ServiceNow (NOW): Has the Recent Share Price Dip Created a Valuation Opportunity?

ServiceNow (NOW) has been on a choppy ride lately, with the stock down about 19% this year even as annual revenue and net income keep growing at double digit rates.

See our latest analysis for ServiceNow.

Zooming out, the share price has slipped this year, but a three year total shareholder return of 104.33% shows longer term holders are still well ahead. This suggests momentum has cooled rather than vanished as investors reassess growth and valuation.

If ServiceNow’s swings have you rethinking your watchlist, this could be a smart moment to explore other high growth tech names via high growth tech and AI stocks and see what else fits your strategy.

With revenue and earnings still compounding briskly and the share price lagging, investors are left with a key question: Is ServiceNow trading at a rare discount, or has the market already priced in its next leg of growth?

Most Popular Narrative: 26% Undervalued

With the most popular narrative putting fair value above the recent 854.91 dollar close, the gap hinges on aggressive growth, margin expansion, and premium pricing power.

The acquisition of companies like Moveworks and Logik.ai can enhance ServiceNow’s offerings, potentially improving net margins by driving efficiencies and offering more integrated solutions.

ServiceNow's progression into the enterprise AI market, notably with their next-gen database RaptorDB, aims to capitalize on the predicted intelligence super cycle, likely impacting long-term revenue positively.

To see the engine behind this valuation, including the detailed growth runway, margin lift, and future earnings multiple that support this potential upside, read on.

Result: Fair Value of $1,154.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks around US federal contract dependence and fierce CRM and AI competition could derail growth assumptions and limit the valuation multiple that investors are willing to pay.

Find out about the key risks to this ServiceNow narrative.

Another View: Multiples Flash a Different Signal

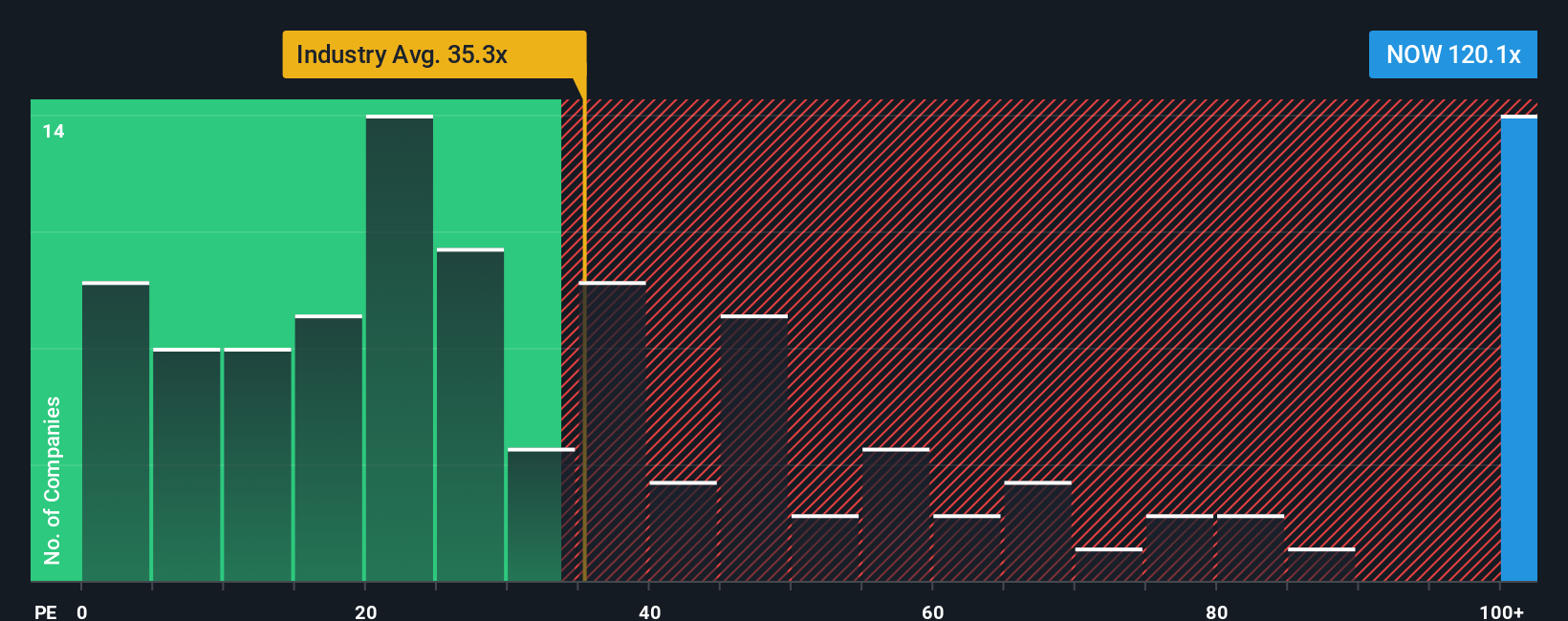

While the narrative points to a 26% upside, ServiceNow trades at about 102.5 times earnings, more than triple the US software sector at 32 times and well above its 46.4 times fair ratio. If sentiment cools, could the share price gravitate toward those lower benchmarks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ServiceNow Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom view yourself in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ServiceNow.

Ready for more investment ideas?

Before you move on, consider exploring additional opportunities using the Simply Wall St screener so you are not relying on a single stock story.

- Explore high potential growth by reviewing these 27 AI penny stocks that may benefit from the adoption of automation and intelligent software.

- Focus on your long term returns by targeting income from these 15 dividend stocks with yields > 3% offering yields that can compound over time.

- Stay informed by scanning these 80 cryptocurrency and blockchain stocks that are involved in the evolution of digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com