Uncovering Middle East's Undiscovered Gems In December 2025

As the Middle East's financial markets experience gains, buoyed by anticipation of a Federal Reserve rate cut and strong fundamentals in the non-oil sector, investors are increasingly eyeing opportunities within this dynamic region. In such an environment, identifying promising stocks involves looking for companies that demonstrate resilience and growth potential amid shifting economic conditions and market sentiments.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 17.65% | 4.48% | 4.46% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Gulf Pharmaceutical Industries P.S.C (ADX:JULPHAR)

Simply Wall St Value Rating: ★★★★★★

Overview: Gulf Pharmaceutical Industries P.S.C. operates in the pharmaceutical sector, producing and distributing medicines, drugs, and related products across the UAE, GCC countries, and globally, with a market capitalization of AED1.50 billion.

Operations: JULPHAR generates revenue primarily from its manufacturing segment, which amounts to AED887.20 million. The company's financial data indicates a significant segment adjustment of AED748.90 million in its revenue reporting.

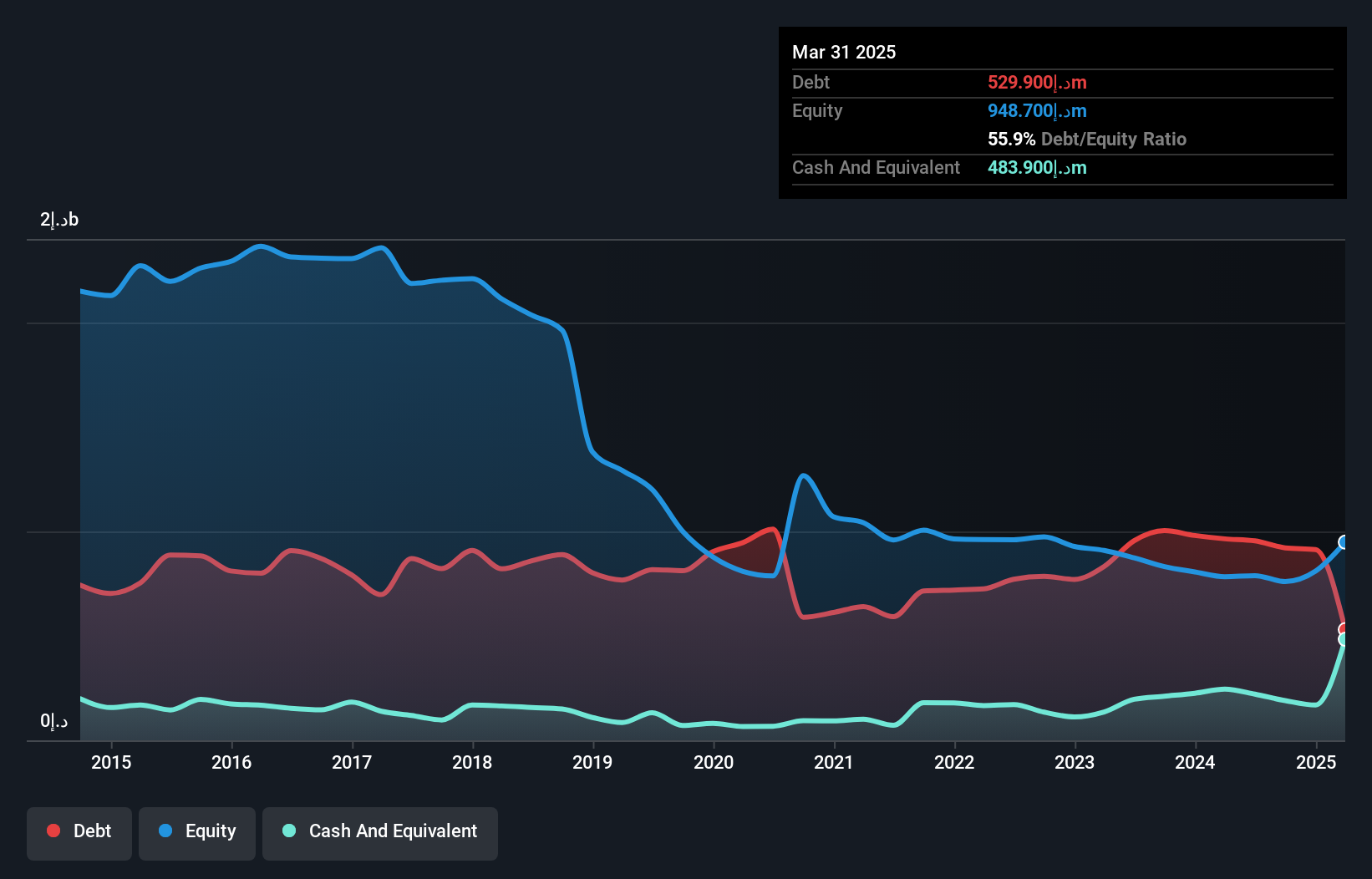

Gulf Pharmaceutical Industries, often known as Julphar, has shown remarkable resilience by turning profitable in the last year. The debt to equity ratio improved significantly from 46.5% to 27.1% over five years, signaling a stronger financial footing. With high-quality earnings and well-covered interest payments at 3.1x EBIT, the company seems poised for stability despite its volatile share price recently. Recent earnings reports highlight a turnaround with AED 8.8 million net income for Q3 compared to a AED 5.9 million loss previously, and sales rising to AED 249.7 million from AED 236.9 million year-over-year.

National Agricultural Development (SASE:6010)

Simply Wall St Value Rating: ★★★★★★

Overview: The National Agricultural Development Company operates in the production of agricultural and livestock products both within the Kingdom of Saudi Arabia and internationally, with a market capitalization of SAR5.62 billion.

