Has Take-Two’s 36% Rally in 2025 Already Priced In Future Blockbuster Growth?

- If you are wondering whether Take-Two Interactive Software is still a smart buy at today’s price, you are not alone, and that is exactly what we are going to unpack together.

- The stock has climbed 1.5% in the last week, 6.3% over the past month, and is up 35.9% year to date, adding to a 30.6% gain over the last year and 137.3% over three years.

- Much of this strength reflects growing optimism around Take-Two’s blockbuster franchise pipeline and the long term potential of its live service and mobile portfolios. Investors are increasingly pricing in future content launches and the company’s ability to monetize its large player base over time, which helps explain the sustained re rating of the share price.

- Despite that performance, Take-Two currently scores just 0 out of 6 on our valuation checks, suggesting the market may already be paying up for that future growth. We will walk through how different valuation approaches compare, and then finish with a more intuitive way to think about what the stock might be worth.

Take-Two Interactive Software scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Take-Two Interactive Software Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth today by projecting the cash it can generate in the future and discounting those cash flows back to the present. For Take-Two Interactive Software, the model starts from current free cash flow of about $181.9 Million and uses analyst forecasts for the next few years, then extrapolates longer term growth using Simply Wall St assumptions.

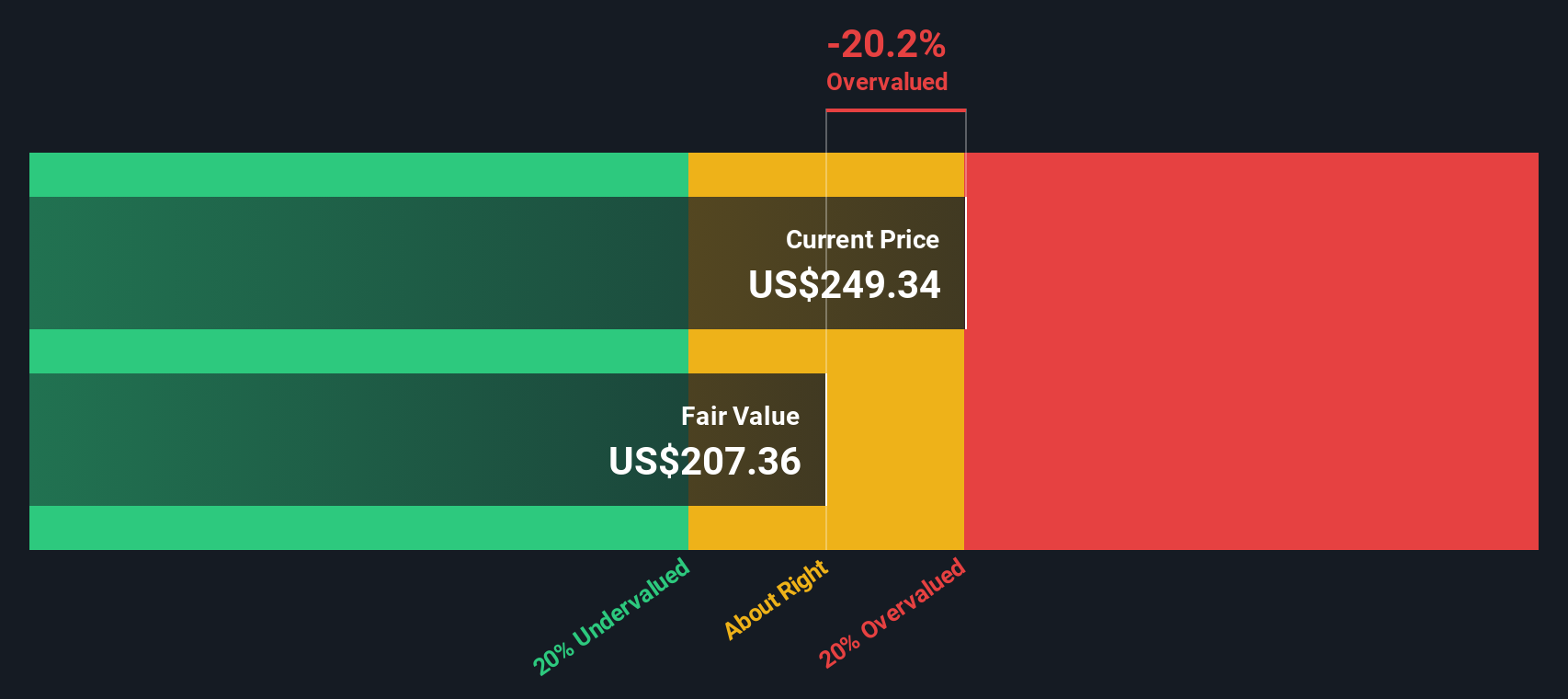

Under this 2 Stage Free Cash Flow to Equity approach, free cash flow is projected to rise to roughly $2.5 Billion by 2030, with intermediate years stepping up sharply as major titles and live service revenues scale. Each of these future cash flows is discounted back to today and summed to arrive at an estimated intrinsic value of about $207.16 per share.

