China Mengniu Dairy Company Limited's (HKG:2319) P/S Still Appears To Be Reasonable

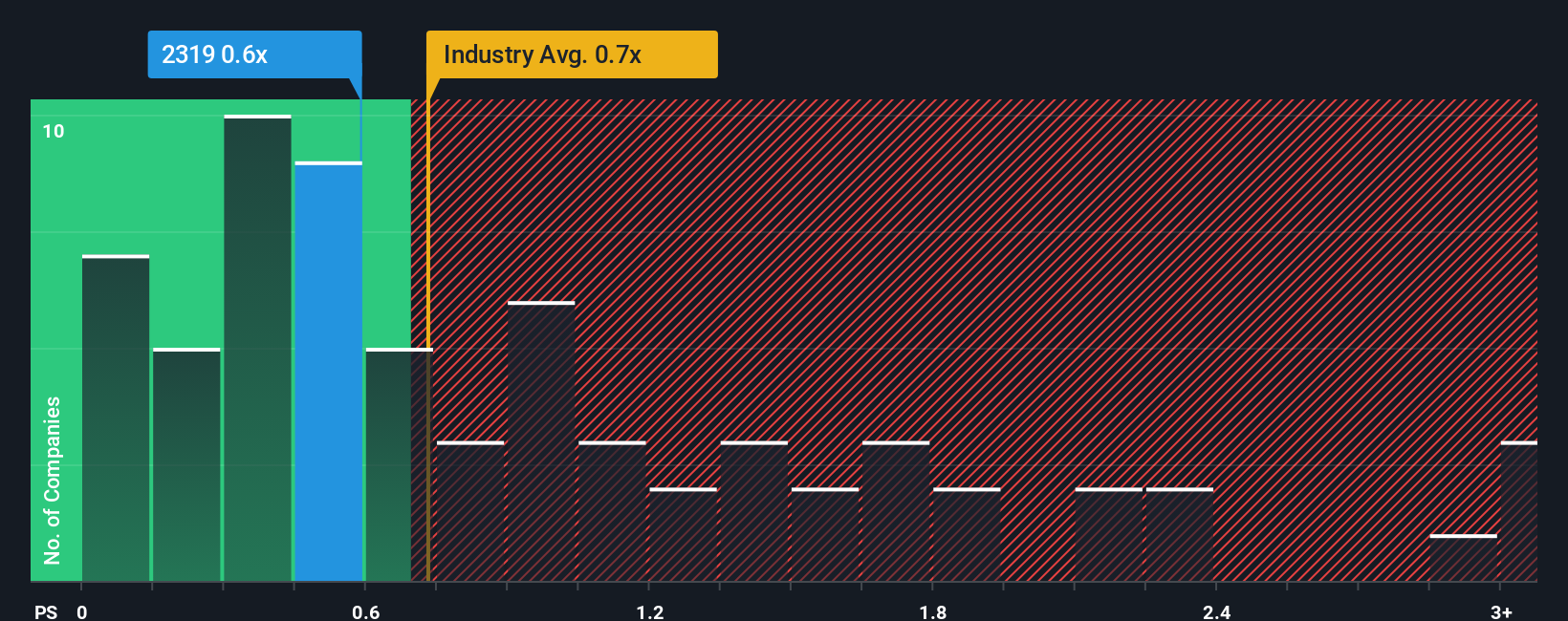

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Food industry in Hong Kong, you could be forgiven for feeling indifferent about China Mengniu Dairy Company Limited's (HKG:2319) P/S ratio of 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for China Mengniu Dairy

How Has China Mengniu Dairy Performed Recently?

While the industry has experienced revenue growth lately, China Mengniu Dairy's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think China Mengniu Dairy's future stacks up against the industry? In that case, our free report is a great place to start.How Is China Mengniu Dairy's Revenue Growth Trending?

China Mengniu Dairy's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 7.2% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 4.9% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 3.1% per year over the next three years. That's shaping up to be similar to the 3.1% per annum growth forecast for the broader industry.

In light of this, it's understandable that China Mengniu Dairy's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A China Mengniu Dairy's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Food industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with China Mengniu Dairy, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on China Mengniu Dairy, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.