Helios Technologies (HLIO): Revisiting Valuation After Recent 5% Share Price Pullback

Helios Technologies (HLIO) has slipped about 5% over the past 3 months even as revenue and net income continue to grow, creating an interesting setup for investors watching valuation and long term execution.

See our latest analysis for Helios Technologies.

The recent 5% slide over three months sits against a much stronger year to date, with a roughly 20% share price return suggesting momentum has cooled but not reversed as investors reassess execution risks against improving fundamentals.

If Helios has you thinking about where else steady operators might be hiding, this could be a good moment to explore aerospace and defense stocks as another pocket of industrial opportunity.

With earnings still climbing, a roughly 25% implied discount to fair value, and a solid year to date gain, investors now face a pivotal question: Is Helios a mispriced compounder, or is the market already discounting that future growth?

Most Popular Narrative: 18.3% Undervalued

With Helios Technologies last closing at $53.30 against a narrative fair value of $65.20, the spread highlights how strongly future execution is being priced in.

The shift in the industry towards electrification of mobile and industrial equipment is driving OEM demand for sophisticated electro-hydraulic and electronic control solutions, areas where Helios is actively innovating (e.g., Enovation Controls, Cygnus Reach), supporting both top-line growth and margin expansion over the medium to long term.

Curious how steady, mid single digit revenue growth could still justify a much richer future earnings multiple? The narrative leans on a powerful profit and margin reset that radically reshapes Helios earnings profile. Want to see the specific assumptions that turn today margins into tomorrow cash machine? Click through to unpack the full valuation playbook.

Result: Fair Value of $65.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, industry electrification and exposure to cyclical construction and agriculture demand could both undermine the margin reset that underpins today’s undervaluation story.

Find out about the key risks to this Helios Technologies narrative.

Another View on Valuation

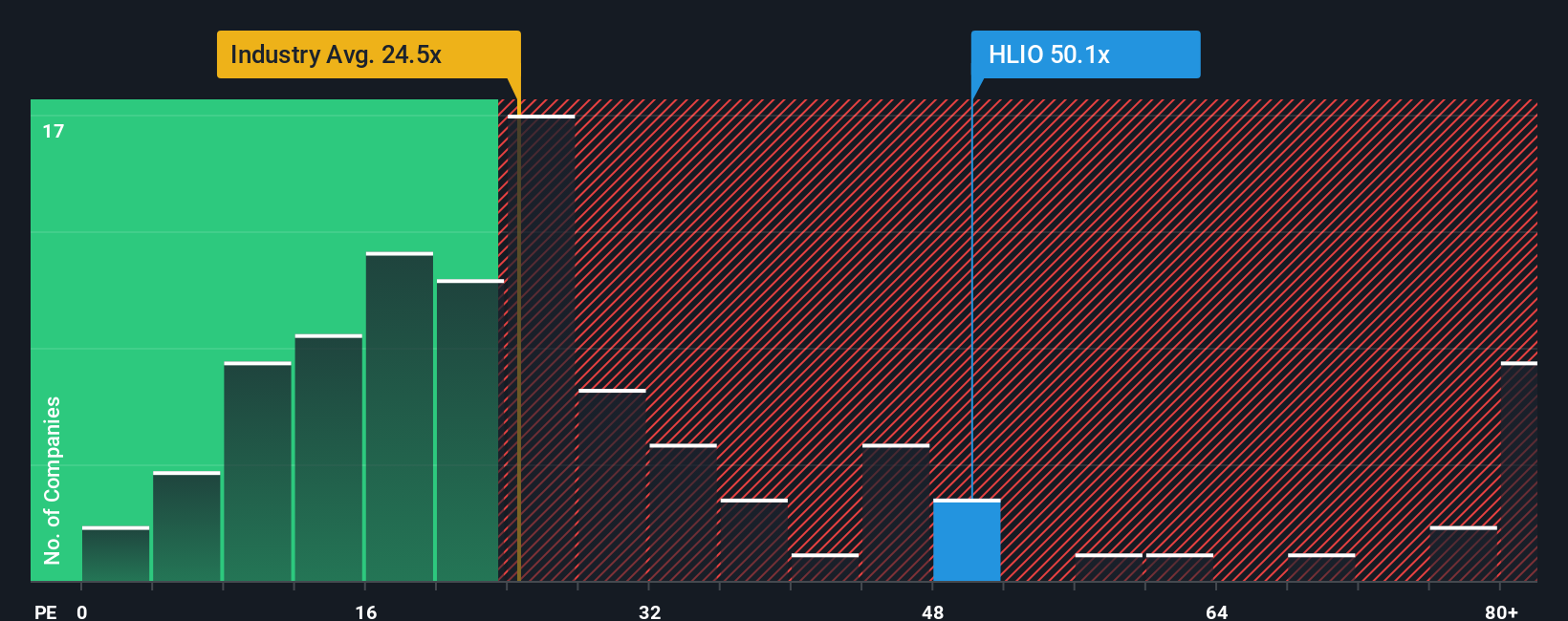

While narratives and fair value estimates suggest upside, the current price to earnings ratio of 52.4 times tells a very different story. This is especially notable against a fair ratio of 30.8 times, the US Machinery industry at 25.1 times, and peers at 35.4 times, which all hint at valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Helios Technologies Narrative

If you would rather challenge these assumptions and work through the numbers yourself, you can build a fresh Helios view in just minutes. Do it your way

A great starting point for your Helios Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next opportunity using the Simply Wall St Screener so you are not late when the market wakes up.

- Capture high-upside potential by scanning these 3588 penny stocks with strong financials that pair tiny market caps with surprisingly resilient fundamentals and improving financial momentum.

- Ride the structural shift toward intelligent automation by targeting these 30 healthcare AI stocks at the intersection of medical innovation and advanced data analytics.

- Strengthen your income stream by filtering for these 15 dividend stocks with yields > 3% that combine meaningful yields with balance sheets built to withstand volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com