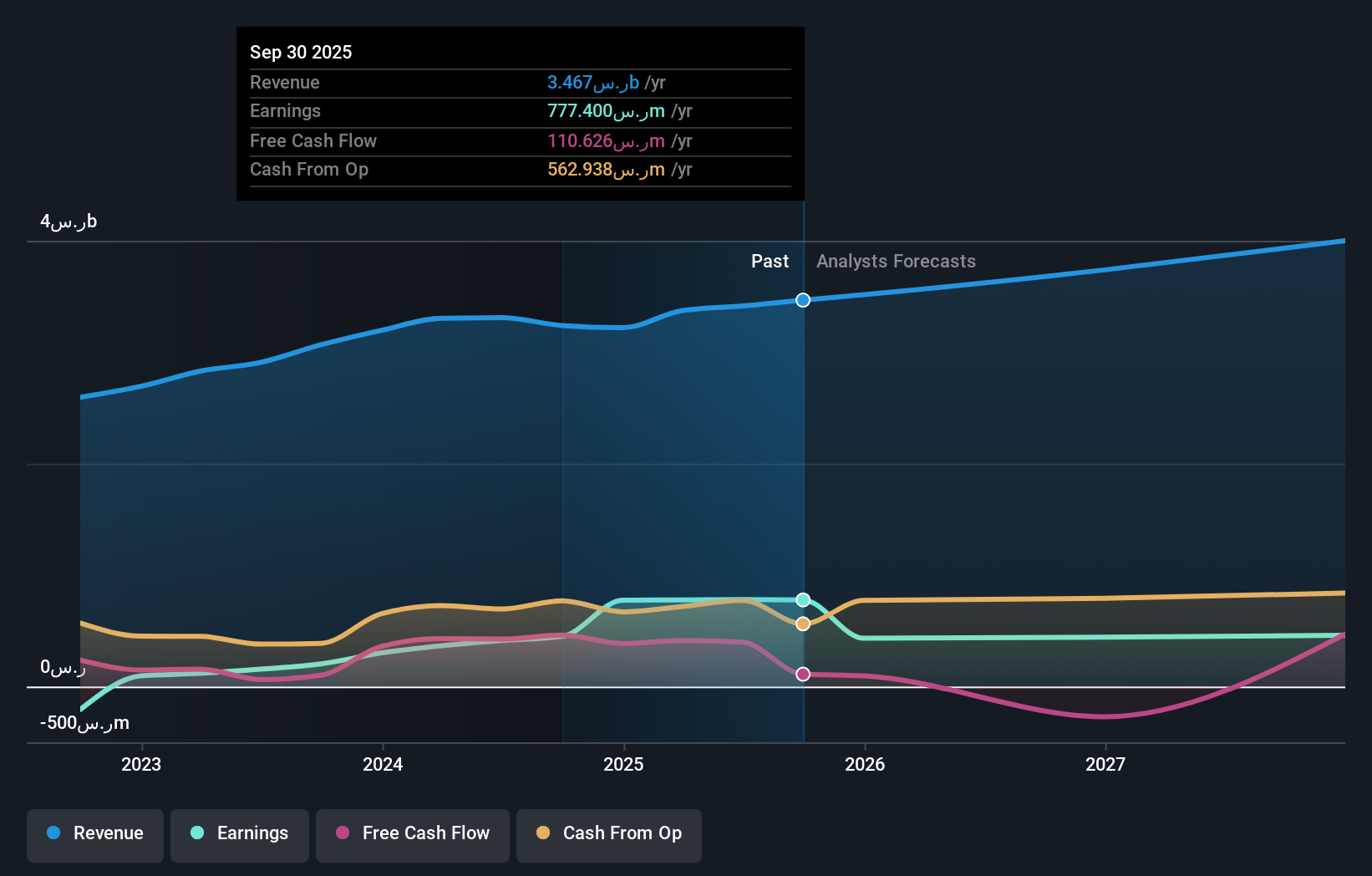

Operations: The company generates revenue primarily from its Dairy and Food segment, which contributes SAR3.07 billion, followed by Protein at SAR267.17 million and Agriculture at SAR264.76 million. The gross profit margin is a key financial metric to consider when evaluating the company's profitability trends over time.

NADEC, known for its agricultural prowess, reported Q3 2025 sales of SAR 843.61 million, up from SAR 791.09 million the previous year, yet net income slightly dipped to SAR 110.67 million from SAR 113.38 million. The company trades at a value below its estimated fair value by about 18%, making it attractive compared to peers and industry standards. With earnings growth of 72.5% last year surpassing the food industry's average growth rate of 7.5%, NADEC's debt-to-equity ratio impressively decreased from 98.4% to just 5.8% over five years, showcasing financial discipline and strategic management decisions aimed at future expansion plans with board restructuring underway.

