Avino Silver & Gold Mines (TSX:ASM): Reassessing Valuation After Sustained Outperformance of the TSX Smallcap Index

Avino Silver & Gold Mines (TSX:ASM) is drawing fresh attention after extending its outperformance versus the soft TSX Smallcap Index, with earnings momentum and sector tailwinds helping it buck broader market weakness.

See our latest analysis for Avino Silver & Gold Mines.

The latest jump to a share price of $8.16 caps a powerful run, with a roughly 28% 1 month share price return feeding into a year to date gain above 480%. This suggests momentum is still building rather than fading.

If Avino’s surge has you rethinking what’s possible from smaller resource names, it could be worth exploring fast growing stocks with high insider ownership for other fast moving opportunities with aligned insiders.

Yet with Avino now trading above consensus targets but still showing strong intrinsic value signals, investors face a key question: is this spectacular run still mispricing future growth, or has the market already discounted the next leg higher?

Most Popular Narrative: 54% Overvalued

With Avino closing at CA$8.16 against a narrative fair value of CA$5.30, the latest outlook leans cautious on how far this rally can reasonably stretch.

The analysts have a consensus price target of CA$5.225 for Avino Silver & Gold Mines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$6.2, and the most bearish reporting a price target of just CA$4.25.

Curious what kind of revenue climb, margin lift, and future earnings multiple are baked into that fair value, and how those moving parts fit together? The full narrative unpacks a detailed forecast path that might surprise anyone assuming this surge is purely sentiment driven.

Result: Fair Value of $5.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained gains in mill efficiency and a smooth ramp up at La Preciosa could drive stronger margins and earnings than current projections assume.

Find out about the key risks to this Avino Silver & Gold Mines narrative.

Another View: Cash Flows Tell a Different Story

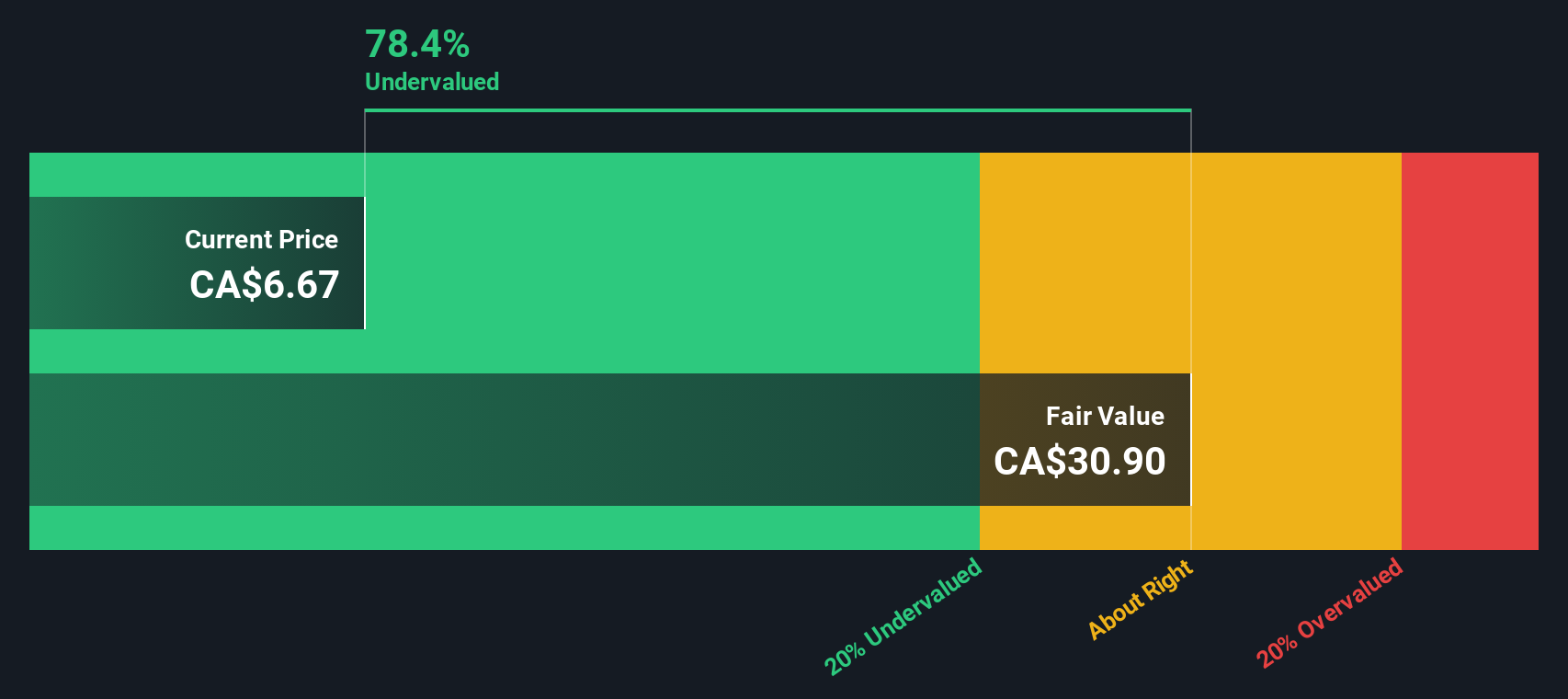

While the narrative fair value implies Avino is about 54% overvalued at CA$8.16, our DCF model flips that on its head and suggests the shares are roughly 66% undervalued versus an estimated fair value near CA$24. Does cautious sentiment risk leaving a lot of upside on the table?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avino Silver & Gold Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avino Silver & Gold Mines Narrative

If this perspective does not quite match your own, or you would rather dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Avino Silver & Gold Mines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop sharpening their edge, so use the Simply Wall St Screener now to uncover fresh, high conviction ideas before the crowd notices them.

- Capture mispriced quality by scanning these 900 undervalued stocks based on cash flows that pair robust cash flows with attractive entry points.

- Ride the next wave of innovation by targeting these 27 AI penny stocks poised to benefit from accelerating adoption of intelligent automation.

- Lock in reliable portfolio income by focusing on these 15 dividend stocks with yields > 3% that combine healthy yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com