InterDigital (IDCC): Assessing Valuation After Legal Wins Boost Streaming Patent Revenue Prospects

InterDigital (IDCC) just scored a legal win that could reshape its streaming royalty stream, with courts in Germany and Brazil siding with its patents and new cases now targeting Amazon’s video technology.

See our latest analysis for InterDigital.

Those court wins seem to be feeding into sentiment, with InterDigital’s 1 week share price return of 6.22% and 90 day share price return of 11.76% supporting an already powerful year to date share price return of 85.17%, alongside an 88.79% 1 year total shareholder return that points to strong, long running momentum.

If this kind of IP driven story has your attention, it could be a good moment to explore high growth tech and AI stocks for other innovative names riding similar digital tailwinds.

With litigation wins stacking up, a fresh dividend affirmed and the stock trading modestly below analyst targets, is InterDigital still misunderstood by the market, or are investors already baking in years of licensing driven growth?

Most Popular Narrative Narrative: 11.9% Undervalued

InterDigital last closed at $363.09 against a narrative fair value of $412, framing an upside case built on durable licensing economics and rich margins.

The company has secured an 8-year, more-than-$1 billion license agreement with Samsung, the world's largest smartphone manufacturer, representing a 67% increase over the prior agreement, which not only boosts recurring revenue but also sets a higher royal baseline for future contract renewals, potentially supporting stronger revenue growth and higher net margins. InterDigital now has leading smartphone manufacturers Apple and Samsung licensed through the end of the decade, covering almost 80% of the global smartphone market and bringing smartphone annualized recurring revenue (ARR) to a record $465 million, greatly enhancing revenue stability and reducing earnings volatility.

Want to see how shrinking headline earnings, rich margins and a punchy future earnings multiple can still justify upside from here? The full narrative reveals the numbers powering that $412 fair value, including how long term revenue compression, margin reset assumptions and share count drift all stitch together into one bold valuation story.

Result: Fair Value of $412 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained smartphone licensing strength and faster than expected streaming monetization could keep earnings elevated, challenging assumptions of prolonged revenue decline and margin compression.

Find out about the key risks to this InterDigital narrative.

Another Angle on Value

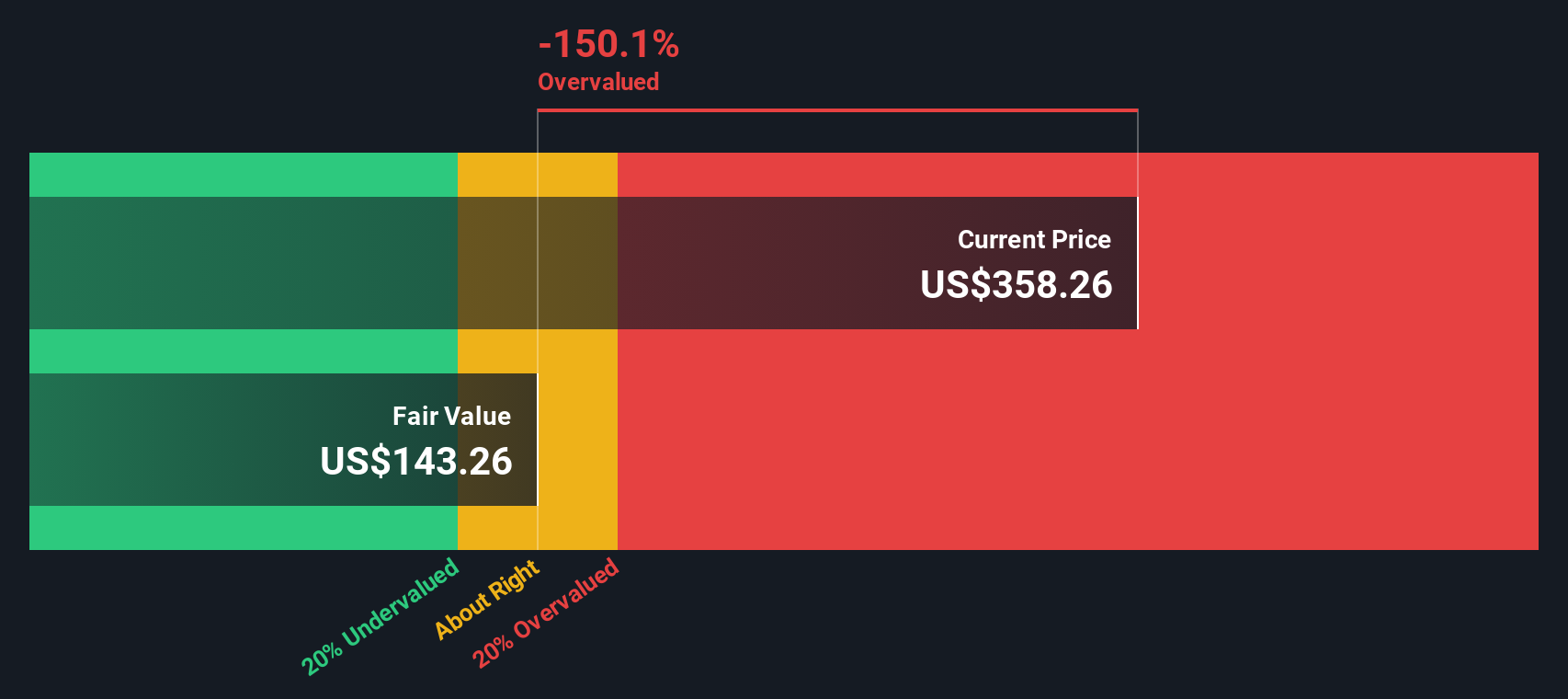

Our SWS DCF model paints a far harsher picture, putting InterDigital’s fair value around $70.67 per share, which would make today’s $363.09 price look significantly overvalued. If cash flows are this fragile, is the upbeat narrative leaning too much on momentum and sentiment?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out InterDigital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own InterDigital Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a full narrative in just minutes: Do it your way.

A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next smart move?

Do not stop at one great idea. Use the Simply Wall Street Screener to uncover fresh opportunities that match your strategy before the market catches on.

- Capture potential mispricing by scanning these 900 undervalued stocks based on cash flows that the market may be overlooking despite solid cash flows and fundamentals.

- Ride structural tech shifts by targeting these 27 AI penny stocks that could benefit from accelerating demand for intelligent automation and data driven platforms.

- Strengthen your income strategy by focusing on these 15 dividend stocks with yields > 3% that can complement growth names with reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com