Unity Software (U): Reassessing Valuation After Wells Fargo Upgrade and Growing Confidence in Unity Commerce

Unity Software (U) just picked up a major upgrade from Wells Fargo, as the bank leans into a brighter 2026 industry outlook and growing confidence in Unity Commerce’s role beyond pure gaming.

See our latest analysis for Unity Software.

That optimism is already showing up in the tape, with a roughly 102% year to date share price return and an 86% one year total shareholder return suggesting momentum is rebuilding as investors warm to Unity’s longer term narrative.

If you are weighing Unity against the rest of the digital infrastructure boom, this could be a strong moment to explore other high growth tech and AI stocks that are starting to attract serious attention.

Yet with shares now trading slightly above the latest analyst price target but still showing a modest intrinsic discount, the key question is whether Unity remains a mispriced growth story or if markets are already pricing in the next leg higher.Most Popular Narrative: 28.6% Overvalued

Unity last closed at $49.47, while the most followed narrative, according to andreas_eliades, points to a fair value of $38.48 using a detailed cash flow view.

Unity's increasingly diversified revenue streams in non-gaming sectors decrease its riskiness and bolster its long-term growth potential.

Curious how slower near term growth can still justify a premium? This narrative leans on sustained double digit revenue expansion and future profitability margins that push Unity into a different league. Want to see which long run growth and profitability mix drives that valuation gap? Dive in to unpack the full playbook behind this fair value call.

Result: Fair Value of $38.48 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing adoption in non gaming verticals, or renewed backlash over monetization changes, could quickly erode confidence in this long term upside case.

Find out about the key risks to this Unity Software narrative.

Another Lens on Value

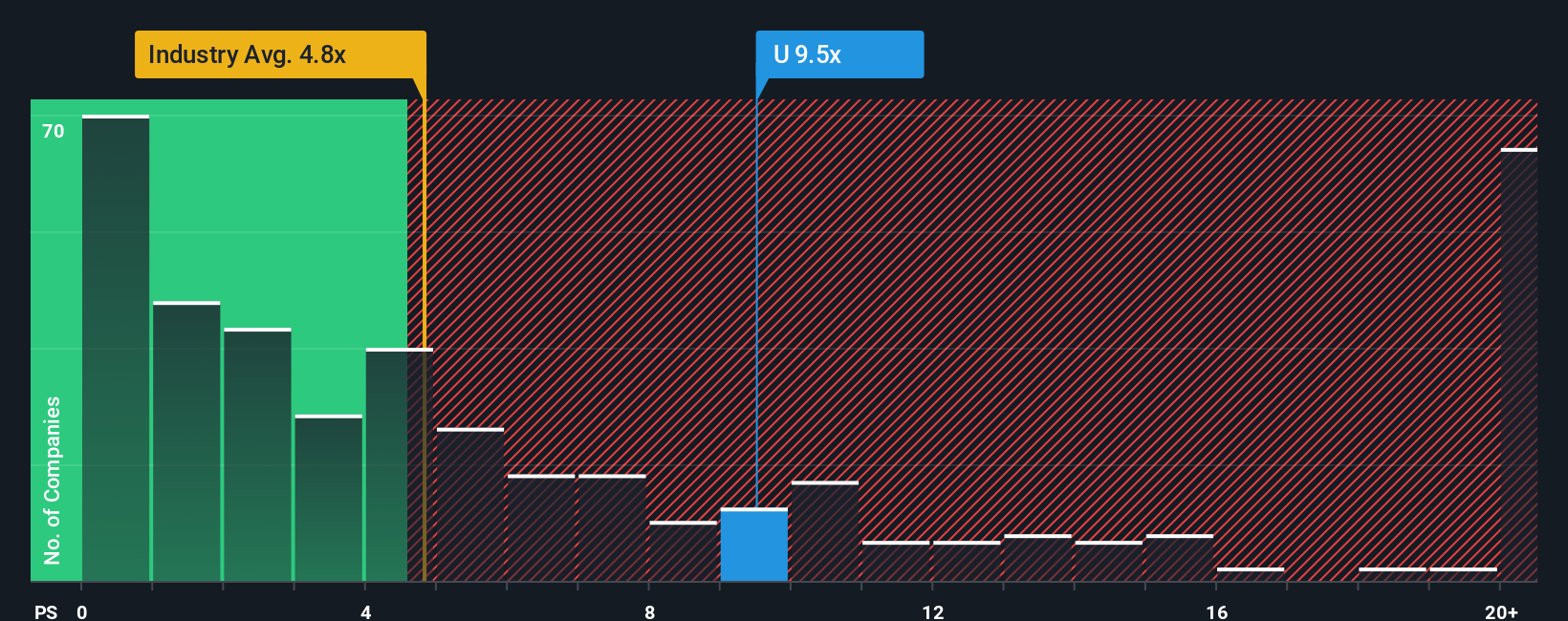

Our valuation checks tell a different story, with Unity trading on a Price To Sales ratio of 11.7 times versus a US software industry average of just 4.9 times and a fair ratio of 8.7 times. This implies investors are paying up today and leaving less room for error if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Unity Software Narrative

If you are not fully aligned with this view, or would rather dig into the numbers yourself, you can shape a fresh perspective in just a few minutes, Do it your way.

A great starting point for your Unity Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single stock when you can line up your next moves with focused, data driven ideas from the Simply Wall St screener.

- Capture mispriced potential by scanning these 900 undervalued stocks based on cash flows that pair solid fundamentals with compelling upside based on cash flow strength and valuation support.

- Ride the next wave of innovation by targeting these 27 AI penny stocks positioned at the heart of automation, intelligent infrastructure, and scalable software growth.

- Boost your income strategy by reviewing these 15 dividend stocks with yields > 3% that combine dependable payouts with balance sheets built to handle market shocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com