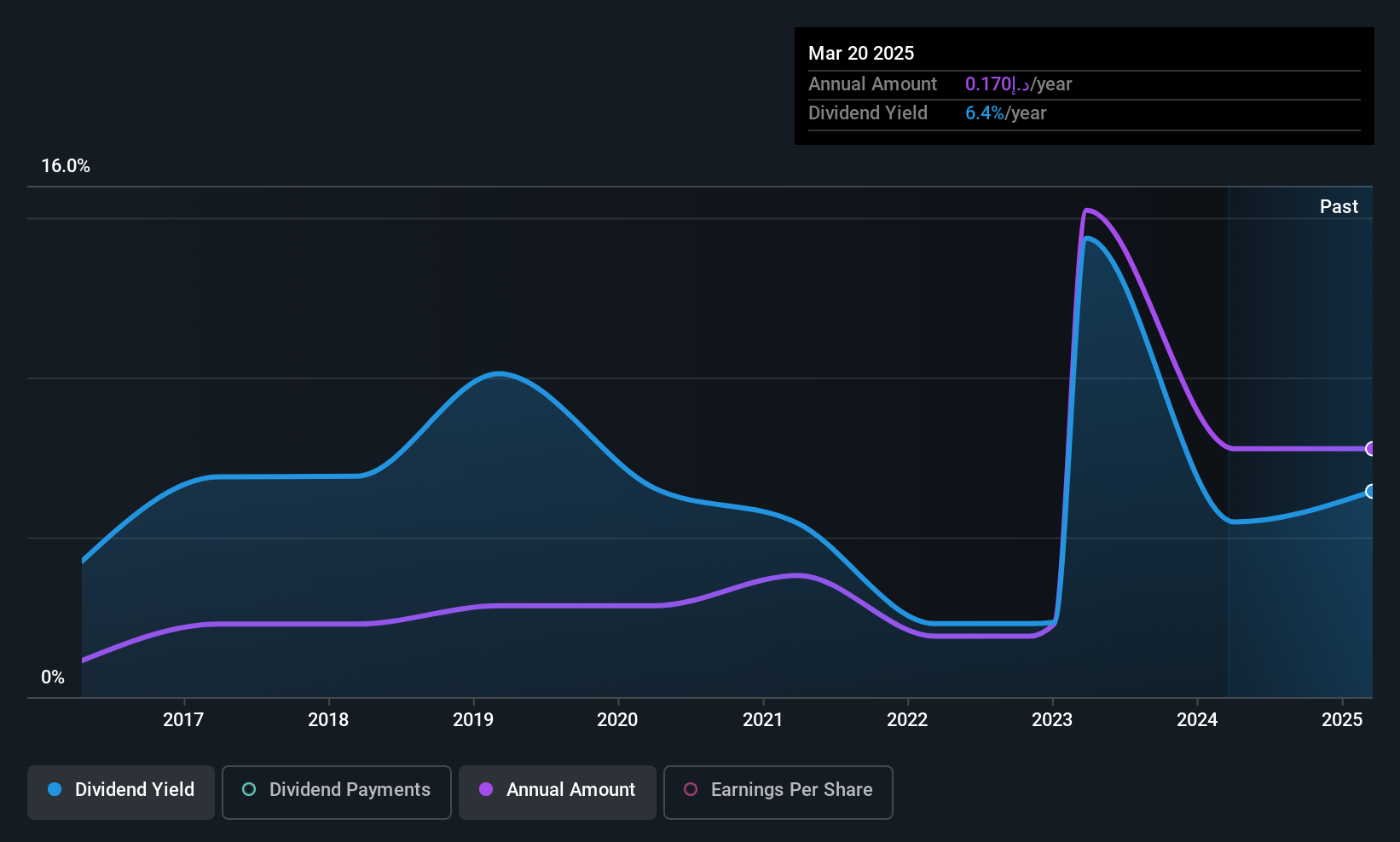

National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: National Bank of Umm Al-Qaiwain (PSC) provides retail and corporate banking services in the United Arab Emirates and has a market capitalization of AED5.60 billion.

Operations: National Bank of Umm Al-Qaiwain (PSC) generates its revenue primarily from Retail and Corporate Banking, amounting to AED423.61 million, and Treasury and Investments, contributing AED413.01 million.

Dividend Yield: 6.4%

National Bank of Umm Al-Qaiwain (PSC) presents a complex dividend profile. Its 6.43% yield ranks in the top quarter of AE market payers, supported by a reasonable payout ratio of 63.1%. However, its dividends have been volatile over the past decade with occasional drops over 20%. Recent earnings growth and a low price-to-earnings ratio (9.8x) compared to the market suggest potential value, though share price volatility remains high.

- Click to explore a detailed breakdown of our findings in National Bank of Umm Al-Qaiwain (PSC)'s dividend report.

- The analysis detailed in our National Bank of Umm Al-Qaiwain (PSC) valuation report hints at an inflated share price compared to its estimated value.

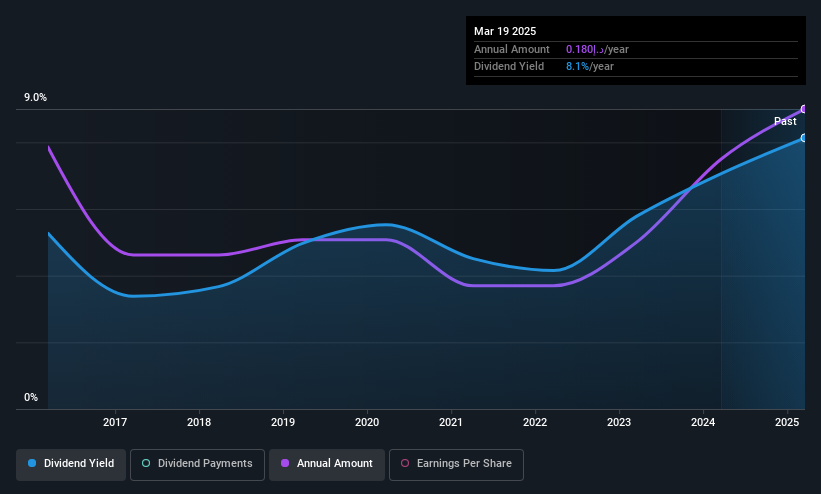

Banque Saudi Fransi (SASE:1050)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banque Saudi Fransi offers banking and financial services to individuals and businesses both within Saudi Arabia and internationally, with a market cap of SAR41.10 billion.

Operations: Banque Saudi Fransi generates its revenue primarily from Corporate Banking (SAR6.75 billion), Retail Banking (SAR6.22 billion), and Investment Banking & Brokerage (SAR639.10 million).

Dividend Yield: 6.6%

Banque Saudi Fransi's dividend yield of 6.63% places it among the top 25% in the Saudi Arabian market, supported by a manageable payout ratio of 54%. Despite a history of volatility in its dividends over the past decade, recent earnings growth and a low price-to-earnings ratio (8.6x) indicate potential value. The bank's strategic alliance with Thunes enhances its digital finance capabilities, aligning with Vision 2030 and potentially bolstering future earnings sustainability.

- Get an in-depth perspective on Banque Saudi Fransi's performance by reading our dividend report here.

- Our valuation report unveils the possibility Banque Saudi Fransi's shares may be trading at a discount.

Key Takeaways

- Access the full spectrum of 59 Top Middle Eastern Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com