Mohammed Hadi Al-Rasheed (SASE:9601)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mohammed Hadi Al-Rasheed Company specializes in the production of silica sand for various industrial applications and has a market capitalization of SAR1.45 billion.

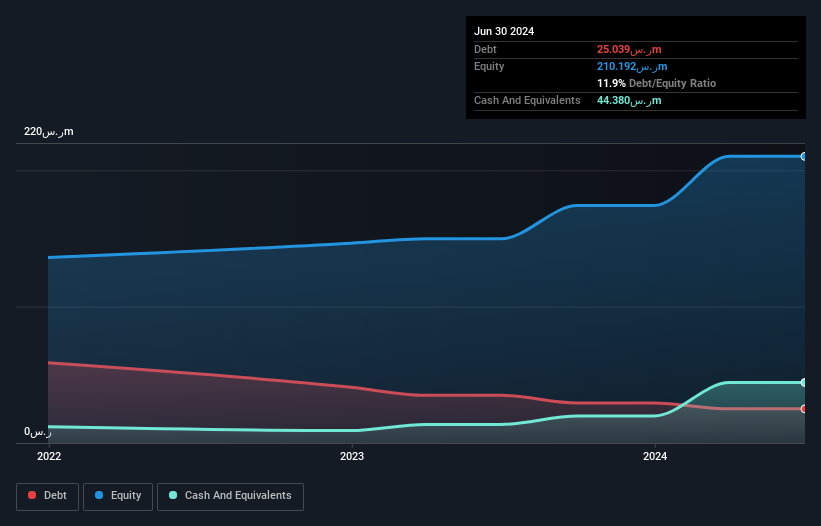

Operations: The company's primary revenue stream is derived from sales, amounting to SAR273.90 million, supplemented by contracting services contributing SAR33.12 million.

Mohammed Hadi Al-Rasheed, a small-cap player in the Middle East, has been making waves with its impressive earnings growth of 81% over the past year, significantly outpacing the Basic Materials industry. The company is trading at nearly half its estimated fair value and boasts high-quality past earnings. Despite recent volatility in share price, it maintains a strong financial position with more cash than total debt and interest payments well covered by EBIT at 93x. A recent strategic alliance with Taif Shipping Company could potentially enhance its market reach and operational capabilities if finalized.

Taking Advantage

- Dive into all 179 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com