Compared with the current share price, the model suggests Take-Two is around 20.1% overvalued. This implies the market is already paying a premium for the expected growth embedded in these forecasts.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Take-Two Interactive Software may be overvalued by 20.1%. Discover 900 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Take-Two Interactive Software Price vs Sales

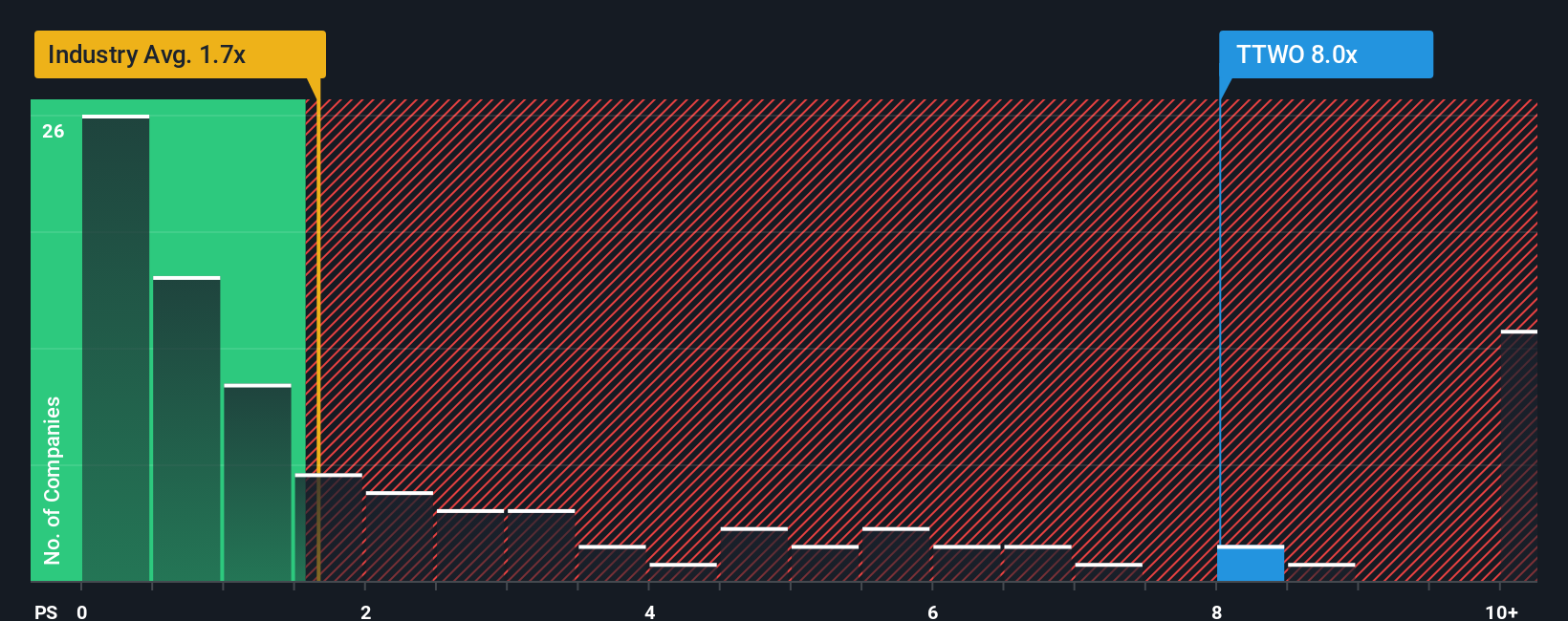

For companies like Take-Two that are investing heavily for future growth and may not show steady profits yet, the price to sales multiple is often a more reliable lens than earnings based metrics. Revenue is usually less volatile than earnings, so it can provide a cleaner signal of how the market is valuing the underlying business momentum, even when margins are temporarily compressed by development spend or acquisitions.

In general, faster growth and lower risk justify a higher price to sales ratio, while slower growth, thinner margins, or elevated business risk call for a lower one. Take-Two currently trades at about 7.39x sales, well above both the broader Entertainment industry average of 1.40x and a peer group average of 6.25x. To move beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what a reasonable price to sales multiple should be once factors like expected growth, profitability profile, industry, market cap, and risk are incorporated. For Take-Two, this Fair Ratio is 4.60x, materially below the current multiple. On this basis, the shares appear stretched relative to what fundamentals justify.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Take-Two Interactive Software Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Take-Two’s business to a concrete financial forecast and Fair Value on Simply Wall St’s Community page, where millions of investors share their perspectives. For example, one Narrative might assume that mobile growth, live services, and Grand Theft Auto 6 create durable record bookings, margins around 13%, revenue growth near 15% a year, and a Fair Value close to $276.59 per share. A far more cautious Narrative might focus on franchise concentration, rising development costs, and shifting gamer behavior to justify slower growth, lower margins, and a Fair Value closer to $150. Because Narratives automatically update as new earnings, news, or regulatory changes arrive, you can quickly see whether your chosen Fair Value still sits above the current share price, which may support a buy, or has fallen below it, which may signal it is time to trim or sell.

Do you think there's more to the story for Take-Two Interactive Software? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com